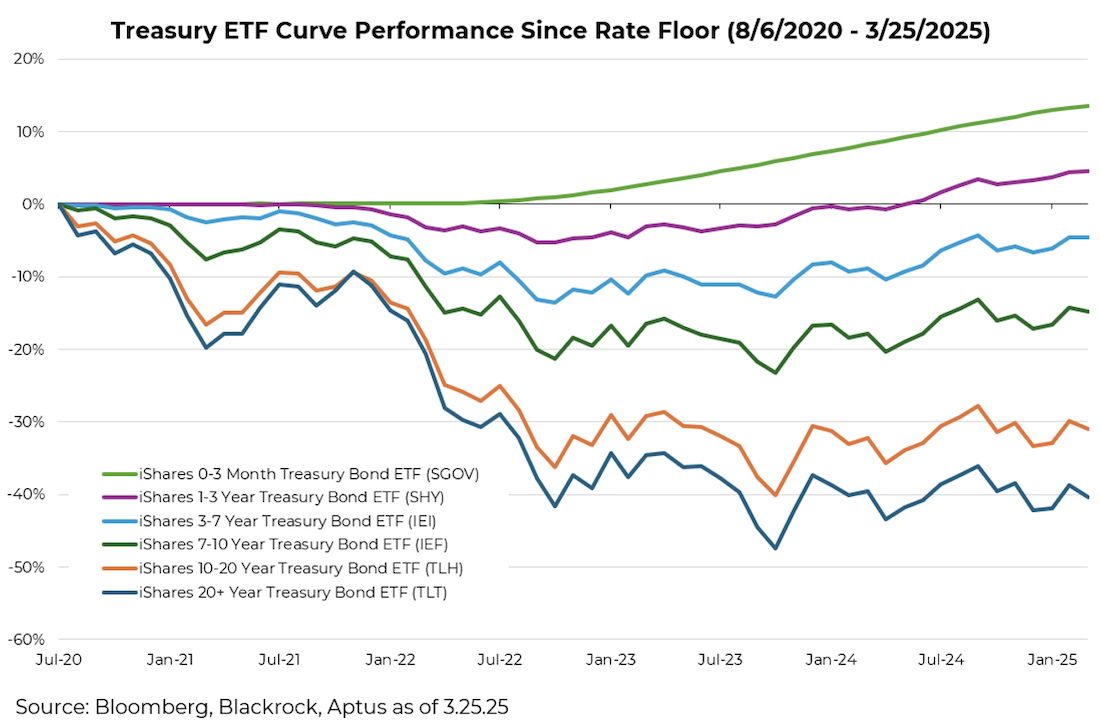

Fixed-income investors have faced a brutal reality since bond rates bottomed in August 2020. Long-dated Treasuries (20+ years) remain down 40% from their peaks, requiring nearly nine years of coupon payments just to break even. While short-duration bond investors have managed nominal gains, even those returns disappear after inflation and taxes.

The good news that I’ve heard outlined is the “pain” experienced has finally led to today’s higher yields, now above 4% across the curve, signaling brighter days ahead. But that optimism may be misguided.

