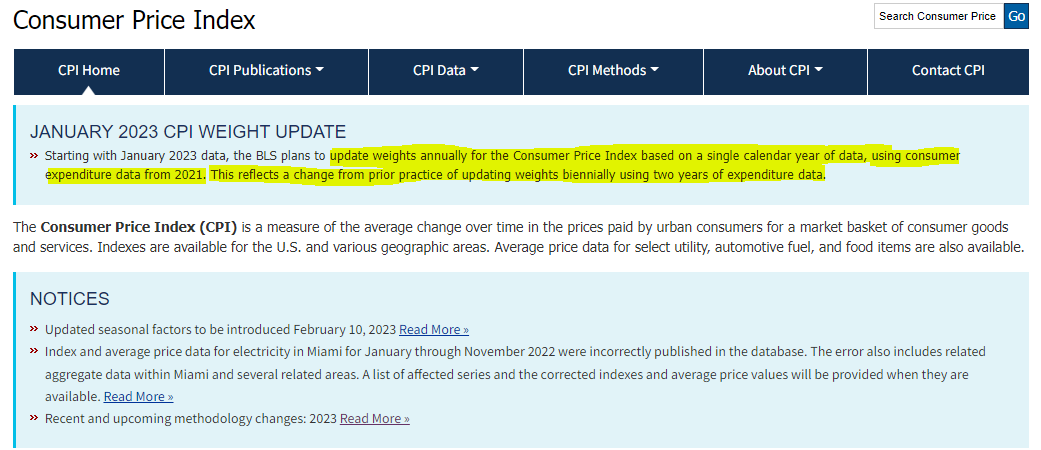

The US government will change its CPI methodology beginning next month. Previously they had updated weights biennially using two years of expenditure data. So for last year, the 2019 and 2020 y/y %’s have been combined to form the “comp” against which y/y inflation has been reported in 2022. 2019 and 2020 y/y CPI %’s were low.

Beginning next month, the US government will begin reporting y/y CPI comparing ONLY against the 2021 comps. As you know, the comps get MEANINGFULLY higher than the combined 2019-20 comps.

Source: BLS. As of 1/13/2023.

Source: BLS. As of 1/13/2023.

The US government is changing inflation methodology in a manner that appears to meaningfully step up the year-ago comparison – which means, even if nothing else changes, reported y/y CPI inflation should fall dramatically in 2023. This could give a political cover to the Fed to pivot policy as the appearance of lower inflation will take hold of the numbers. Is this the change in inflation policy (i.e., move inflation target higher) we predicted back in Q4 ’22, just in a more subtle way?

This is very recent news and we are still digging in to the implications ourselves. We will be back with a more detailed note in the coming weeks.

