May 5th, 2022 – Bond Market Week Over Week Update

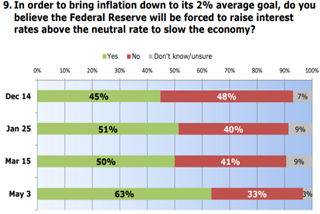

* Fed Hikes 50bps and Starts QT, albeit more Slowly than Expected. The Fed hiked rates 50 bps (instead of 75) and basically ruled out 75 bps increases going forward. In our opinion, the Fed eased policy yesterday. If you are a central bank that is behind the curve, you need to do MORE than the market expects, not less. One year forward fed funds futures yields dropped from 3.30% to 3.17%. Waiting this long to normalize policy increases the odds that the Fed will ultimately have to engineer a more significant overshoot of the neutral rate (3%+ Fed Funds Rate).

Source: CNBC as of 5/4/22

* The Battle of Transitory/ Persistent Continues: The Fed wants to get to neutral “expeditiously”, but will do so only in 50bp increments. At this pace, the FOMC will achieve policy normalization around September, which means that – in theory – it won’t begin to tackle inflation until Q4. While their jawboning has tightened financial conditions, it will take more than words to handle the issues at bay (too much demand, handicapped supply chains, and robust wage pressures/ tight job market). So, with only three hikes on the books (+25bps and +50bps), we do not believe the Fed is close to ending its tightening campaign. They are focused on inflation, not real growth. They will keep tightening until they see inflation “break.” Accomplishing this will likely require more strain on the real economy. Some would categorize this as a policy error. To be blunt, the error was made in 2021 when the Fed continued to push the idea of transitory inflation. 2022 is the consequence of that error.

* Yields are A’Rising: The 10-year yield has risen by 1.5% since the end of December because expectations of the Fed Funds Rate have risen (i.e., expectations of the Fed Funds Rate for February 2023 have risen by 2.2% since the end of December). Simultaneously, the yield curve has meaningfully flattened (indicating a growth slowdown, because of a tighter Fed). The rise in the 10-year yield has been driven purely by a rise in Fed Funds Rate expectations not increased economic growth expectations (which would lead to curve steepening). The shape of the curve will be important to watch moving ahead, specifically the 3M/10YR curve as the Fed continues hiking.

Source: Strategas as of 5/5/22

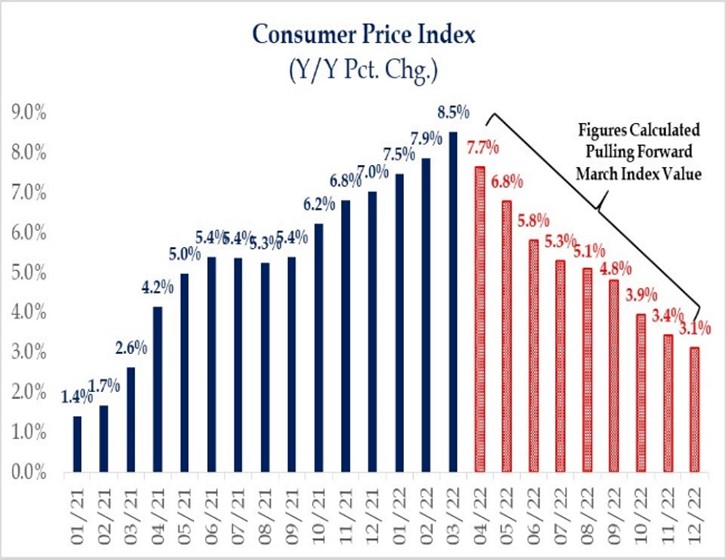

*Mathematically Impossible To Get Below 3% Inflation By Year-End: A hypothetical exercise of holding the March consumer price index value constant for the remainder of 2022 would still equate to a headline rate of inflation that is greater than 3%. The Fed made it clear yesterday, they are committed to fighting inflation and would be willing to raise rates 50 bps the next several meetings. Inflation is still very much an issue.

*Fun Fact: There are now only 100 negative yield bonds left in the world. At the peak there were >4,500.

The value of junk bonds trading for <70c in the $1 has risen to $27bn from $14bn at the end ’21. Over 8% of the US junk bond market has an all-in yield >10%

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

The 10 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 10 year. The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the “risk free” rate when valuing the markets or an individual security.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2205-9.