We are three quarters through 2022 and it’s been a tough year. We’ve weathered this market turmoil, but I’m fully aware being down ‘less’ is not something most investors view as a win.

Let’s recap what’s happened, while keeping our focus forward. The windshield matters more than the rearview. We’ll stay high level in this note, but if you need more detail on any market data – please don’t hesitate to ask. The team is pumping out content that covers nearly every area of the markets.

This is a positive note by the way. There’s enough negative sentiment out there, y’all don’t need more of it from us. The cup is half full…let’s dig in.

Why This Year Has Been Tough

Nothing has worked.

Our options as investors can be grouped into stocks or bonds. Stocks are often referred to as the risk asset while bonds are the conservative asset, and they are supposed to complement each other. Investors have grown used to certain relationships, both of which have been flipped upside down:

- If stocks perform poorly, bonds should be holding up, and vice versa

- Bonds are safe … if you are risk averse, just own more bonds

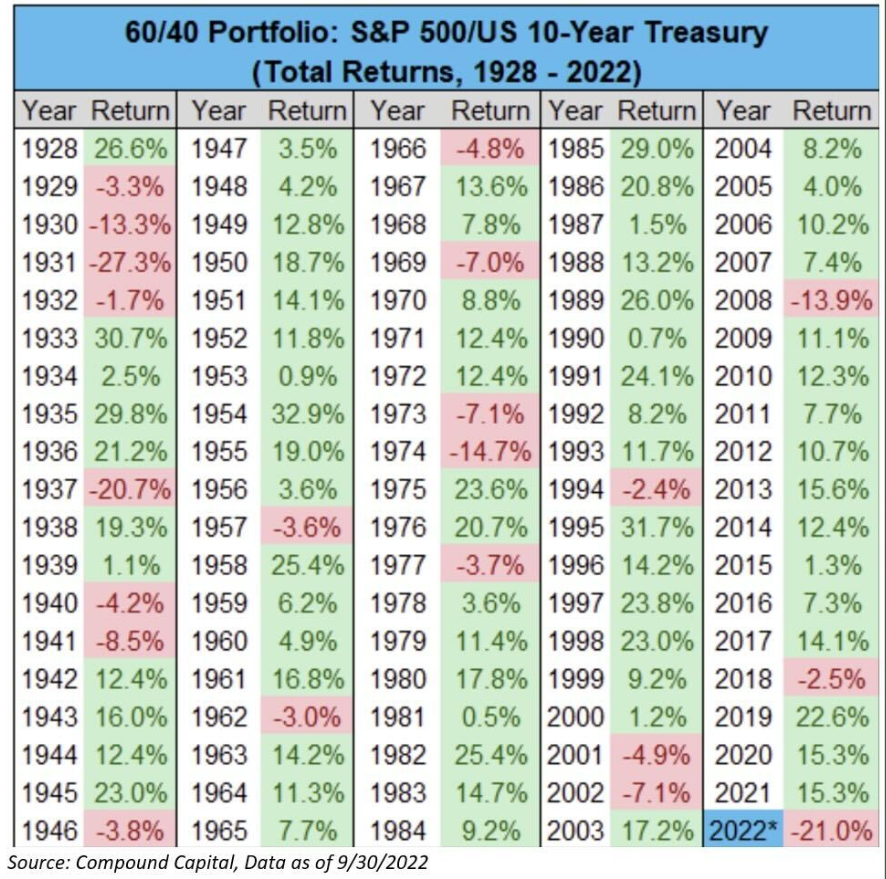

Well, look at this table. Through Q3 of 2022, an allocation of 60% S&P 500 and 40% 10-Year Treasury bonds has returned -21%. 95 years of data and 2022 is currently 2nd in terms of the worst years for this combination.

Discount Rates going Up

Harking back to Greg Odens Everywhere, a security (stock or a bond) is a claim on future cash flows. Discounting the cash flow generated by a security is how we determine that security’s value…today.

Why do we discount? Because, as John Law said, ‘Anticipation is always at a discount. $100 to be paid now is of more value than $1,000 to be paid $10 a year for 100 years.’

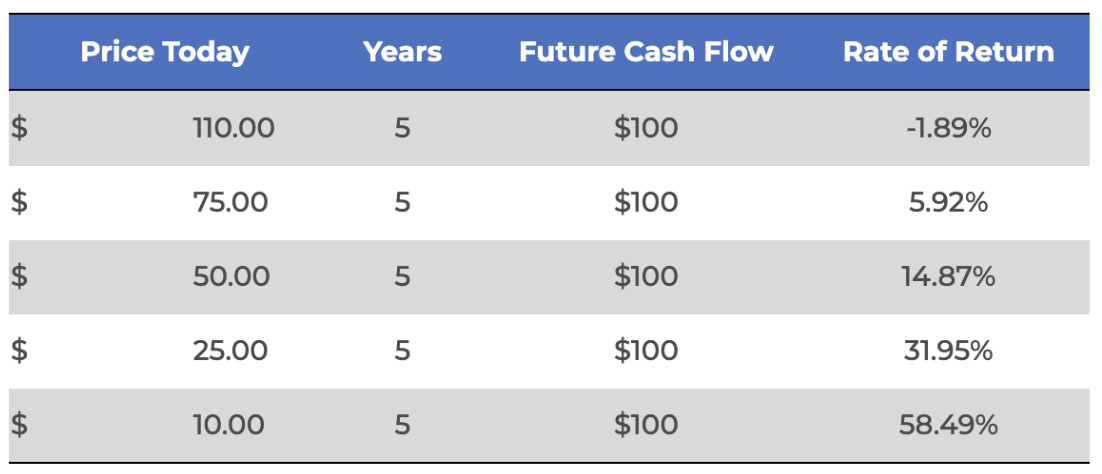

The value of an investment (a claim on future cash flows) is inversely correlated with the discount rate used to determine today’s value. Think about it like this…

If you know you own a claim to $100 in the future, paying $50 for that claim would generate a higher return than paying $75. The lower price you pay, the greater the return.

