Hedge funds have long been a polarizing topic in investing. Though they date back to the mid-20th century, they’ve come to represent sophisticated strategies often associated with the ultra-wealthy. Critics argue they come with high fees, high tracking errors, and often fail to beat traditional benchmarks like the S&P 500—and, frankly, they’re often right.

However, when structured and priced correctly, hedge fund returns can offer uncorrelated excess return that plays a critical role in a diversified portfolio, particularly during market downturns. But how can the typical retail investor access these kinds of returns in today’s evolving financial landscape?

Why Have Traditional Hedge Funds Fallen Short?

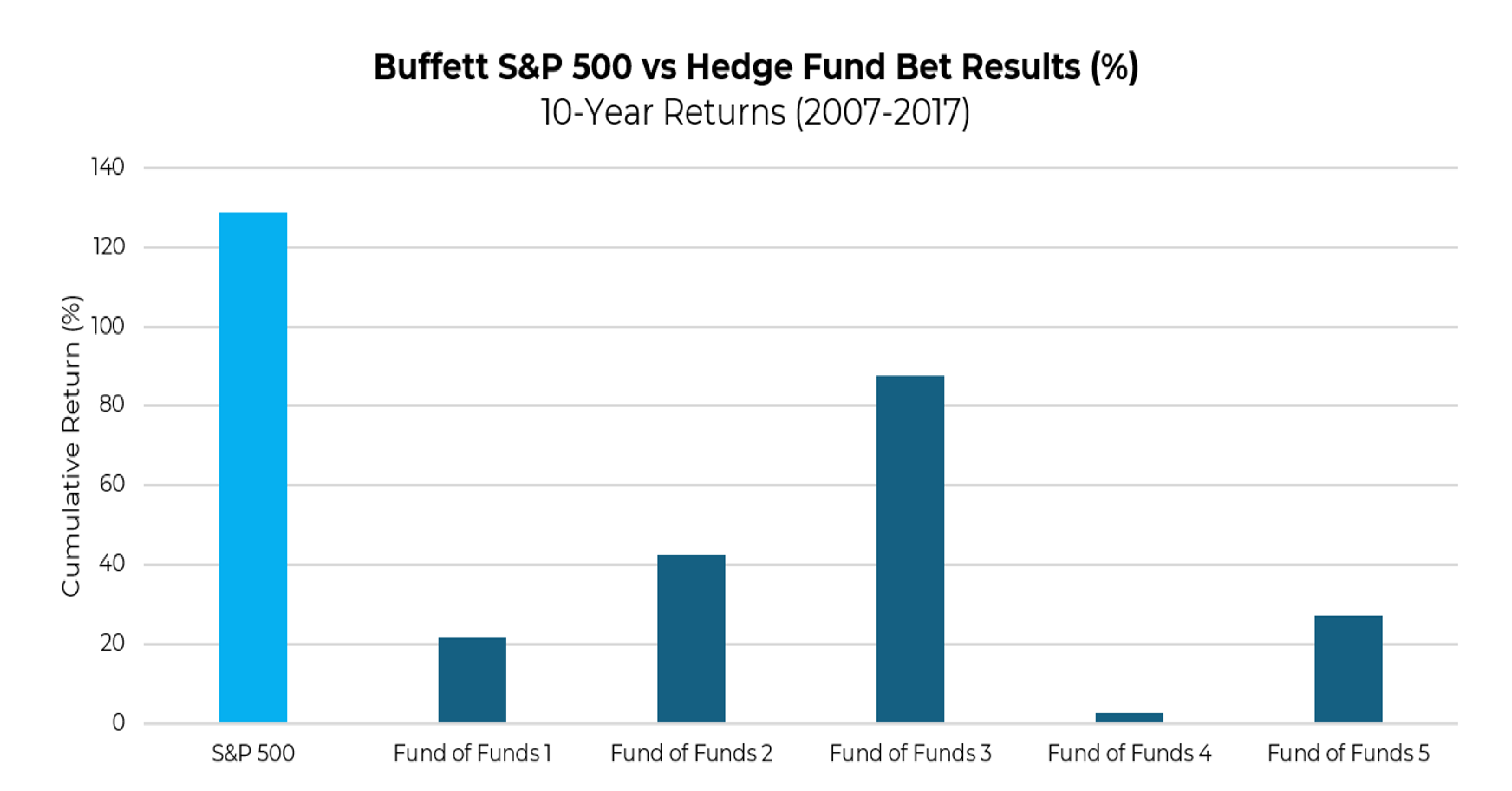

In 2007, Warren Buffett famously bet $1 million that a low-cost S&P 500 index fund would outperform a selection of hedge funds over the following decade. The result was telling: the S&P 500 Index significantly outperformed all five hedge fund portfolios chosen by a well-known fund-of-funds manager, despite the market turbulence during that period.

Source: Berkshire Hathaway 2017 Letter to Shareholders

Source: Berkshire Hathaway 2017 Letter to Shareholders

This outcome isn’t unique. Hedge funds have consistently struggled to meet expectations, primarily because they are often judged on their absolute returns rather than their intended goal—delivering alpha, or excess returns above cash, with low correlation to traditional assets. When compared directly to broader equity markets, they frequently fall short.

