As broadly expected, the Fed left their target Fed Funds rate unchanged at the 5.25% to 5.50% range. The pause from July to November marks the longest period without an increase since the liftoff in March of 2022. Powell did leave the door open for further tightening, which goes in line with his recent comments to the Economic Club of New York last month, “Additional evidence of persistently above-trend growth, or that tightness in the labor market is no longer easing, could put further progress on inflation at risk and could warrant further tightening of monetary policy.”

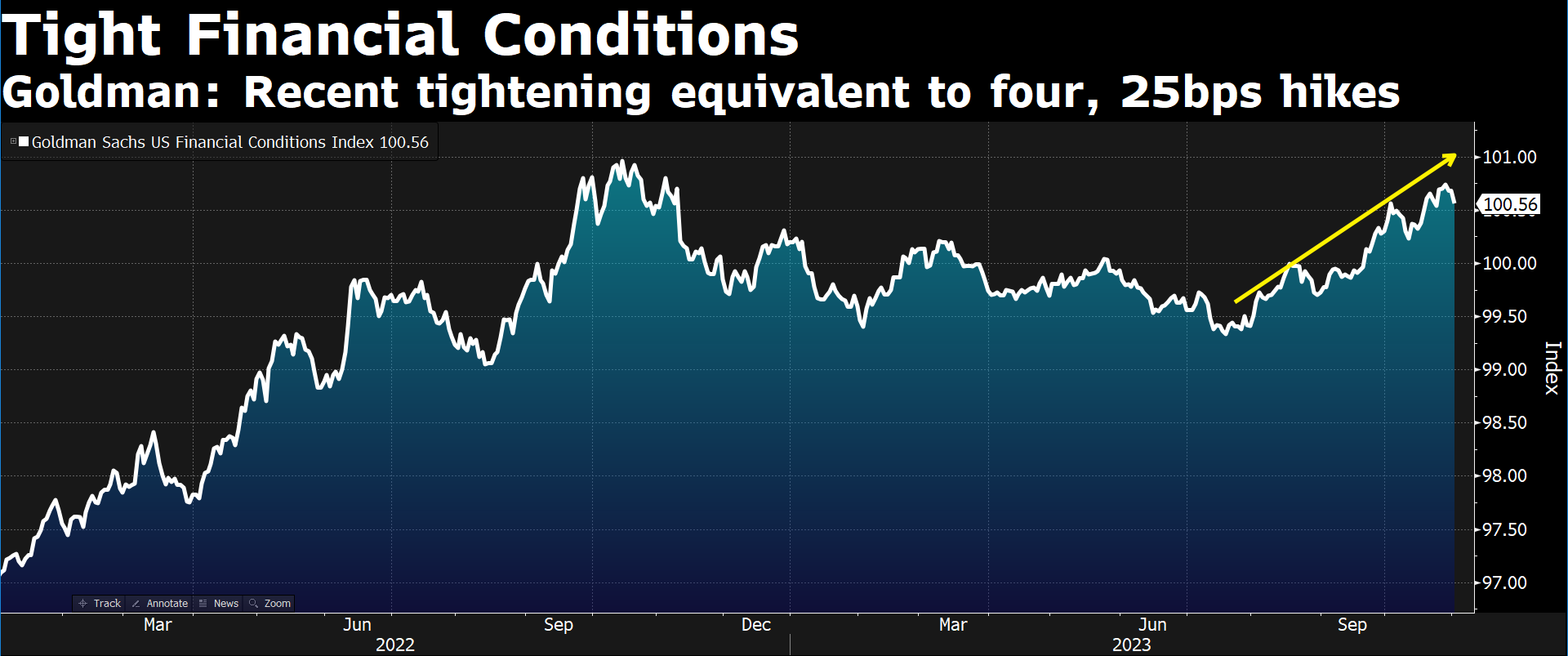

The FOMC’s accompanying statement justified skipping the hike this meeting due to “tighter financial and credit conditions” (from the rise in the long end of the curve + lagging effect of past hikes) that should continue to weigh on economic growth.

Source: Goldman Sachs as of 11.01.2023

Source: Goldman Sachs as of 11.01.2023

To us, there is still a decent amount of uncertainty as to whether the work done thus far will be enough to really extinguish inflation.

Powell & Co. remain hopeful that they’ve done enough. He did keep his options open as he conveyed during the press meeting that the consensus at the Fed is that tighter conditions will need to persist, and they’d hike again if the data indicated it was necessary.

12 of the 19 dots back in September implied that the Fed will hike one more time this year. While it does appear that the Fed collectively seems to consider their stance as near “terminal”, there are still two employment reports and two CPI reports before the next Fed meeting on December 13th that could dictate what happens.

Any Indication of Cuts?

Powell stated more clearly that the Committee isn’t thinking about or even considering rate cuts at this point. He also stated that there were no changes in the Quantitative Tightening program and the monthly roll-off will continue as planned.

Markets Reacted Positively to the Perceived “Pause”

Following the meeting, markets rallied, and bond yields fell. Market participants have been anxiously waiting for “The Pause”. Risk markets understand the long history of what happens next after the Fed pauses following a long period of rate hikes: they cut rates, often aggressively. As pressure valves release, markets subsequently ease financial conditions.

This signals to us that the Fed might not be restrictive enough to create the economic damage needed to anchor inflation at target. If real growth continues (anything similar to Q3), the disinflation of the last 12 months runs its course, and inflation rebounds, it could risk pulling the Fed back into a tightening cycle.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2311-3.