Being willing to pay a higher price for the investment means you are willing to accept a lower return. And the opposite is true. Being willing to pay only $50 for the investment means you are demanding a higher return.

Now read the preceding paragraph and swap the word ‘return’ for ‘discount rate’. It’s the same thing. If you as an investor demand a higher return on your investment, then you’d have to discount the future cash flows with a higher rate, which leads to a lower value TODAY.

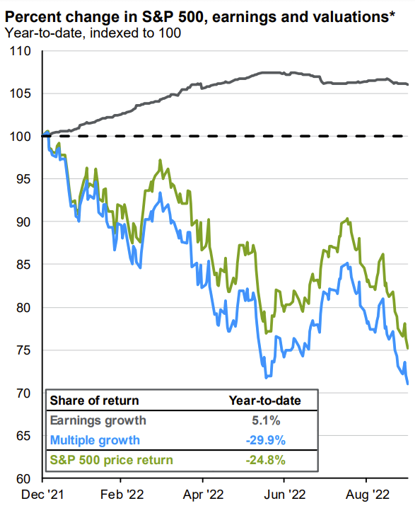

‘Multiple’ is shorthand for valuation. If a company earns $1 of earnings and trades at a Price to Earnings multiple of 10x – then the company’s stock would trade for $10. If for whatever reason the company starts trading at a 15x multiple, current shareholders will benefit from rising stock prices.

Higher multiples in stocks are mathematically the same thing as lower discount rates, assuming no change to expected cash flows. If you buy a stock at a 10x multiple, and I buy it when it’s a 15x (assuming no change to future cash flows), your discount rate (or required return) is higher than mine.

We’ve witnessed discount rates across the board increase. Investors have moved from accepting lower rates to demanding higher, and multiples have compressed. This is the culprit in the market year to date…so far.

Source:JP Morgan, 09.30.22

Source:JP Morgan, 09.30.22

The Good News

Returns come from one of three places:

- Yield

- Growth

- Valuations (multiples) changing

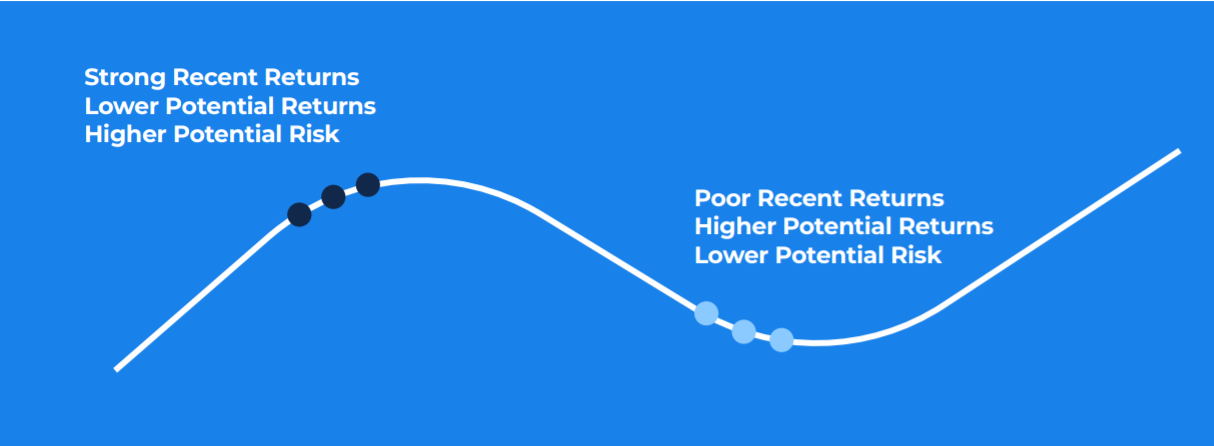

The outlook for generating returns has improved. Yields are higher, valuations are lower, and that combo alone is beneficial looking forward.

The growth piece is the biggest question mark now, and even if there is some turbulence with that, we believe the conservative part of allocations should start looking more and more conservative. While we still don’t love them from a return standpoint, at least the risk is significantly reduced from the rise in yields/fall in prices.

We say that simply because of the math. Unlike a stock where the valuation process requires numerous assumptions, bonds are straightforward. The cash flows are known and fixed. Rising rates hurt bonds, but the hurt is less and less as rates go higher and higher. In other words, going from 0% to 3% is painful, going from 3% to 6% is much less painful.

Conclusion

Bonds and stocks have been awful year to date. At these reduced valuations, the potential for future returns for both has improved. That’s kind of the way markets work.

Those who can stomach and navigate the bad periods are the ones who reap the rewards of the good. That makes me think of Andy Dufresne, and I hope you get why.

We are holding a defensive posture with heightened exposure to hedges. We think this market calls for it. If equity markets continue to face multiple compression and/or issues with prospective growth, our positioning (along with bonds stabilizing) should help.

We believe the worst part of things is behind us for the portfolios we manage. If you have concerns about positioning, please reach out.

As always, thank you for your trust.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 11.2 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 4.6 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

The 10 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 10 year. The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the “risk free” rate when valuing the markets or an individual security.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2210-4.