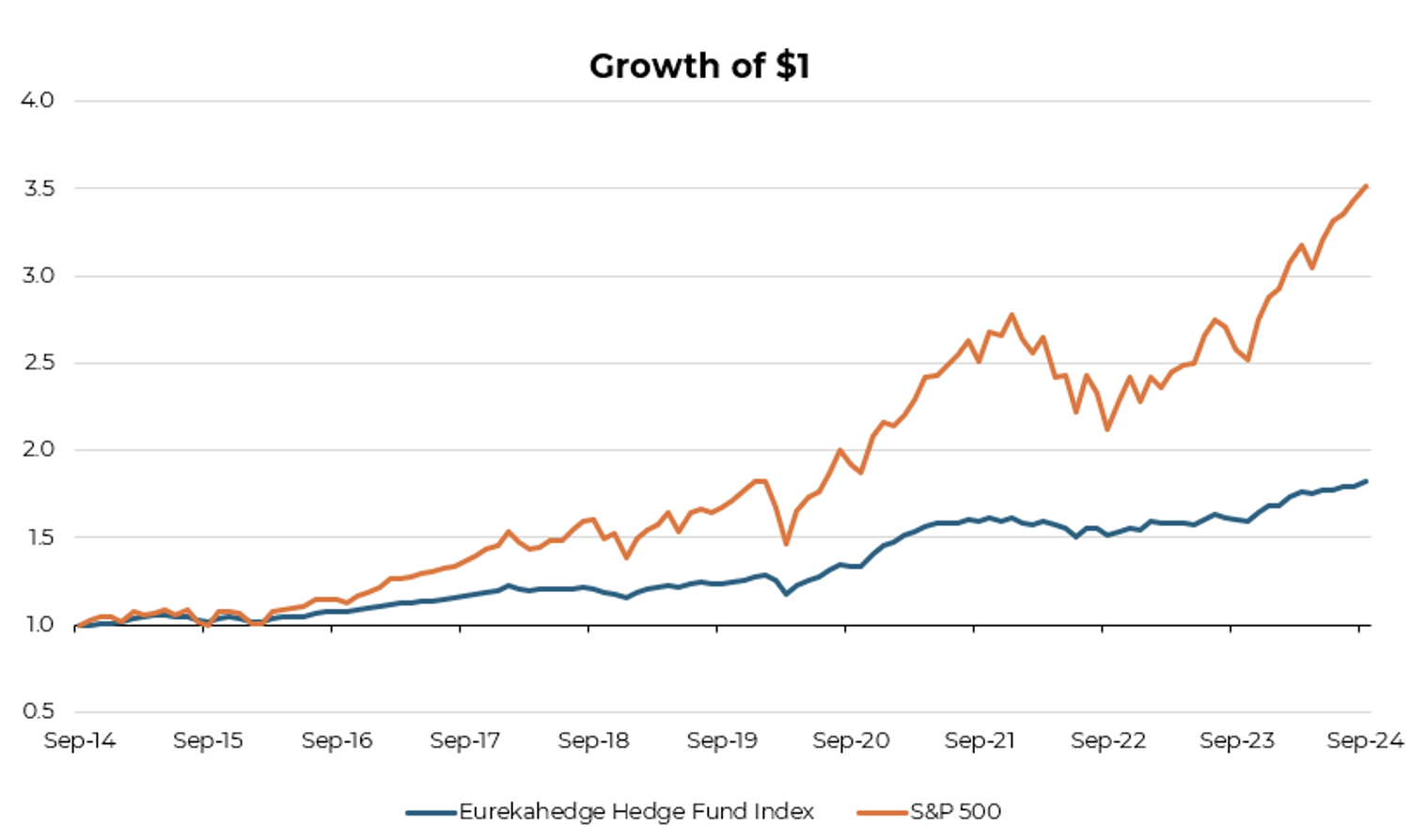

Take the Eurekahedge Hedge Fund Index as an example: over the past ten years, this index of 3,044 hedge funds has lagged the S&P 500 by more than 7% per year. Many investors allocating to hedge funds over equities have not only underperformed but likely faced a higher tax bill. The high fees and additional due diligence often involved further contributed to investor dissatisfaction, even if the hedge fund managed to achieve risk-adjusted success.

Source: Eurekahedge, Bloomberg, Aptus

Source: Eurekahedge, Bloomberg, Aptus

The Case for Structurally Efficient ETFs

This is where structured ETFs come into play. Unlike traditional hedge funds that aim for standalone alpha but often fail to deliver, these ETFs combine multiple return streams, market beta, and sometimes leverage—all within a tax-efficient wrapper. This blend of alpha generation and beta exposure offers a more holistic approach to performance.

