As we accumulate wealth and look to save for a variety of goals, there are quite a few factors that will get us to the ultimate decision of how to invest. Understanding how to balance risk and reward while you intermingle that into your specific goals is not easy. Add to the equation the different time periods we have lived through which inherently change the view we have on money. This is hard.

As outlined in the Psychology of Money book by Morgan Housel in much more detail: “people from different generations, raised by different parents who earned different incomes and held different values, in different parts of the world, born into different economies, experiencing different job markets with different incentives and different degrees of luck, learn very different lessons.” Today, lets focus on how a sequence of returns can impact your plan and talk through balancing risk that fits not just your plan, but you.

Sequence risk looks at periodic returns and the variation of when those returns are received when taking income. If you take an investment over a 10-year sample period (with different returns each year) and then reverse the sequence of returns, your ending balance is the same. That is not the case if you are taking income. Pretty self-explanatory: as you take income, your bucket to compound capital is less, resulting with a portfolio needing even more growth to recoup losses. Although we believe longer term horizon returns are most meaningful to meet goals, the returns the few years before and into retirement become very important to a successful plan.

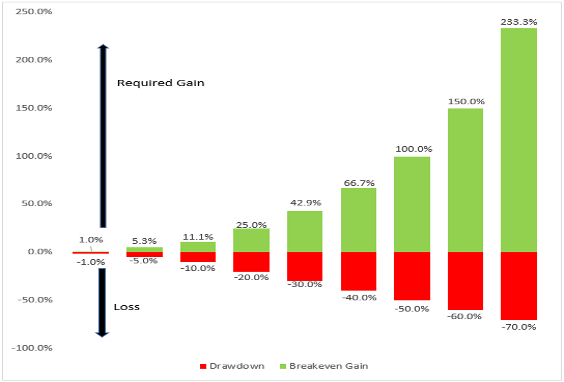

My hope with this discussion is that it may serve as a way to think through needed vs. desired returns. Risk and return are directly correlated, so you cannot talk about one without the other. Related to taking on risk that can lead to portfolio declines, the chart below shows the required gains to get the portfolio back to even after different levels of market drawdowns. Keep in mind that there are no income distributions in the below illustration. A portfolio drawdown of 30%, requires 42.9% to get back to the balance before the market decline.

Source: Aptus

“Compounding capital is the royal road to riches.” – Richard Russell in Rich Man, Poor Man

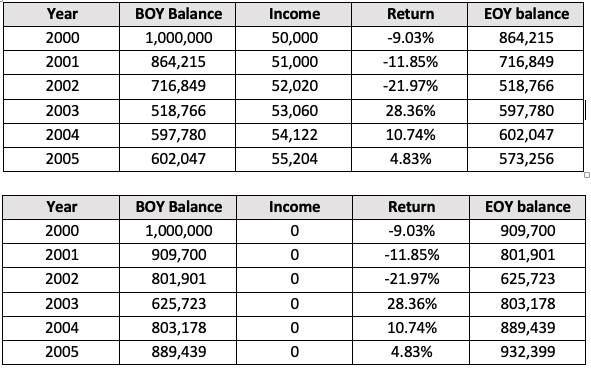

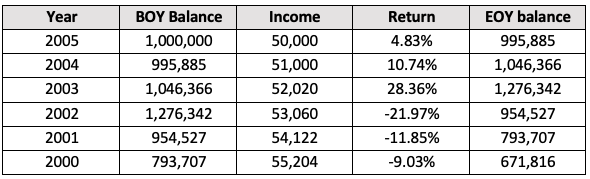

The two scenarios below illustrate a sequence of returns with and without income taken.

Through the period outlined above, the retiree took $315k in total income (5% of the initial account balance pulled at the beginning of year 1, that 50k number is then adjusted 2% each year for inflation) and has an ending balance of $573k vs. an ending balance with no income leaving your million dollars at 932k.

Let’s look at the same scenarios as above with the returns reversed. Again, the same returns, just rearranged. You end up with a balance nearly $100k more which is 17% higher. That is certainly a meaningful difference and hopefully illustrates the importance of managing risk in the early years of retirement.