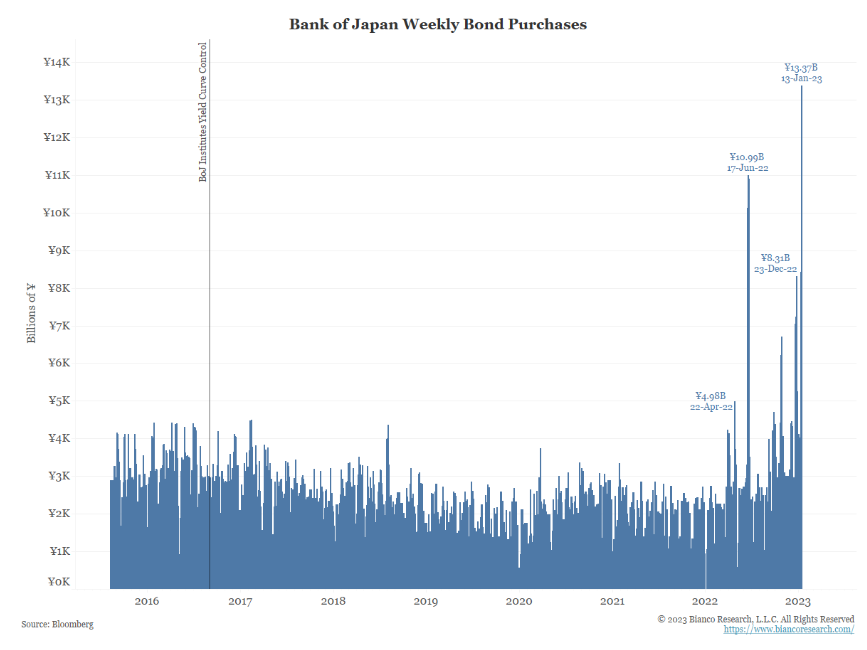

Japan Maintains Yield Curve Control (YCC) at 50bps

We believe Japan is another potential pressure on longer duration US Treasuries. The Bank of Japan (BOJ) notably moved the ceiling on their long-implemented Yield Curve Control (YCC) back about a month ago from 25bps to 50bps. What exactly does this mean? Well, as yields rise above the ceiling, the Japanese Central Bank buys the bonds (i.e. the whole point of yield curve control is to control the level of rates).

Source: Bianco. As of 1/13/23.

Source: Bianco. As of 1/13/23.

How does the BOJ buy the JGBs (Japanese Government Bonds)? They have two options: print their own currency or sell their war chest of US Treasuries. We believe this selling pressure could continue to elevate yields on the longer end of the UST curve (i.e., Treasury notes). With both the Fed out of the market and Japan (historically one of the largest buyers of US Government debt) out of the picture, we believe that, historically, the attractiveness of long duration bonds is much less certain even in a recessionary environment.

The Risk of An Early Pivot

Policy tools are blunt, and the path toward equilibrium is likely to be volatile. Typically, the first move is to tighten to fight inflation at a time when growth is strong (Fed started too late). Once growth has been reigned in and inflation is in a downtrend, the tendency is to pause and see how things turn out. The pause tends to trigger a sharp relief rally in assets, which supports the economy, which cuts short the decline in inflation, requiring a second round of tightening.

These pauses generally weaken the currency as well, adding yet another inflationary pressure that increases the odds of further tightening. Pair that with the second largest economy in the world reopening and you could have the gasoline needed to continue to provoke the inflationary fire. In the ’70s, most countries required three rounds of tightening.

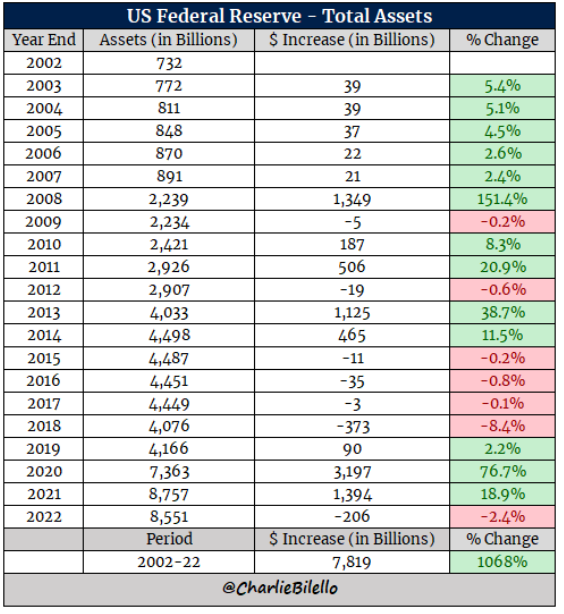

2022 QT Was Fairly Insignificant In % Terms

The Fed reduced its balance sheet by a measly 2.4% in 2022. QT should continue in the background at $95bn a month (although it’s closer to $80bn in reality, thanks to mortgage prepays slowing drastically).

Source: Bilello. As of 1/06/23.

Source: Bilello. As of 1/06/23.

We would expect the Fed to pivot their QT policy before they pivot their rate policy. Stay tuned to see how the Fed’s balance sheet plays out in 2023.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

When a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2301-20.