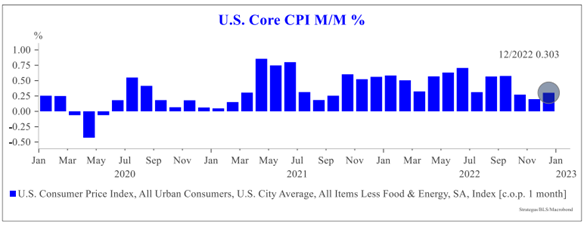

CPI was right on the screws with expectations at -0.1% on headline and +0.3% core. But the details do paint a picture of lingering pressures at the core. Core services rose by 0.5%, up from the 0.4% in November. Owners’ equivalent rent rose by 0.8%, the highest increase in 3 months.

Source: Strategas. As of 1/12/23.

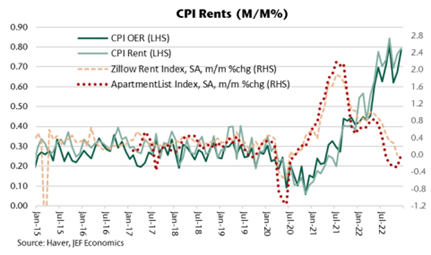

Rents Continue to Pressure Inflation Upwards

There was a notable upside surprise to shelter, which printed 0.8% (vs 0.7% exp). Real-time rents have slowed, so the upside surprise is something that is poised to slow here in 2023 (CPI rents and OER lag real-time rents by about 1 year). Although market rents are no longer rising, and have in fact declined in recent months, the lagged effects of past increases are still feeding putting upward pressure on CPI rents and OER.

As shown below, CPI rents are still about 7%-10% below market rents, which is explained by the fact that some homeowners are locked into older leases which have not yet been market to market. As these leases reset, rents will almost certainly be adjusted higher.

Source: Jefferies. As of 1/12/23.

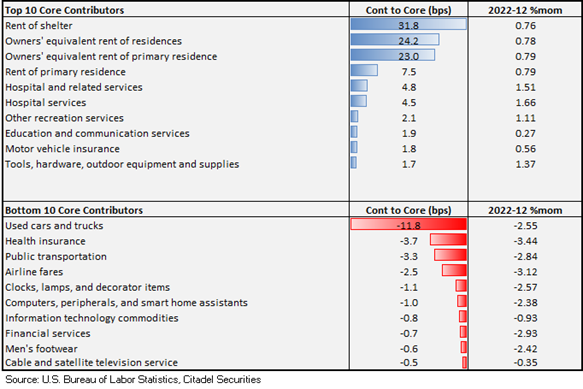

Goods Continue to Deflate

Goods deflation continued for the third straight month, led by used cars -2.5% and new cars -0.1%. The drag in December came mostly from volatile components, including energy (-4.5% m/m), food (0.3% m/m, which was the smallest increase since Mar’21), used cars (-2.5%), tech products (-0.9%), and airfares (-3.1%).

Core services ex-shelter and medical (a new favorite of the market) rose a pretty modest 0.25% and now annualizing at 5.0% over the last 3 months. Energy prices were down, but some of the core services components rebounded a bit this month, so this composition of the number may not be as encouraging as the headlines (more on energy below). For example, both medical care services and transportation services were up on the month after negative readings last month. The Fed has flagged core services as the most important component for monetary policy.

Source Citadel. As of 1/12/23.