We have a number of smart people who evaluate markets and provide expected returns for us each year, but the truth is none of us have a crystal ball. Negative outcomes or performance below expectations happen to the best of us. In retirement, take sequence risk into consideration, how are you able to plan for negative markets? Does your distribution strategy have the needed flexibility? Have you revisited your risk as you approach or enter early retirement?

These are all questions I would ask to build in a buffer of some kind to help you stay as much invested as you can to recoup any potential losses, sell the right securities when taking income, and making sure the portfolio as it sits today is well aligned with your plan and risk. Depending on your age and experiences you may be the most optimistic investor here. Optimism is great. Possibly that optimism leads to taking on more risk than necessary? Or alternatively maybe you are on the opposite side? The bottom line is that your personal experiences matter and so does your plan. Whether you are retired or a young professional focused on saving, the principal of compounding returns can never be discounted. Steady Wins The Race!

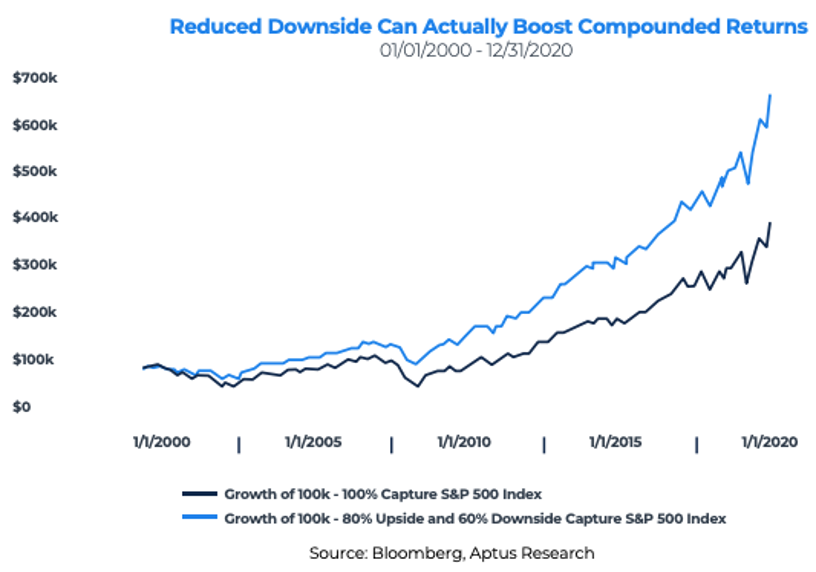

Let’s take a look at the power of consistent returns in the below example. The black line includes 100% upside/downside capture of the S&P index. The blue line provides 80% upside capture, and 60% downside.

Two key items to address…

The first being that your plan must build in negative outcomes to understand what your risk appetite is. If you have done that and continue to do that year over year you should have more comfort staying invested. Taking income plus negative returns can be a double whammy to the success of your plan. Take an inside look at your history with money which has led you to today. How are those experiences affecting your ability to manage risk within your plan? Adjustments to your strategy may still be needed over time as the market environment and your goals change, BUT… if you were to move to cash after a drawdown event and continue taking your income, the sequence of negative returns followed by zero returns would then further inject longevity risk into your plan.

In addition to managing portfolio risk, flexibility in your plan is also a must. Adapt to the market conditions, adjust costs where you can, be strategic with taxes, tweak your income plan, turn that hobby into a small business; this list could continue for a few pages. A perfect example of being flexible is adapting your investment plan to adjust to today’s market conditions. Whether you are concerned about elevated risk in equity markets, or you are looking to navigate higher inflation paired with historically low rates – each will play a role in your plan and investment strategy.

“The highest form of wealth is the ability to wake up every morning and say, I can do whatever I want today.” – Morgan Housel, The Psychology of money

Retirement planning takes time, patience, and an understanding of projected outcomes. Projected being the key word here. We are predicting what we will have and making estimates of what may happen around us. Ultimately, we believe proper risk management planning in all asset categories can help make whatever growth and income expectation better suited for you. As we all attempt to achieve our own highest form of wealth, the impact of early negative performance years while taking income is something you should plan for.

Stay tuned for our last piece in this series where we dig into asset allocations impact on addressing both longevity and sequence/drawdown risk.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500 Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization. Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2201-31.