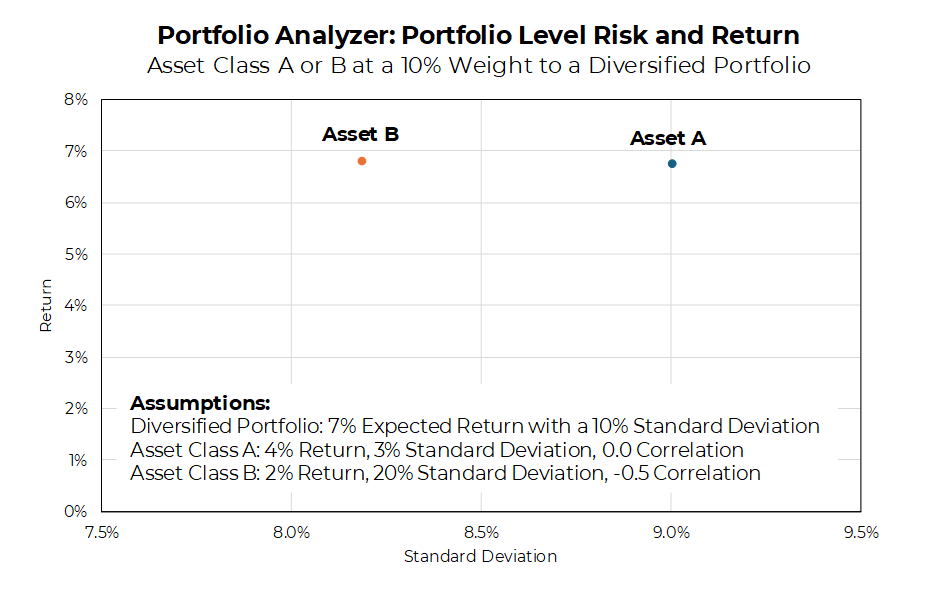

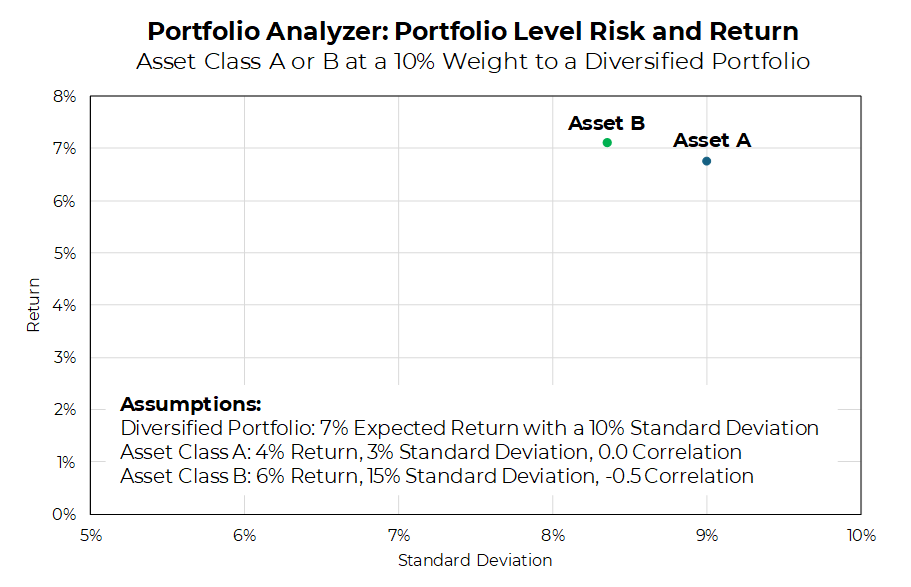

Which diversifier added to a balanced portfolio at a 10% weight is more likely to result in a portfolio with higher returns and lower volatility?

Asset A:

Expected annualized return: 4%

Annualized standard deviation: 3%

Correlation with existing investment: 0.00

Asset B:

Expected annualized return: 2%

Annualized standard deviation: 20%

Correlation with existing investment: -0.50

At first glance, the choice might seem obvious. After all, Asset A provides a higher return with materially lower risk and has no correlation to the diversified portfolio. But there’s much more to consider.

Perhaps surprisingly, a portfolio allocated to Asset B may not only allow it to keep up with a portfolio allocated to Asset A—despite the lower expected return— but it may also reduce portfolio-level risk given the negative correlation (despite materially higher volatility).