The Illusion of “Safe” Returns

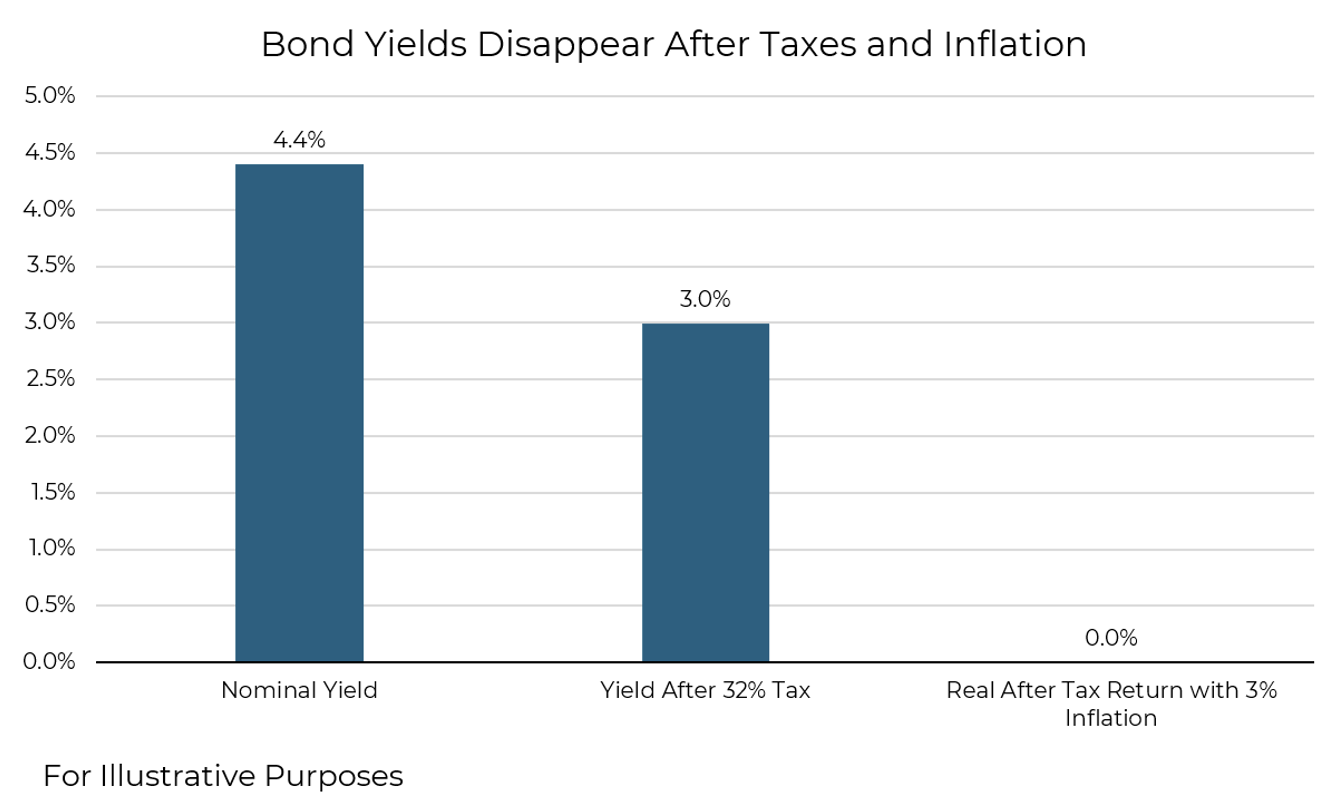

At first glance, a 4.4% bond yield seems attractive, especially after years of near-zero interest rates. But hidden beneath the surface, taxes and inflation are silently eroding your returns. By the time they take their cut, that “safe” yield could leave you with nothing—or worse, less than you started with.

This isn’t speculation; it’s simple math. And too many investors are missing it.

How a 4.4% Yield Turns to Barely Scraping By

Let’s break it down with the following starting assumptions:

1. Nominal Yield: 4.4%

2. Marginal Tax Rate: 32% (note tax rates vary by individual, thus applicable rate may be higher or lower)

3. Inflation: 3%

Here’s what happens:

-

- After Taxes: 4.4% yield × (1 – 0.32) = 3.0%

-

- After Inflation: 3.0% – 3% = 0.0 real return

That’s right; your “return” is effectively zero after accounting for taxes and inflation.

The situation worsens if inflation rises or additional taxes are applied. At 4% inflation, investors would lose 1% annually in real terms. For those in states with income taxes, the after-tax return shrinks even further. What appears as a low-risk investment can become a gradual erosion of wealth.

What Should Investors Do?

This doesn’t mean bonds are worthless, but it does mean investors need to look beyond nominal yields, especially for long-term allocations. Real wealth growth requires strategies that:

-

- Outpace inflation

-

- Generate tax-efficient returns

-

- Balance safety with growth

The Bottom Line: Don’t Be Fooled by the Number

In today’s world, where inflation lingers and taxes are inevitable, a 4.4% yield isn’t what it seems. Before settling for “safe” fixed income, look deeper. Because in real terms, your returns might already be disappearing.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2503-25.