Fed Doubles Taper to $30M a month, Signals Three 2022 Hikes in Inflation Pivot

Source: Bloomberg LP. As of 12.15.21

Source: Bloomberg LP. As of 12.15.21

As of 12.15.21

What Changed?

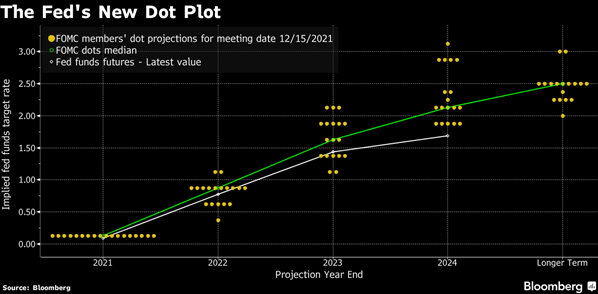

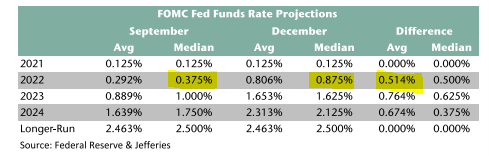

The ’22 dots on the FOMC dot plot increased fairly substantially since September. The ’22 dot bumped up from a median expectation of 0.25% to a median of 0.875% (indicating 3 hikes in ’22). The main takeaway was while the change in dot plots lays the foundation for firmer monetary policy in ’22, we are still far from an aggressive, inflation-fighting Fed.

The Fed’s long-run inflation expectations remain unchanged, they see the current inflation dynamic being temporary (even if not “transitory”). Powell did stress the Fed would likely wait for any rate hike decisions until the taper was completed which at current pace will be in March. He did state they could hike rates before reaching full employment (based on an already tight labor market i.e., quit rate and wage data) were inflation to remain sustained. This would put the first hike in May, then September, then December, i.e., three rate hikes in 2022.

Faster Taper = Faster Rate Hikes… Not so Fast!

As of 12.15.21

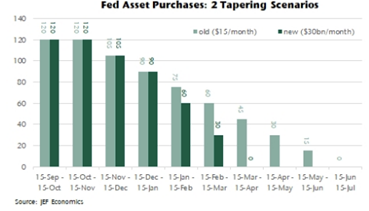

The new taper schedule looks like this: Starting Jan 1 the Fed will purchase “only” $60 billion of bonds, half of what they had originally been purchasing ($120bn). The taper is now expected to end by Spring (March). Following the end of the QE purchases, the Fed will just be reinvesting maturities/cashflow.

At this point, we saw the risk of not speeding up the taper to be larger than the risk of maintaining status quo given a continuation of red-hot inflation prints on top of strong jobs numbers. Powell admitted the “near term” inflation problems persist with November’s Headline CPI coming in at 6.8% (40-year high) and PPI at 9.6% – both higher than expectations. We also saw a strong job number earlier this month with the unemployment number dropping to 4.2%. Powell cited the inflation pressures continue to revolve around the supply chain issues which will “work themselves out over time”.

Inflation a Political Problem

Source: Twitter/ ABC News. As of 12.12.21

Powell did face an interesting question during the Q&A regarding the sudden pivot in his stance and the seemingly overnight change to a more hawkish position, right after being renominated by Biden. He noted the strong October data (continuation of high inflation prints, recovering economy and improving job market) as the microcosm. Ultimately, we see the current inflation situation turning into a political problem, specifically heading into ’22 midterms, spurring a lot of pressure from Congress.

Updates to Economic Forecast

The Fed made the following adjustments to their forecasts from September:

- Core PCE inflation: from 3.7% to 4.4% for 2021 and from 2.3% to 2.7% in 2022.

- Unemployment: from current 4.2% down towards 3.5%.

- Real GDP: 2021 from 5.9% to 5.5%, and 2022 from 3.8% to 4.0%

Overall, the Fed is expecting a strong economy in ’22 as inflation cools, employment continues to improve and solid growth. This strength is expected to give them flexibility regarding policy moving into next year.

Market Impact Following the Announcement

Per usual, Chairman Powell confidently and comfortably answered difficult questions regarding QE tapering, interest rate policy and future expectations on the economy – not once seeming to panic on the recent inflation data. The market responded positively, as the S&P rallied about 2% from the day’s lows following the meeting and speech.

Both the short and long end of the curve saw yields initially pop higher, but both retraced most of the move. The yield curve steepened modestly from 75bps between 2s and 10s to start the day, ending at 80bps. Our take was the market appreciated the clarity from Powell on the speed of the taper and the state of our economy (being robust) as well as the “wait and see” approach to rate hike timing.

Bottom Line

While the policies implemented during the heights of the pandemic helped avoid a major economic depression, the spigot of aid and liquidity has appeared to overstay its welcome. Following the GFC, short-term interest rates stayed at 0% from December 2008 until December of 2015. BUT the psychology of investors at that time was very much different than today.

Following the GFC, our financial markets (banks) experienced a near collapse, investors saw their portfolios cut in half, the economy was tanking and unemployment well over 10%. While the pandemic has created its challenges, the consumer has been much more insulated from lost incomes given the direct stimulus payments. The corresponding run-up in risk assets has spurred a risk taking amongst investors (meme stocks, cryptos, ARKK, etc.) that we’d consider “bubble-like”.

Given investor sentiment, market valuations, leverage and risk taking, we’d argue that a 0% interest rate environment likely creates the opportunity for future moral hazard and excessive speculation. While Powell was somewhat cavalier in his approach to hiking rates based on econ and job data moving forward, we do expect to see rate hikes in 2022 following the completion of the taper. But importantly, the Fed has time to (re)act versus a quick, immediate action that would have certainly spooked markets.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2112-14.