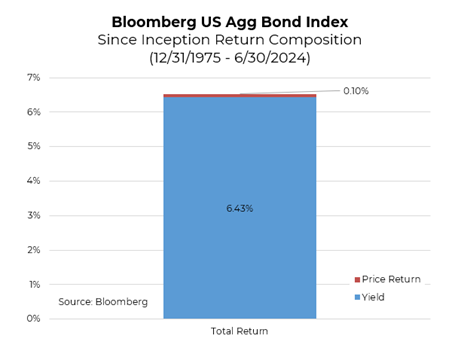

When investing in investment-grade bonds, many investors might be surprised to learn that the vast majority of returns come from coupon payments rather than price appreciation. Historically, 99% of the return of the Bloomberg Aggregate Bond Index can be attributed to the coupon, with only 1% coming from price return. This has significant implications for how investors should approach their fixed-income allocations.

The Power of the Coupon

As of July 18th, the yield on the Bloomberg Aggregate Bond Index stands at 4.74%. Given the index’s duration of six years, investors should expect a best-case return of 4.74% per year over the next six years. The yield essentially acts as a cap on what bonds can earn, making it a crucial metric for fixed-income investors.

Tax and Inflation

While a 4.74% yield may be appealing, taxes and inflation can significantly erode the real return. Bonds are taxed at the short-term rate, which can be quite high for many investors. After taxes, the nominal expected return might be closer to 3%. Additionally, inflation will further reduce this real return.

Visualizing the Breakdown

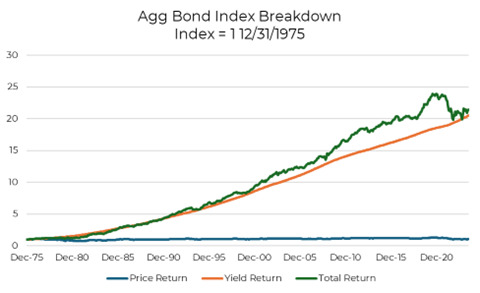

A chart breaking down the historical returns of the Bloomberg Aggregate Bond Index shows a consistent and dominant contribution from coupon payments, while the price return remains minimal and more volatile. This visual reinforces the idea that focusing on yield is key when making bond allocations.

Source: Aptus via Bloomberg as of 06.30.24

Conclusion: Yield is Your Guide

In conclusion, bond investors should pay close attention to the yield of their investments. With the Bloomberg Aggregate Bond Index currently yielding 4.74%, and after accounting for taxes and inflation, the real return may be closer to 0%. For those needing a store of value, this yield might be sufficient. However, for those aiming to grow their capital for retirement or other long-term financial goals, this return is likely to prove insufficient.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2407-29.