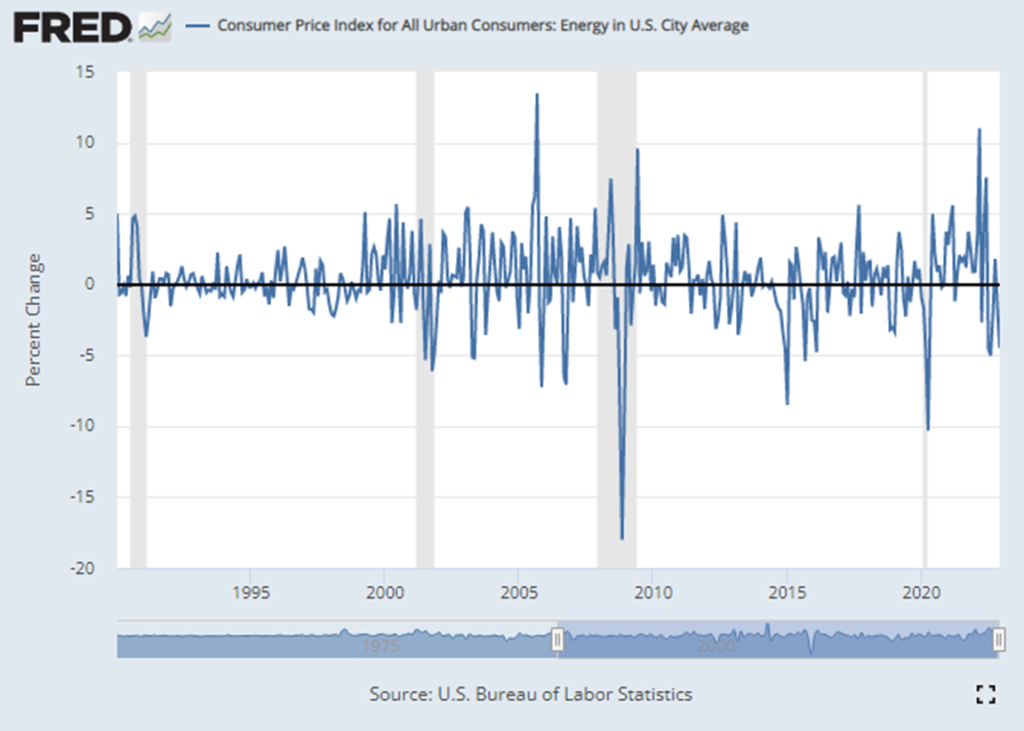

As noted, energy contracted 4.5% m/m. This past month saw one of the most disinflationary impulses that’s been seen in this category other than extreme crises. We don’t expect energy deflation to continue, especially given the China reopening.

Source: US Bureau of Labor Statistics. As of 1.12.23.

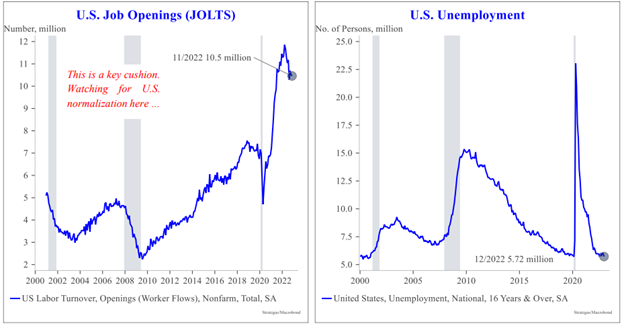

Tight Jobs Market Likely to Keep Service Inflation Elevated

The real story is whether inflation continues to grind lower to 2%, or stops decreasing. The softening of inflation the last couple months has led to hopes across the market that the Fed has indeed slayed inflation, with inflation coming right back down to their target. This would in turn allow the Fed to soften policy (cut rates) and give us the so called soft landing.

In reality, while inflation is slowing sharply around the edges (food/energy, core goods), core/sticky prices remain sticky. So for now, we have a Goldilocks scenario as inflation data continues to leak lower and appears to be under control. In our opinion, this could change as the base effects wash out the y/y calculation. At that point, core inflation is likely to settle around 3.5%, and we see it as difficult in breaking below that level without substantial further weakness in the labor market (which isn’t happening yet, see below).

Source: Strategas. As of 1/12/23.

My takeaway is while inflation is slowing, the Fed may not be happy with how quickly it is slowing. As I have been firm in saying, I tend to disagree with the quick return and recapture of 2% inflation. In saying that, I’d expect a step down to 25bps come Feb 1 in response to today’s data but no change in the terminal rate (still >5%).

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2301-17.