*Aptus Conceptual Illustration

This post will provide a framework to explain how a diversifier with higher volatility and lower correlation might be more helpful than traditional bonds going forward. At the VERY end, we’ll break down the math behind those takeaways for those interested (don’t worry, I will attempt to explain all the parts of the equation – yes, equation – in simple terms).

Implications for Selecting an Ideal Portfolio Diversifier

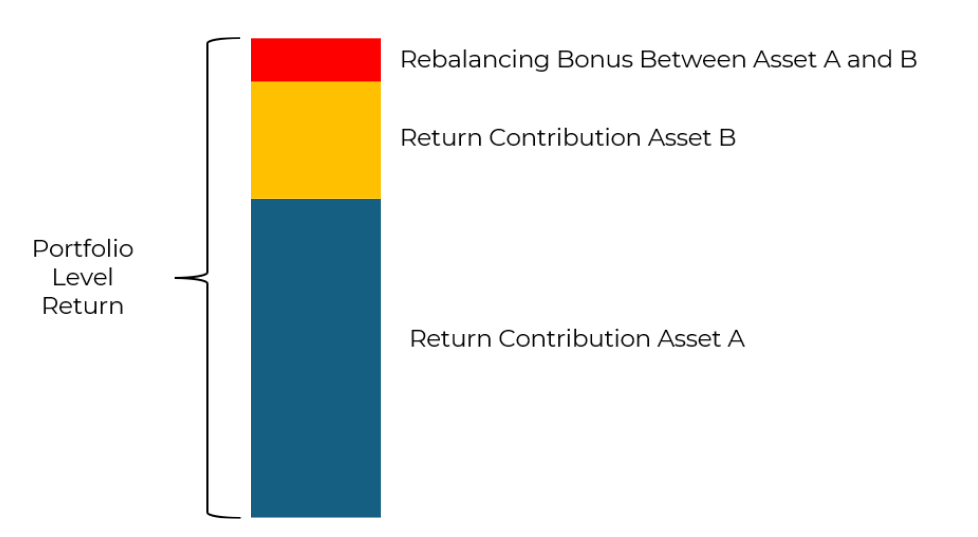

The Return Side: Introducing the Rebalancing Bonus

In simple terms, a rebalancing bonus is the reward an investor receives for re-adjusting diversified investments over time. In other words, the rebalancing bonus is how much incremental return a diversifier adds to portfolio-level returns, above and beyond what the holdings return on their own at allocated weights.

*Aptus Conceptual Illustration

*Aptus Conceptual Illustration

The full formula for the rebalancing bonus is at the end of the post, but to summarize its key drivers:

- a lower correlation leads to a greater bonus

- a higher standard deviation results in a greater bonus

- a larger difference in standard deviation to the broader portfolio increases the bonus

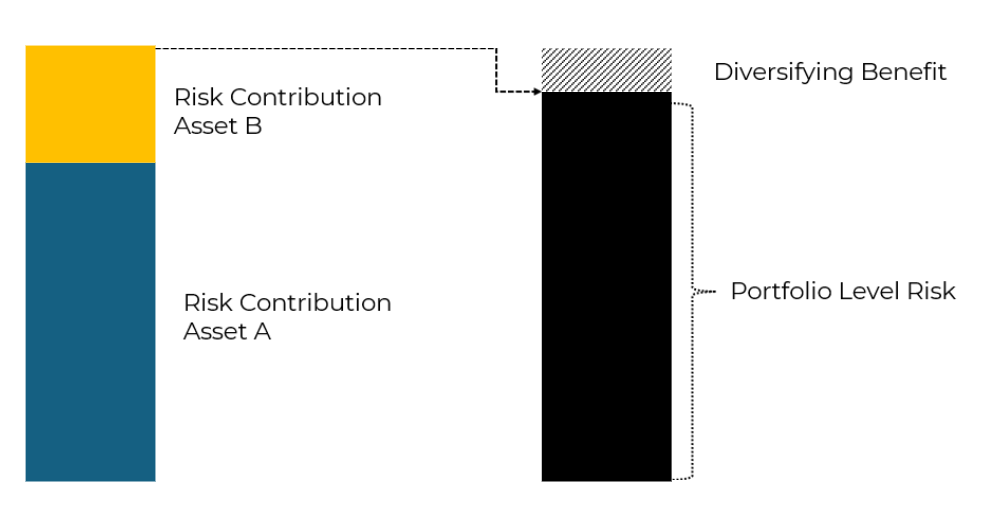

The Risk Side: The Diversifying Benefits of a Low Correlation Investment

While incremental returns can be advantageous for any investor, the true key to a diversifier lies in its ability to mitigate portfolio-level risk, by zigging while the broader portfolio zags. Therefore, while an asset with a higher standard deviation implies a wider range of potential return outcomes (all else being equal), an asset class exhibiting a negative correlation may effectively decrease portfolio risk, even if it has a (significantly) higher standard deviation, provided that the diversification benefits outweigh the impact of its inherent risk.

