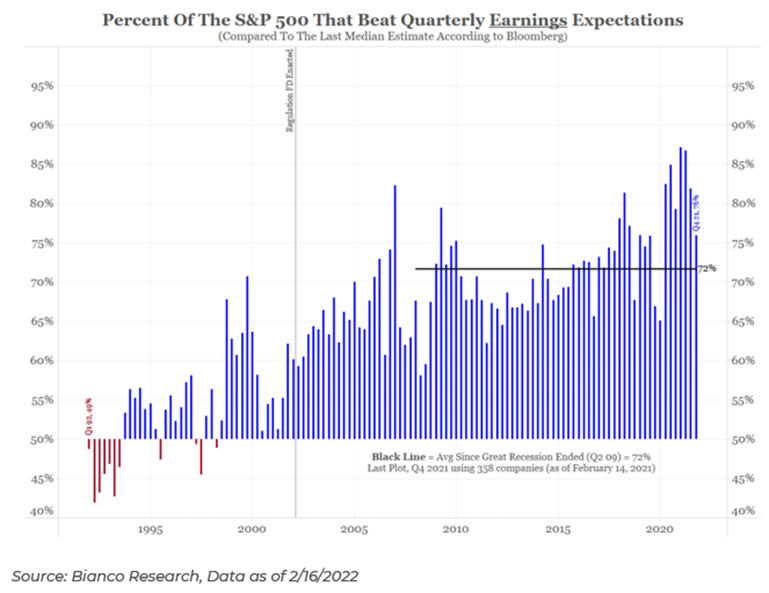

The culmination of the NFL season tends to coincide with another ending – Q4 earnings season, as 82% of the S&P 500 constituents have now reported. Fourth-quarter earnings have come in high versus historical norms, albeit slightly below previous quarters. We knew that there would be growth, in fact, year-over-year sales growth was +26%. Furthermore, earnings growth was +27.5% – Q1 earnings growth is only expected to be +5.4%, as the “base effect” in earnings starts to take hold.

Throughout earnings, we were focusing on two items: 1) management commentary surrounding growth in ’22 2) S&P 500 profitability moving forward.

- Management Commentary – In our opinion, management commentary, specifically within the Technology and Energy sectors, was quite bullish. In fact, the combination of reported Q4 results and management guidance has led to a very modest upward revision to consensus earnings expectations for full-year 2022.

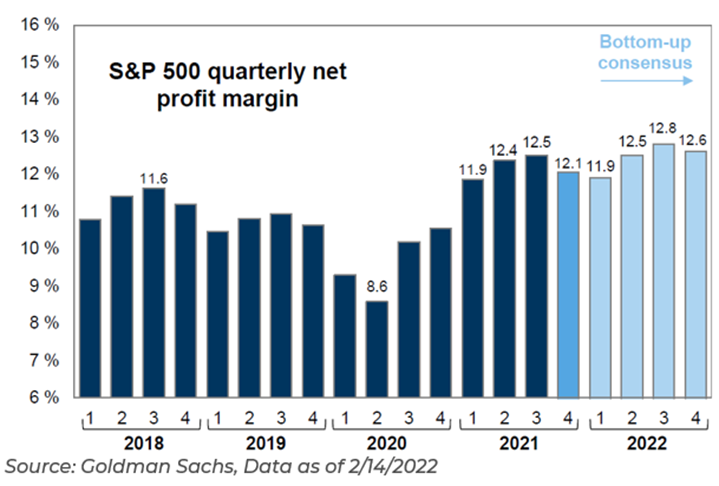

- S&P 500 Profitability – S&P 500 net profit margins in Q4 2021 were better than expected (12.1% vs. 11.5%) but dipped from the record high of 12.5% reached in last quarter. The margin decline in Q4 was partly attributable to seasonality among consumer stocks as well as some idiosyncratic losses – think PYPL, NFLX, and FB. Looking forward, consensus expects profit margins will decline slightly in Q1 2022 but rise to a new record high in 2H 2022.

How Did Companies React?

Companies that have missed earnings estimates have fared very poorly this earnings season, as the market has proven far less tolerant versus the third quarter. The market has given companies that beat estimates a modest reward with the median company trading up 1.1% after reporting. The median company that missed estimates have traded down 3.2% on reporting day.

We think this dynamic will be in play for much of the 1H of the year. As growth slows, we believe that the market is likely to favor high-quality companies with earnings stability and a strong ability to execute.

What Can Support Earnings Growth for the Remainder of the Year?

