Fed Waiting, Like the Rest of Us

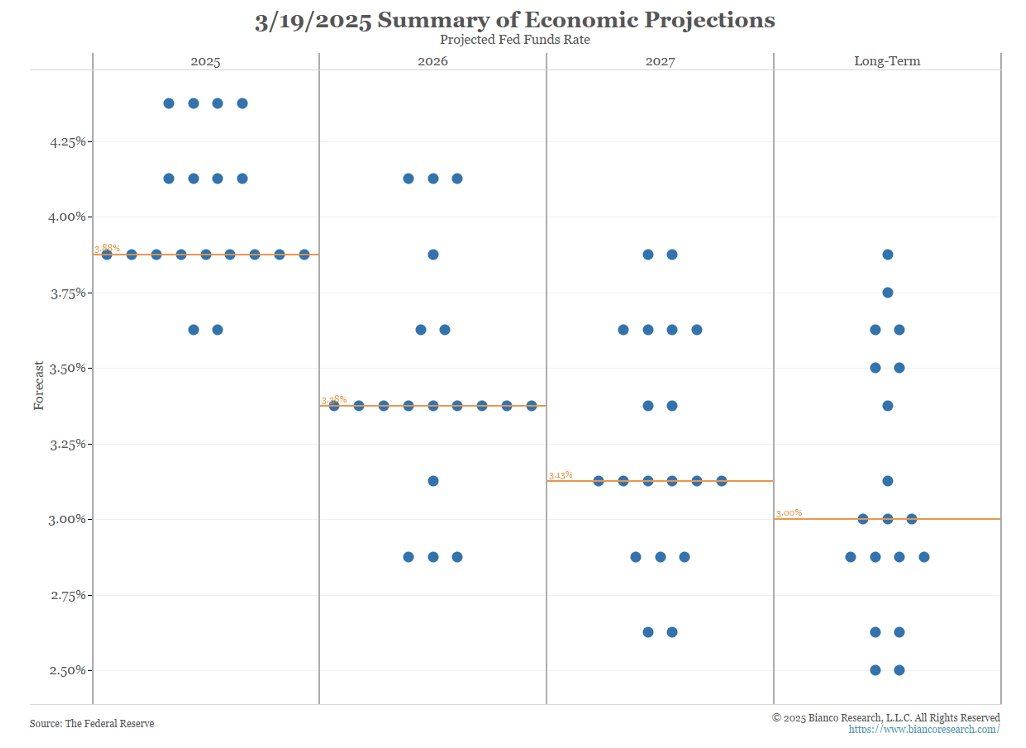

The Federal Open Market Committee (FOMC) met this week, deciding to leave the reserve rate unchanged as expected (a unanimous decision amongst voters). The Fed’s so-called “dot plot,” which projects participants’ expectations for future rate moves, continued to indicate two additional cuts (50bps total) for 2025, which is generally consistent with the market’s betting odds (calling for 2-3 cuts). The market expects the Fed to remain on hold through its next meeting (May 7th), with an expectation for a June 18th rate cut.

While two cuts with an additional two next year seem benign, many expect a more volatile outcome (indeed, the dots themselves suggest that possibility with many well removed from the average). Economist Steven Blitz at TS Lombard noted the following:

“With the current outcome highly uncertain and recession now a marginally higher possibility, policy dosage needs to be subtly hawkish without damaging current growth. That is what the FOMC delivered. The economy determines what comes next, meaning the Fed will be late if unemployment jumps. In other words, funds rate forwards are wrong. It is a binary game – 200BP of cuts if unemployment hits 5%, or no cuts this year and hikes in 2026.”

While this was a relatively quiet Fed day, the announcement was made of an adjustment to the path of Quantitative Tightening. The statement noted, “Beginning in April, the Committee will slow the pace of decline of its securities holdings, by reducing the monthly redemption cap on Treasury securities from $25 billion to $5 billion.” Moreover, participants noted uncertainty around the economic outlook (not the least of which would be fiscal policy, namely tariffs).

