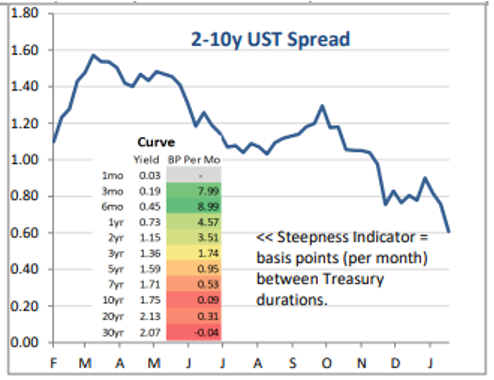

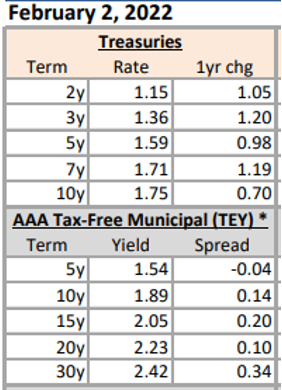

* Current Rates & the Curve: The front end of the curve continues to feel pressure as economists are now projecting five to seven rate hikes in 2022, and the forwards market forecasts just under five rate hikes by year-end. However, longer-dated interest rates are unwavering as the 10-year US Treasury appears unable to breach the 1.88% support and is now headed towards the 1.70% resistance level. The curve has flattened to 59 bps of spread between 2s and 10s for the flattest curve since last fall.

* Rate Futures & Volatility: The market believes the bear flattener will continue for years, as the forwards market shows a spread of only between overnight rates and the 10-year US Treasury in three years. The market expects 3-month T-Bills to be just under 2% and the 10-year UST to be only 2.17% to start 2025.

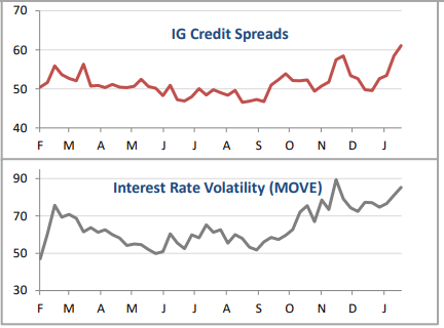

Credit Spreads and bond market volatility remains stubbornly high. High yield bond spreads as measured by CDX (5yr tenor) have increased by about 60bps to start 2022.

* Investor Activity: Tax-exempt interest rates finally followed US Treasuries to higher yields, and holders of tax-exempt municipals had one of their worst months on record. However, awash with cash, banks can now find value in municipals as the Muni to Treasury ratio shifted back to historical norms. The 10-year AAA Muni/UST ratio began the year at 63.8% and finished last week at 87%.

*All data and charts sourced from Bloomberg LP. As of 2/2/2022

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2202-6.