The plan was to discuss valuations, but July created the opportunity to revisit two important concepts:

- Asset Allocation

- Upside and Downside Capture

We wanted to touch on both and their impact to our portfolios.

Asset Allocation

Asset allocation is the most important decision we can make as investors. What percentage of risk assets (stocks) should I own vs. “conservative” assets (bonds)? That’s the general question.

Our entire portfolio construction process, for years now, is built around our ability to own more stocks and less bonds. Why?

We continue to believe bonds lack the potential for real return. Remember, we just had a CPI print (the default measure of inflation) at 9.1%. If you have a bond paying you 4% interest and inflation is running at 9.1%, assuming price stays constant, that’s a negative 5.1% real return annually on that bond.

We understand (and hope) that inflationary pressure may be relieved over time, which should gradually create less negative real yields – maybe even positive someday! We just don’t see that happening overnight. Therefore, we like stocks in favor of bonds as we’d like to hold more of an asset that can generate return, vs. one that cannot.

Upside and Downside Capture

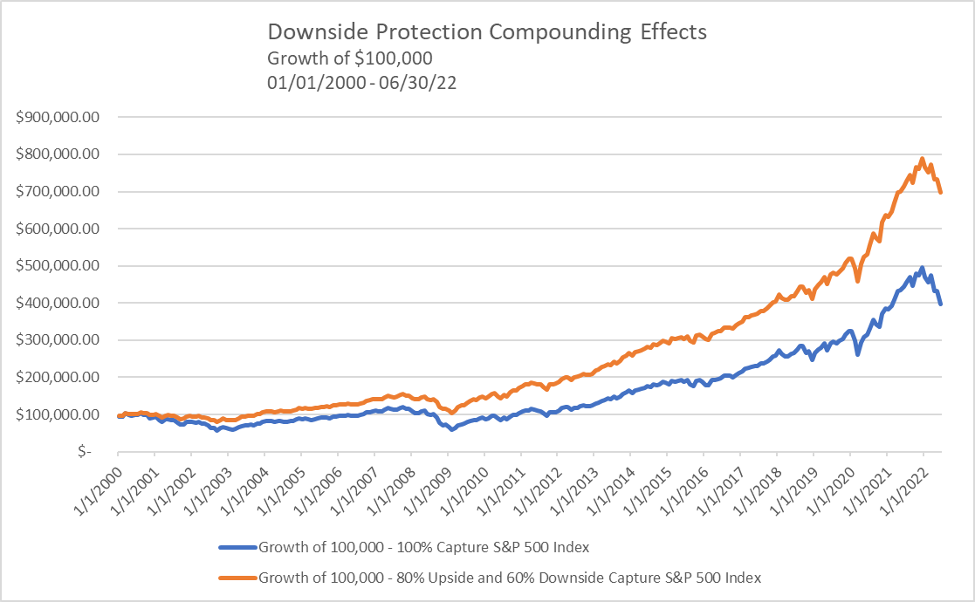

We could make the argument that capture ratio is the most important concept we discuss. It all ties into volatility tax and how harmful large losses can be to the ability to compound capital.

No matter your benchmark, if you can capture less of the negative moves, you don’t have to capture all of the positive moves. Look at how powerful this can be:

Source: Bloomberg, Aptus Research

Source: Bloomberg, Aptus Research

Our portfolios hold more stocks (the risk asset) and less bonds (the conservative asset) than our iShares benchmarks. Doesn’t that position us for more risk? Wouldn’t that translate to a larger drawdown capture? Good questions…

Our Portfolios

The biggest difference in our portfolio construction process is our view of volatility. We treat it as an asset class, and attempt to own it in a way that allows allocations to shift without absorbing too much risk. We are advocates of hedged equity.

Hedged equity exposure can be found within each allocation, and we hold different variations. Some hedges are designed for effectiveness in markets that grind lower, while others are designed for effectiveness in markets that fall off a cliff.

We began to refer to the variations as either seatbelt hedges or airbag hedges thanks to a partner of ours. Not every crash needs an airbag, but you definitely don’t want to throw it out just because it didn’t deploy in a fender bender.

As a reminder, a hedge is a security that benefits from another security dropping in price. A put option that gives you the right to sell a security at $100 will increase in value if the security you can sell for $100, because you own the put, drops from $100 to $50.

Let’s focus our capture discussion on our moderate portfolios, since most assets we manage fall into this bucket and are compared to the iShares 60/40 allocation as a benchmark.

Downside Capture

The low of the year was on June 16th. According to Bloomberg, the iShares 60/40 benchmark was down -17.30% while our moderate portfolios were down -15.26%.

That’s an 88% downside capture ratio and relative outperformance of 2.04% when markets were at lows.

While we outperformed on the downside, it sure didn’t feel like it. This drawdown and environment have been drastically different from the crash in 2020. We’ve received questions about why our downside capture was greater than it was in other periods.

The short answer is that volatility has not performed…there’s been a lid on it. During 2020, the S&P dropped nearly 35% in a month with VIX going over 80. That’s an explosion of volatility that benefited our allocations.

This year, the market dropped roughly 23% over 6 months with the VIX never breaking above 40. That’s a very difficult environment for hedges. While they worked, the effectiveness was just watered down.

Here’s the good news that can be taken from this downside discussion:

- Even though the outperformance wasn’t as powerful as we’d like, we can still illustrate our allocation shift not injecting more risk than the benchmarks despite holding more stocks.

- The price damage to bonds should be minimal compared to what it was in the first 6 months of the year. Going from ~0% to 3% is more painful to bond prices than going from 3% to 5%. In other words, we find it hard to see an environment where your conservative assets take the beating they did in the first half of the year.

- We are constantly reviewing how we deploy and manage hedges. I believe the team has done an incredible job of working at our craft and our portfolios should benefit from the learning process.

Upside Capture

In July, according to Bloomberg, the iShares 60/40 benchmark was up 5.23% and our moderate portfolios were up 5.78%. That’s an upside capture of 110%!

Upside capture is the least of our worries. Even if our hedged equity exposure drags on the upside, at the allocation level we will be fine simply because we are exposed to more stocks in general.

Closing

Bonds have been an incredible allocation in portfolios for nearly 40 years. They’ve created diversification benefits and have been a great source of return. Moving forward we believe returns will be hard to come by. For this reason, we think investors who do not adapt will be susceptible to longevity risk.

We want to avoid making allocation decisions while looking in the rearview. We will continue to be advocates for owning more stocks with hedges in place rather than bonds. Our funds and portfolios are showing themselves as effective tools to handle this shift in bond (lack of ) usefulness.

If you want more detailed numbers on the portfolios, please don’t hesitate to reach out. As always, thank you for your trust.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2208-4.