And…We Have Lift Off

As expected, the Fed raised the overnight target rate 25 bps to 0.25% – 0.50%. The market had priced seven hikes this year prior to the meeting, and the Fed delivered. For some time now, the market has been pulling the Fed in its direction on rate hikes and this looks to be the case once again. This is not surprising given the strength of the inflation data.

Source: Bloomberg LP. As of 3/16/2022

Source: Bloomberg LP. As of 3/16/2022

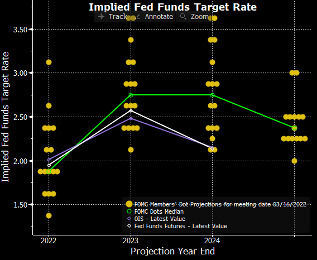

The updated Dot Plot now shows a total of seven 25 bps hikes in 2022, including todays, and another three hikes in 2023 with the Fed Funds rate reaching 2.75%. The longer-run Fed Funds terminal rate is forecasted to be 2.4%, reached in 2024. There was speculation that the terminal rate would be raised in recognition of the generationally high inflation numbers, but it essentially remained unchanged (updated Dot Plot above).

While the Dot Plot was very hawkish, Powell at the press conference sounded less so, and that may have contributed to the market rally after the initial drop. At times Powell seemed to imply that his policy views are softer than the committees (remember from previous blogs, his opinion matters most) as a whole and that he does not share the idea of pushing policy above neutral. He also seemed to play down the notion that the Fed may tighten in 50-bp increments in the future when he emphasized that the dots imply 150 bps of additional tightening this year and there are six meetings left (150 bps divided by six meetings equals 25 bps per meeting). Of course, he didn’t rule out faster hikes, but he noticeably tried to soften the message.

What Are the Implications?!

For Financial Assets: Nominal yields across the curve are rising which we believe will lead to higher stock market volatility along with wider credit spreads, we are started to see some of our key liquidity metrics flash yellow. Even though the market’s response following the meeting was the opposite as equity markets ripped higher, we aren’t sold the volatility is over. While we aren’t exactly sure as to why the market ripped into the close, it seems rationale that a good bit of the market move was short covering/ shoddy dealer liquidity.

Source: Bloomberg LP. As of 3/16/2022

Source: Bloomberg LP. As of 3/16/2022

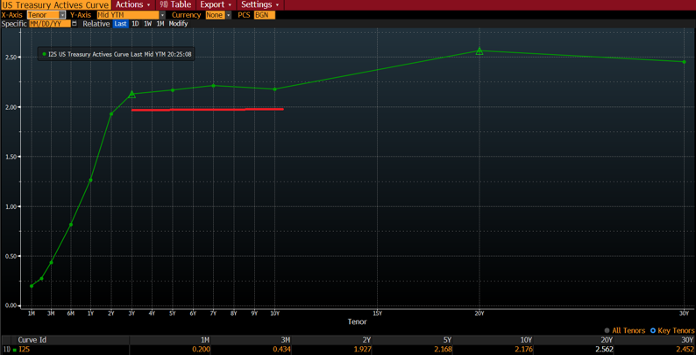

On the Economy: The fact that the Fed dots indicated it will have to go above neutral in 2023 and stay there in 2024 should flatten the curve meaningfully. In our opinion, it likely leads to a curve inversion. Following the presser, the market agreed as 2s moved up about 10 bps and 10s only 2 bps. In fact, the curve flattened about 6 bps to a 25-bps spread between 2s and 10s. It is also almost perfectly flat between the three- and ten-year tenors. Historically, every time the Fed has tightened to neutral, let alone above, the economy has stalled in short order.

From a cost pressure perspective, only time will tell on the severity of the commodity price inflation directly from the Eastern Europe tensions (Russia/Ukraine), as well as the 2nd derivative impact from the global sanctions in place against Russia. We believe they will likely leave a mark on global growth and continue to elevate commodity prices into the future (although less in the U.S. than Europe). Inflation hasn’t yet hampered demand in the US, but flush consumer savings are likely to start being spent and higher inflation/cost of living and still present lockdown risk (China) creating ongoing supply chain issues on goods. With these in place, it’s likely the economy will slow closer to 2% here over the next year with downside risk given price pressures and tighter monetary policy.

Fed’s Amended PCE, GDP & Unemployment Forecasts

While the word “transitory” may have been stricken from the Fed’s verbiage, they still expect inflation to move quickly lower. For Core PCE, they see it ending 2022 at 4.1%, down to 2.6% in 2023, and then down to 2.3% in 2024. This forecast would be a fairly quick reversion to pre-pandemic levels. We shall see.

The Fed also has GDP heading back to pre-pandemic levels in short order. For this year, they see GDP growth of 2.8%, significantly down from the 4.0% they saw previously. For 2023, they have GDP at 2.2%, followed by 2.0% in 2024. So, a quick return to pre-pandemic growth is the forecast.

The Fed forecasts that the unemployment rate will bottom this year at 3.5% and stay there for the next couple years before ticking up to the long-run rate of 4.0%. Recall, 3.5% was the pre-pandemic low reading for unemployment. So, the Fed is certainly forecasting a labor market that returns to that prior strength and stays there for the next couple years. We will also be closely watching labor participation which still is 1.1% below the pre-pandemic level of 63.4.

Fed Balance Sheet

We didn’t get much as far as specifics on the balance sheet other than that quantitative easing is over and the Fed’s balance sheet is just over $8 trillion. Powell said that details on the Fed’s plan on the shrinking of the balance sheet (aka quantitative tightening) will likely be disclosed at the May meeting; that would set up a start of QT in June, but no specifics as to how much (or pace) was offered today. In his recent Capitol Hill testimony, Powell did mention shrinking the balance sheet will be a 3+ year process. If you think the balance sheet will return to a pre-pandemic level of $4 -$5 trillion, that would be around $1 trillion per year, with much of that coming from their MBS holdings.

On that note, mortgage yield spreads have been widening all year in anticipation of this shift by the Fed. How much more these spreads will widen once the actual drawdown begins is something the Fed will closely monitor as will investors (aka how high a rate will homebuyers be able to borrow at!?). The Bankrate 30Y Mortgage rate has increased 120bps in ’22 to 4.47% (chart above).

Source: Bloomberg LP. As of 3/16/2022

Source: Bloomberg LP. As of 3/16/2022

Bottom Line

The Fed is on high alert given the inflation backdrop, and to maintain credibility MUST act against inflation by raising rates (we think 6 more times this year, or the equivalent of 150bps) and beginning to reduce its balance sheet. Today was just the start of the hiking cycle, and we think the next several months will continue to see monetary policy tighten as the Fed attempts to hone in inflation and maintain their credibility.

Next month’s inflation data will be important for guidance because if it is again very strong, the odds of a 50-bp move at the May meeting (currently below even) go up significantly. We will also listen to speeches by key FOMC members paying close attention to communications by Powell, Brainard, and Williams (the leadership). In addition, comments from San Francisco Fed president Mary Daly, have proven to provide good clarity as she has emerged as a reliable bellwether for the committee.

Overall, today was a hawkish meeting with seven rate hikes penciled in for this year versus just three hikes forecasted back in December. The significant markdown of GDP from 4.0% to 2.8% for ’22 is no doubt a reflection of the economic headwinds from the war in Ukraine and higher prices expected to eat into household budgets and limit discretionary purchases.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

This document may contain certain information that constitutes “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology. No assurance, representation, or warranty is made by any person that any of Aptus Capital Advisors, LLC’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2203-16.