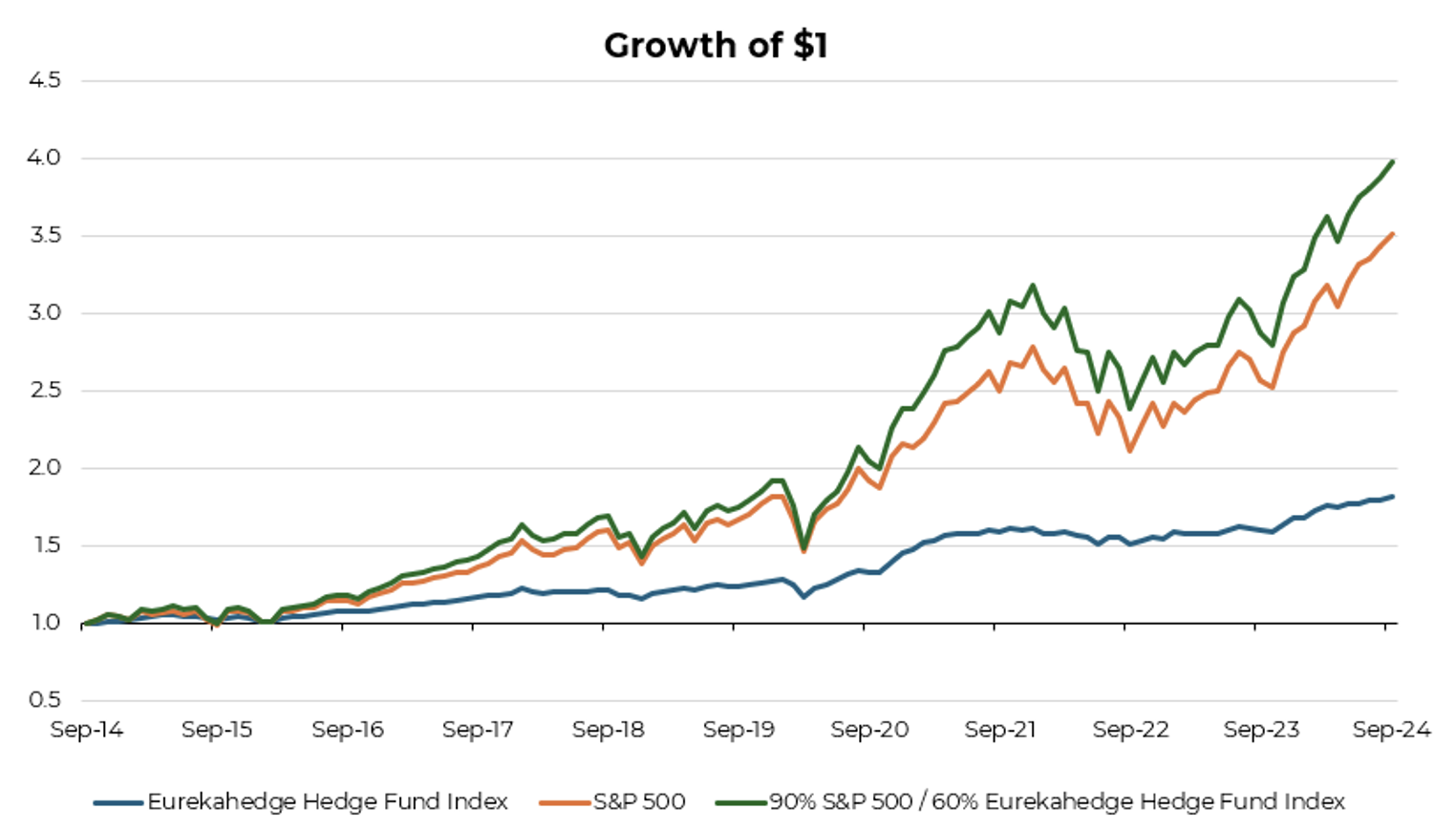

Imagine coupling the Eurekahedge Hedge Fund Index’s return stream with core market beta. In this scenario, an investor could achieve higher risk-adjusted and absolute returns—even after financing costs—within a more efficient structure. This approach contrasts sharply with traditional hedge funds or liquid alternatives, which often require sacrificing core beta to achieve alpha.

Source: Eurekahedge, Bloomberg, Aptus

Source: Eurekahedge, Bloomberg, Aptus

In structured ETFs, core beta can be maintained while layering in excess return potential, thereby enhancing expected portfolio returns without a material increase to overall risk.

A Better Solution for Liquid Alternatives

In today’s market environment, fixed income has struggled as both a return driver and a diversifier. ETFs that incorporate both alpha and beta exposures offer a modern alternative, moving beyond the traditional “cash plus” strategy of many liquid alternatives. These dynamic ETFs provide greater return potential while preserving desired risk characteristics, all at a fraction of the cost of hedge funds.

Moreover, structured ETFs offer greater transparency, liquidity, and cost efficiency—traits that traditional hedge funds often lack. This makes them an appealing choice for investors looking to access sophisticated strategies without the complexity and fees that hedge funds impose.

Conclusion

The shift from hedge funds to structurally efficient ETFs marks a fundamental change in how investors can capture both beta and alpha. By combining the best aspects of alpha generation and beta exposure, structured ETFs not only have the potential to outperform traditional hedge funds but also align more effectively with broader market returns. In this new era of liquid alternatives, structured ETFs offer a compelling option for investors seeking better performance and more efficient portfolio solutions.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2410-26.