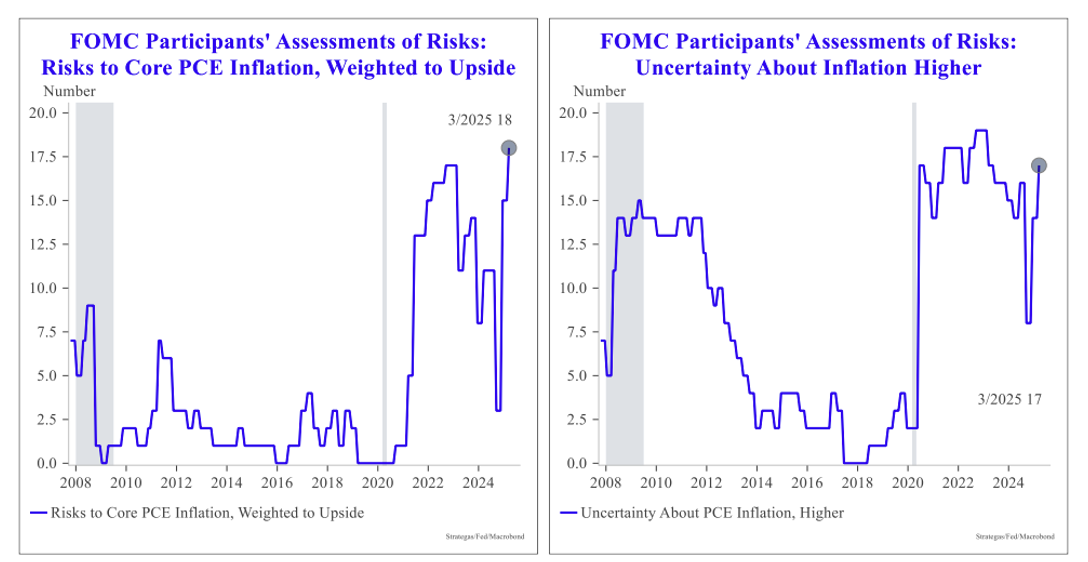

As is typical, Chair Powell noted that “The Committee is attentive to the risks to both sides of its dual mandate,” referring, of course, to employment and inflation. Of late, sentiment indicators, consumer spending, and fiscal policy have created concerns regarding economic growth, which could weigh on the employment side of the mandate. However, this meeting saw a continued (and accelerated) worry logged amongst participants in regard to the future path of inflation. This two-sided attack hints at stagflation, a rare phenomenon feared by investors and policy makers alike, though likely much too early to consider as a major alarm.

