Most people hate taxes – that’s why they should love ETFs. As in past years, capital gains distributions from ETFs in 2021 were a tiny fraction of those distributed by their mutual fund counterparts.

Our objective is not to restate the fact that ETFs are more tax efficient than mutual funds, but to explain why that is. Creation, redemption, APs, baskets…. we are going to cover some stuff. We are going to do so by walking through a simplified example of a custom redemption, don’t worry, we will break all the jargon down.

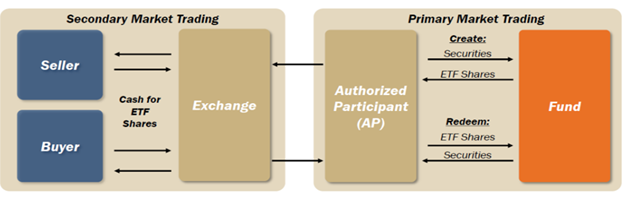

Tax Efficiency for ETFs starts with the fact that ETFs trade in two markets, the primary and the secondary. What’s the difference? Good question!

When you buy shares of a fund, you are participating in the secondary market. You take cash and buy shares of a fund. When you sell a fund, you are receiving cash for those shares. That’s all happening in the secondary market. And let me stress…you are buying shares of the fund. You are not buying the actual securities the fund represents.

Remember, the supply of an ETF is determined by demand…if demand exceeds supply, somebody has to create more supply and if supply exceeds demand, somebody has to destroy (or redeem) supply, that’s the role of an Authorized Participant (AP). They interact directly with the fund itself in the Primary market swapping securities for shares of the ETF depending on demand. OK…here is a picture of what I just said so we can catch our breath:

Source: Penserra

***One point to make clear before we move on – When an AP creates or redeems an ETF it happens in units of typically 50,000 shares.

In summary, ETFs trade in both the Primary and Secondary markets. Why does that bring potential tax efficiency to the table? To answer that, we have created a simple custom rebalance example to walk through.

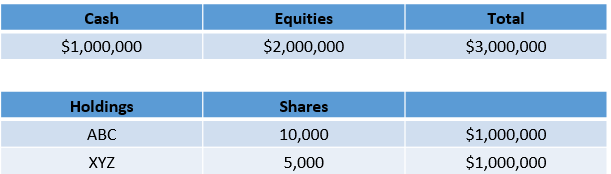

Introducing the 123 ETF. This ETF has a Net Asset Value (NAV) of $30 and has only 2 units (at 50,000 shares a piece) outstanding. That’s 100,000 shares outstanding for a total Assets Under Management value of $3 million. Below is a picture of this ETF and a breakdown of its holdings – again this is fake and simplified example to explain tax efficiency:

Now, let’s assume the portfolio manager decides to remove ABC from the fund. On top of that, ABC has an unrealized gain that the portfolio manager would prefer not to realize and distribute to shareholders. In order to facilitate that, they call up an AP to help with a custom redemption – this is typically a 3 day process.

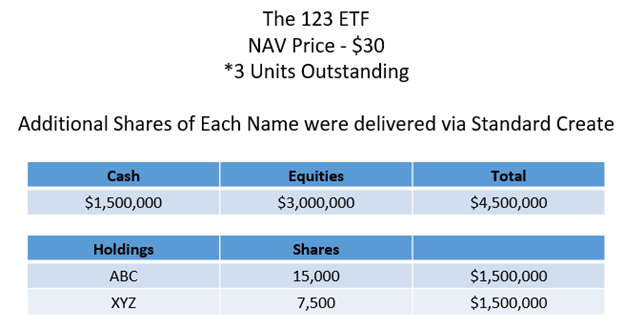

To kick things off, the AP creates one standard unit of the fund. This will involve the AP delivering another unit of actual securities to the fund in proportion with the current make up, and in return, receiving back from the fund, 50,000 more shares of the fund. Keep in mind the 123 ETF has 2 units outstanding – or 100,000 Shares.

So one unit is just half of what’s already there. For example, the AP will deliver 500k of cash, 5,000 shares of ABC, and 2,500 of XYZ in return for 50,000 more shares of the fund itself. That is the AP creating more shares which will increase the size of the fund. Here is a breakdown to further detail what’s happening

1 Unit = 50,000 shares An AP delivers the basket of Tickers and Cash and in turn receives back 50,000 shares of the fund. The Value of the “In-Kind” Transaction is $1,500,000 ($30 NAV x 50,000). This is a typical or standard Creation.

Here is what the fund looks like during the rebalance process after the standard unit was created:

Everybody still with us…ok good, we will keep moving.

As you will see, the fund is now $1.5m bigger than it was with each position increasing as more shares were delivered in from the AP. Now for the fun part…

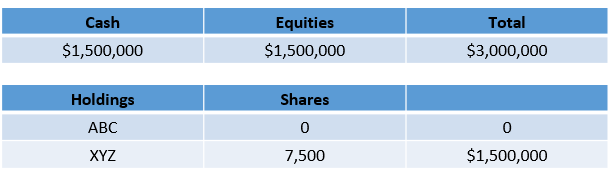

The portfolio manager then instructs the AP to redeem (the opposite of create) the recently created 50,000 shares. This would be the AP returning shares of the fund back to the fund itself, in return for shares of securities. If the AP is swapping $1.5m worth of the fund, they get back $1.5m worth of something. Typically, it would be a standard unit (or basket) of the fund.

But remember, we are walking through a custom redeem example. So, the portfolio manager instructs the AP to redeem back the recently created shares in return for ONLY the 15,000 shares of ABC which is valued at $1.5m. (in real life that never works out perfectly but this is an example so stick with me!)

Now, post standard creation unit and the custom redemption, the fund is back to 2 units outstanding (no change there) and $3m total of AUM (no change there either). The weightings of the holdings have changed but the important part is ABC has been removed from the portfolio without being sold. It was removed via an “in-kind” exchange, which is a non-taxable event. Below is a picture of the fund now:

That’s a basic look at a custom redemption, the process that creates tax efficiency for an ETF. To summarize, the portfolio manager was able to remove a position with a large unrealized gain through redemption, a non-taxable event. Pretty cool stuff. Now, you’re an expert in ETF mechanics and will be able to explain why ETFs are more tax efficient vehicles.

There’s a lot more we could cover, but I’ll shut up for now! Thanks for reading.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2203-22.