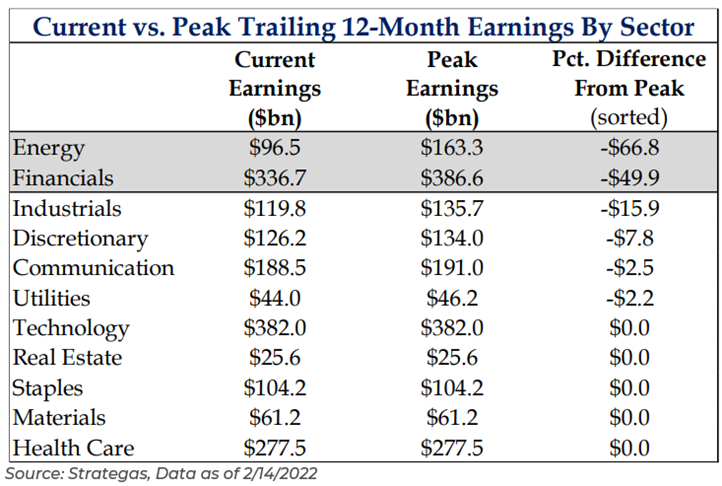

Despite 40-year highs in inflation and elevated wage pressures, market consensus regarding profit margins remains bullish at the index level in 2H 2022. Why? Energy. Although the Energy sector has earned roughly $100B dollars over the last 12-months, this remains well below its peak earnings potential that was achieved in late 2008. Over the last 14 years, profitability has steadily declined – bottoming during the shutdowns of 2020. At a time when oil prices are rising and energy demand is soaring, profitability could easily surge past previous levels. This has the ability to support earnings in 2022 for the S&P 500 as a whole and even into 2023, if prices remain high.

Random Charts That Have Caught My Eye This Week

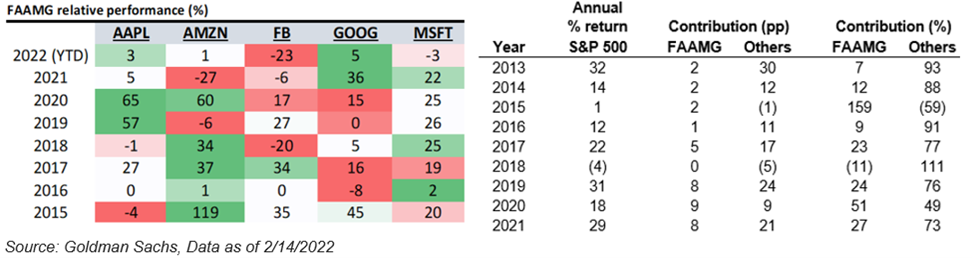

1. Two interesting takes from Goldman Sachs analysts on FAAMG – In the first, Ben Snider lays out how significant this cohort is to the S&P 500. In the second, Pete Callahan lays out how dispersed intra-FAAMG returns tend to be within a given year — it’s really not all the same trade.

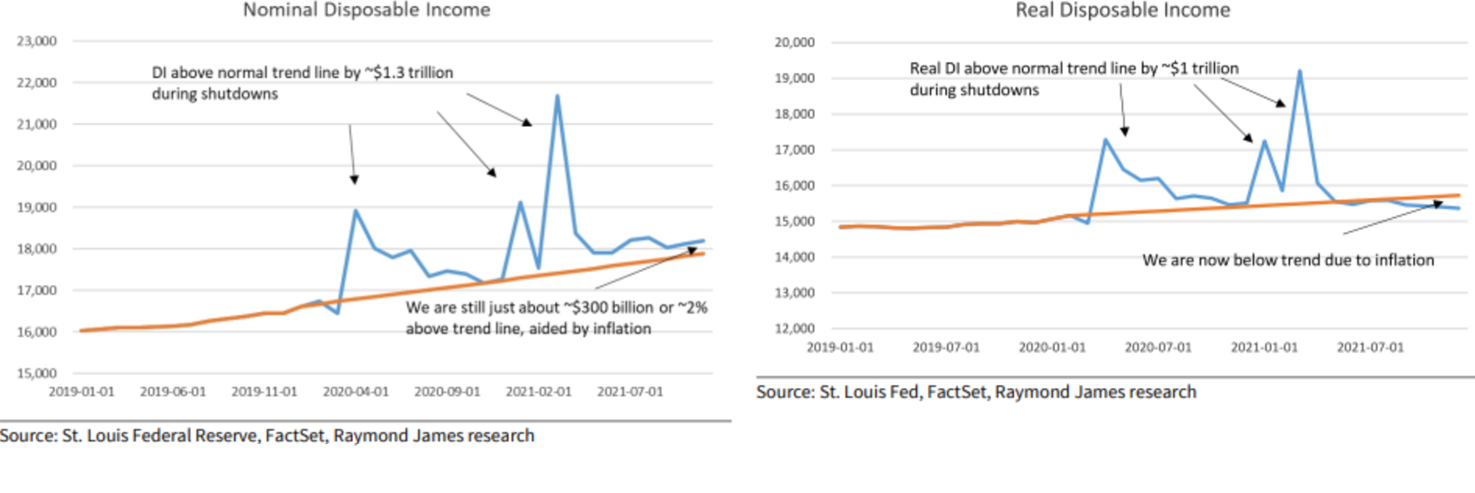

2. Disposable Income – Nominal disposable income is ~2% above the pre-pandemic trend line, aided by strong nominal wage growth. While real disposable income is now below trend as nominal income has been eroded by inflation. But keep in mind, real disposable income is still ~$1 trillion above the pre-pandemic trend line with excess savings of ~$2.1 trillion, and although savings is least impactful at lower income cohorts, these cohorts are also seeing much faster wage increases than high income cohorts.

As of 12/31/2021

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

Neither past actual nor hypothetical performance guarantees future results. The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization. Neither past actual nor hypothetical performance guarantees future results.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2202-28.