Strategas as of 03.19.2025

Strategas as of 03.19.2025

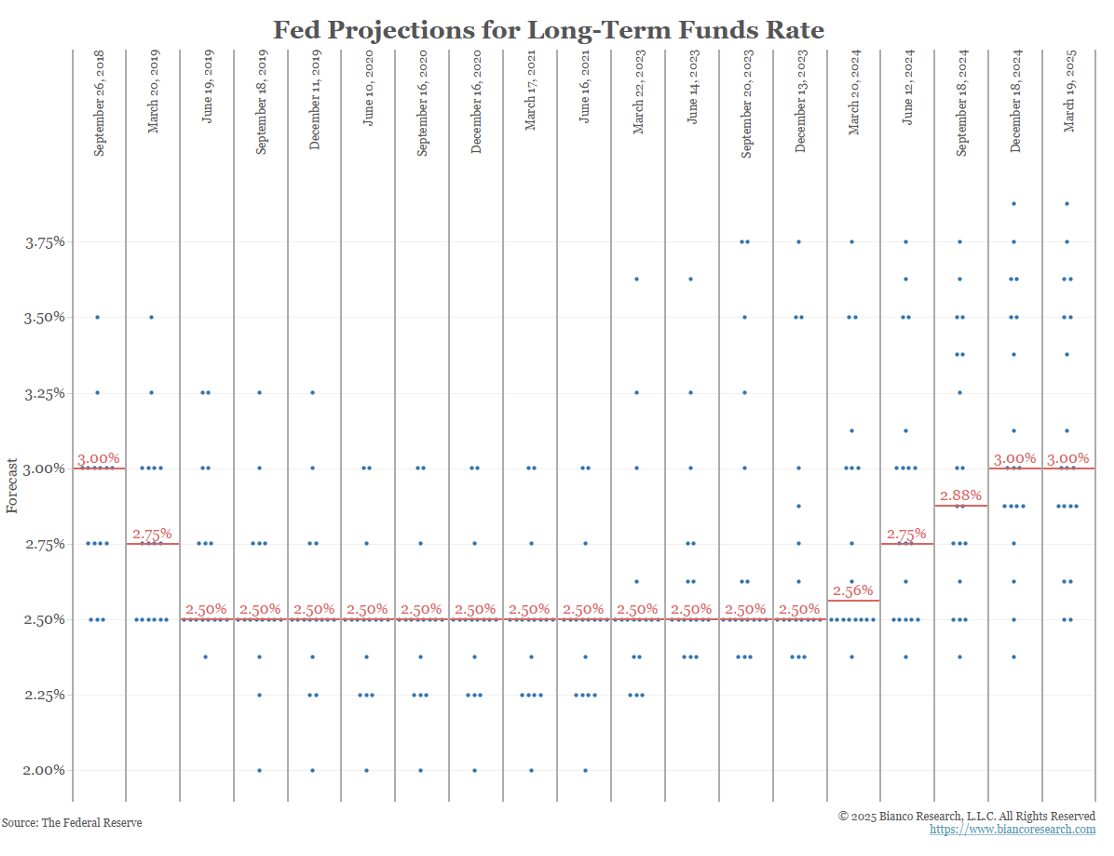

One final point of note would be the Fed’s projection for long-term rates. Of course, one could consider this no better than a shot in the dark, but it provides insight into what policy makers are thinking in terms of perceived structural shifts. From the following chart, what we see is through the inflationary years of 2021-2023, Fed officials still believed that rates would eventually settle back at 2.5% (remember when inflation was “transitory”?). Over the last several meetings, that rate has ticked up to 3.0%, even as inflation has largely subsided on a year-over-year basis. This tells us that those making policy have changed their views on the neutral rate, a slight nod to the “higher for longer” camp.

Since our update two weeks ago, the 10yr treasury note has chopped around, declining by a few bps. Frothy sentiment among investors in view of the new administration initially drove rates higher, peaking at 4.8% on January 14th. We then witnessed a complete reverse of course, with rates dropping on the growth scare narrative and the realization that Trump 47 is seemingly more concerned with rightsizing policy (including explicitly driving long-term interest rates down) than with the equity market scoreboard.

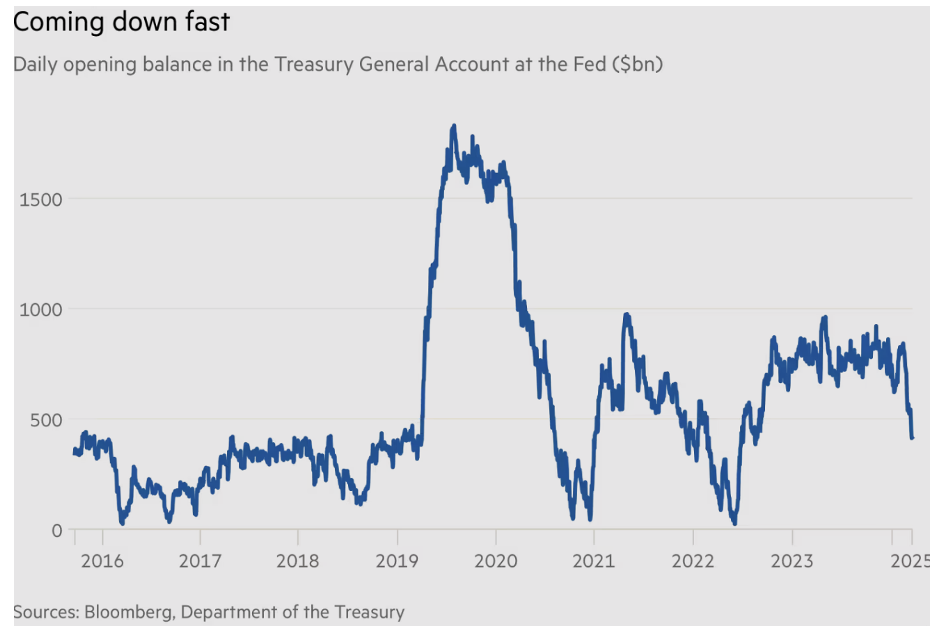

Now that rates have come off the boil, investors are weighing multiple inputs including fiscal policy (tariffs), economic growth, inflation, and liquidity, the last of which is driven in part by the absence of new debt issuance due to the debt ceiling being reached. To that end, the government is financing continued deficit spending via a drawdown of the Treasury General Account, a piggy bank with an absolute $0 bound that will eventually need to be replenished. In the meantime, this should serve as a headwind to higher rates and allow the debt ceiling debate to be kicked into the back half of the year.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2503-22.