*Aptus Conceptual Illustration

*Aptus Conceptual Illustration

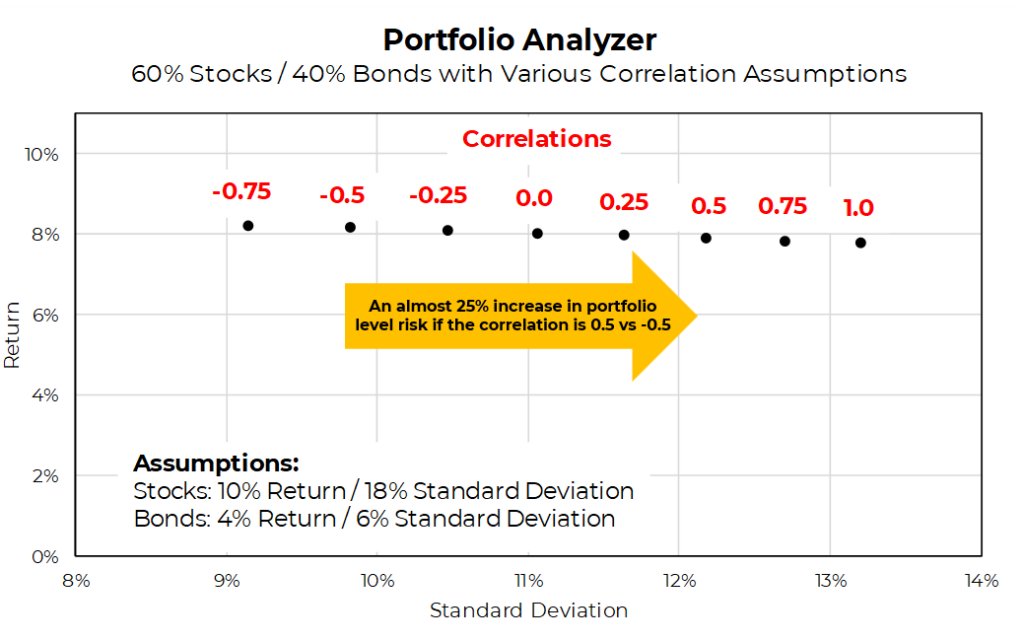

For example, contemplate the return and risk at the portfolio level for a 60% stock and 40% bond allocation, assuming consistent return expectations in each scenario but with different correlation assumptions. If the correlation between stocks and bonds transitions from -0.5 to 0.5, the portfolio’s standard deviation increases by nearly 25%.

*Aptus Conceptual Illustration

These observations carry several implications for asset allocation. Despite stocks and bonds maintaining a negative correlation over much of the past three decades, recent years have seen a shift to a positive correlation, and this trend may persist in the future. If this continues, bonds may lose effectiveness as a diversification tool. Considering their low yields and tax inefficiency, it might be less prudent to maintain them in portfolios at the same allocation weight.

Conversely, this framework supports the idea of allocating to uncorrelated strategies with higher expected return, even favoring those with increased volatility. A strategy capable of delivering superior returns in extreme market conditions—whether during sell-offs in the left tail or robust market environments in the right tail—could serve as an ideal portfolio amplifier without introducing incremental risk.

*Aptus Conceptual Illustration

Appendix: The Formula Behind the Rebalancing Bonus

The way to capture diversifying benefits over time is to rebalance from winners to losers. William Bernstein introduced a formula for what he referred to as the rebalancing bonus (RB), which helps explain this phenomenon:

RB1,2 = X1X2 {SD1SD2 (1 – CC) + (SD1 – SD2)2 / 2}

Breaking it down:

RB = rebalancing bonus

X1 = allocation weight to Asset A

X2 = allocation weight to Asset B

SD1 = standard deviation to Asset A

SD2 = standard deviation to Asset B

CC = correlation coefficient between Asset A and Asset B

To repeat what was outlined earlier. A diversifier with:

- a lower correlation leads to a greater bonus

- a higher standard deviation results in a greater bonus

- a larger difference in standard deviation to the broader portfolio increases the bonus

Try it out yourself.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

*Conceptual Illustration: Information presented above is for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flow.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2401-37.