We will build on this note in weeks to come. As you’ve probably heard us say, we think it makes sense to equip portfolios with a stronger engine (stocks), using better brakes (hedges) to stay risk-neutral vs. traditional benchmarks.

If you’ve heard us speak recently, you’ve also heard the phrase, “just add beta”. We’re growing in conviction that this concept is one of the biggest items for us to get right in order to produce the investment results you desire while limiting behavioral risk (performance chasing).

Our focus in portfolio construction revolves around 2 areas:

- Improving the portfolio’s yield + growth outlook

- Doing this through an asset allocation shift, driven by owning volatility

To beat this drum again:

Yield is improved through enhanced yield funds like DUBS, IDUB, and JUCY. They each provide exposure to the respective underlying asset class, with the goal of additional yield. So far, so good. For example, do you want to own the S&P 500, or a tightly correlated basket with an added yield overlay? The answer should be pretty easy.

Growth is improved by a strategic shift in our stock vs bond allocation. In short, more stocks, less bonds. Stocks can grow. Bonds cannot. There’s plenty of evidence supporting this shift as a contributor to higher compounded returns.

Volatility is the glue guy. Short volatility strategies provide enhanced yield potential. Long volatility (think hedging) provides the potential for risk management, to complement the additional stock exposure.

Back to beta…

It’s not as complicated as it sounds. Beta is a measurement to gauge the expected movement of a position vs. the market overall. A beta > 1 means there is more volatility in a holding, and a beta < 1 suggests the opposite. If you have a position that carries a beta of 1.5 and the market goes up 1%, you can estimate a 1.5% return on that position.

Now we are on the edge of this conversation getting more complicated than it needs to. Just remember, the opposite holds true. Higher beta helps on the way up but can really hurt on the way down. Just ask an ARKK investor.

Here’s why we love the idea of improving long-term outcomes with beta…

We can clearly define and gauge tracking error while setting expectations. Assuming the directional relationship of a holding is closely aligned with the market, beta provides all we need to know. We don’t have to worry about strategy risk, style risk, momentum, etc.

All of this boils down to:

- Improve potential outcome

- Reduce the performance-chasing urge

Our point is we just want to provide additional equity while cutting off the left tail risk. We don’t want to chase or bet on what might happen. Beta is enough.

What additional risk do investors tend to add into portfolios? Here’s a hint… in the summer of 2021 it was Ark Funds and bitcoin. Summer of 2022 was value, managed futures, and cash cows. In summer of 2023, anything with an AI story.

Recent performance tends to dictate the types of risks that show up in portfolios. In other words, performance chasing is our largest enemy. If it hasn’t worked recently…then I hate it. Let’s go buy what has worked.

Our desire is to continue to improve our strategies and services, and the communication of both, to minimize the impact of performance chasing.

Better in the tails. That’s the ultimate objective. More beta for the right tail and true risk management for the left, add yield in the middle of the bell curve.

There will be times when we live in that middle, and those periods could be good or bad vs. expectations. We are in one of those stretches now, and battling through it. It’s on us to communicate, and spend the time needed to drive home the what and why of the portfolios.

Our Portfolio Approach

We tend to build risk-based target exposures. It’s traditional in the sense that conservative portfolios own more bonds than aggressive portfolios.

Where we deviate is in our exposures vs. traditional benchmarks. Our approach is to over-allocate to equities, while providing a buffer against the additional volatility that gets felt.

- Additional equity exposure is designed to increase the durability of financial plans, through higher returns at the portfolio level.

- The additional risk is managed by owning hedges that can benefit from markets experiencing higher volatility.

When we break returns down into Yield and Growth (investments returns), or valuations expanding (speculative returns), we focus on the combination of yield and growth. Each strategy we launch is designed to either enhance portfolio yield, or provide greater access to growth. If we improve the collective Y + G in each portfolio, the likelihood of success for our advisors and their clients improves.

The question comes up: ”Won’t the additional equities generate more risk?”

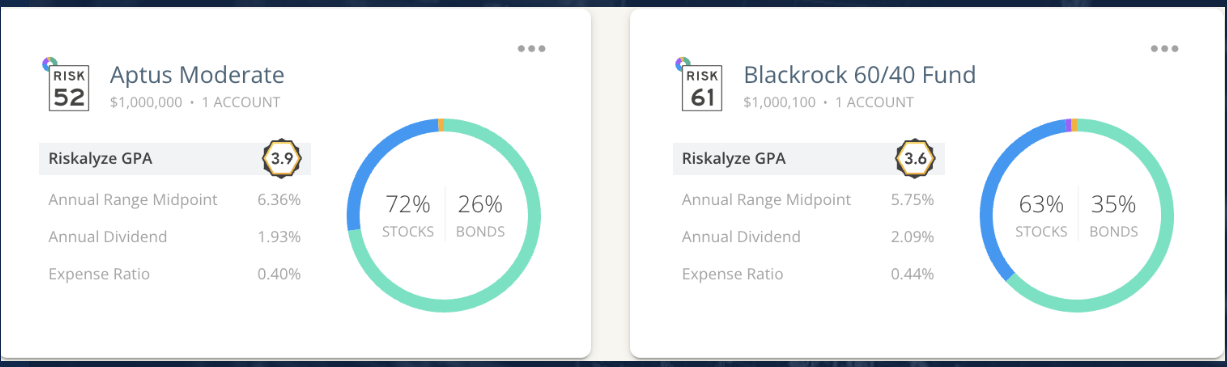

You may or may not be users of Nitrogen and their risk analytics platform. I’ve added a snip of our moderate portfolio vs a traditional 60/40 to illustrate our point. While we own more exposure to equities (72% vs. 63%), our overall risk score is just a 52 vs. the benchmark’s 61. That’s the power of real portfolio brakes, supporting a stronger portfolio engine.

Source: Nitrogen as of 09.30.2023

We won’t always look great over short-term periods. We are confident in our strategic shift when it comes to long-term results. When it comes to risk exposure within portfolios…we just want to provide more equity upside while limiting our exposure to nasty drawdowns.

Better in the tails, for the ultimate benefit of your clients. As always, thank you for your trust.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies, and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2310-10.