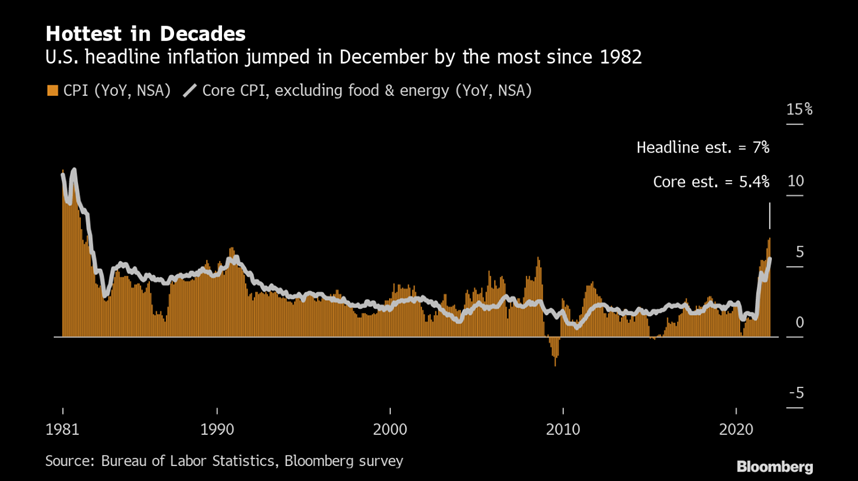

It’s been a big week for Chairman Powell as the Senate held his reconfirmation hearing on Tuesday and this morning (Wednesday) brought the release of the final inflation data for 2021. Headline CPI came in at 7%, a 39 year high. The back half of 2021 will be remembered for the re-emergence and surge higher in prices – across the board. We’ll see if this momentum continues in 2022.

Source: Bloomberg LP. As of 1/12/22

CPI Details

- Year over Year (YoY): Headline CPI +7.0% vs 7.0% survey; Core +5.5% vs. 5.4% survey.

- Month over Month (MoM): Dec US CPI +0.5% vs. survey +0.4%; Core +0.6% vs. +0.5% survey.

Headline CPI came in line with consensus at 7% and Core came in slightly ahead of consensus at 5.5%. The increase was predominately across shelter (+0.4%), food (0.5%) and used vehicles (+3.5%). Energy was lower (by 0.4%) which was the first drop since April, likely following the implications from Omicron. We’ve seen a strong rebound in oil prices to start ’22 so expect this component to bring substantial volatility into the ’22 CPI data.

Word from the Wise… Former Fed Insider Bill Dudley

When it comes to the Fed insiders, many are handicapped on what they can say to the public, especially if their opinions deviate from leadership. I always raise an antenna when the old officials speak up after leaving their post. Bill Dudley (former NY Fed President) offered four comments (or criticisms) on the Fed’s current predicament:

“The first mistake, Dudley said, was how the Fed “operationalized” this framework…The Fed’s second mistake was in misjudging the strength of the labor market…The third mistake the Fed made was to view inflation as “transitory,” …The final mistake was that the Fed was too worried about spooking the bond market and causing another “taper tantrum”.”

Dudley’s comments (and their acceptance by the market) are beginning to become more mainstream as markets carry the viewpoint of inflation moving from transitory to more structural. I fall in the camp with Dudley that the market isn’t taking the Fed seriously enough.

A Wage Spiral is Becoming Problematic

While we are still seeing goods inflation run hot, the rate of change is slowing. This is welcomed news as the level of rising prices is near records. One thing that is catching our eye is the slow-moving dragon: “sticky” wage growth. Driven by an incredibly tight jobs market, wage pressures are percolating.

Right now, the wage growth of people switching jobs has never been higher. This implies that wage pressures will continue to spread as firms are forced to pay up to keep talent. So, as the economy returns to normal, the bulk of US consumption (and jobs) are in the service sector, increasing the chance for wage pressures on top of lingering inflation.

Looking Ahead into ‘22

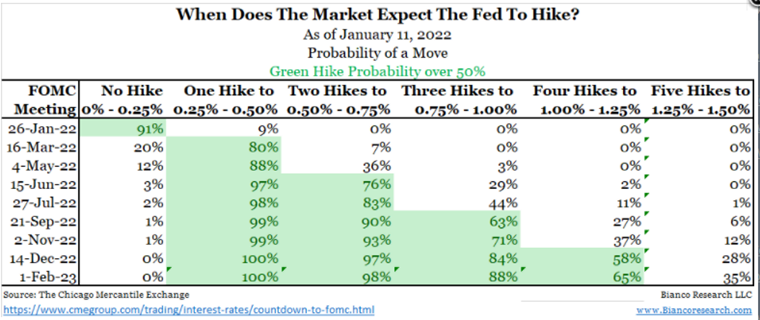

The market is pricing in 4 hikes in ’22 with an 80% chance of lift off in March. Following last week’s employment numbers (unemployment rate falling to 3.9%) indicating the job market is nearing in on full employment (plus wage pressures brewing). We believe the strong job market and the continuation of elevated inflation prints (7% today) puts the Fed in a spot where they will act (sooner rather than later) before allowing inflation to entrench consumer psychology more than it already has.

While things are turning more hawkish at the Fed, Biden still has a few Fed seats to fill. Whispers of Sarah Bloom Raskin, a former Fed board member and Treasury official, is atop the list for vice chair for supervision, joined by economists Lisa Cook and Philip Jefferson, all of which are believed to fall more in the dovish camp. This is important as all three will be FOMC voters. Potential clash with the hawks? We will see!

Market Response

Markets were hit last week with indications of a much less accommodative Fed in ’22 following the FOMC notes release. While the markets had priced in the taper ending in March and multiple rate hikes in ’22, the potential for Balance Sheet Reduction (Quantitative Tightening, i.e., “QT”) could be sooner than anticipated, which jolted markets quickly lower.

Interest rates have risen across the yield curve to start the year. The markets have recovered much of last week’s losses this week likely following Powell downplaying the hawkishness of the December FOMC notes during the Senate testimony. We continue to expect higher valuation tech to face stiff headwinds as rates are likely to continue their march higher the next couple months, a nice tailwind for value and cyclical sectors…and quality.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2201-14.