The narrative that U.S. equity markets are overpriced has gained traction amongst investors, particularly when headlines are dominated by the astronomical valuations of mega-cap tech stocks. Yet, this broad-brush view overlooks the more nuanced picture painted by the wider market, where many areas, especially small and mid-cap stocks, exhibit valuations that are not only reasonable but might even be characterized as undervalued.

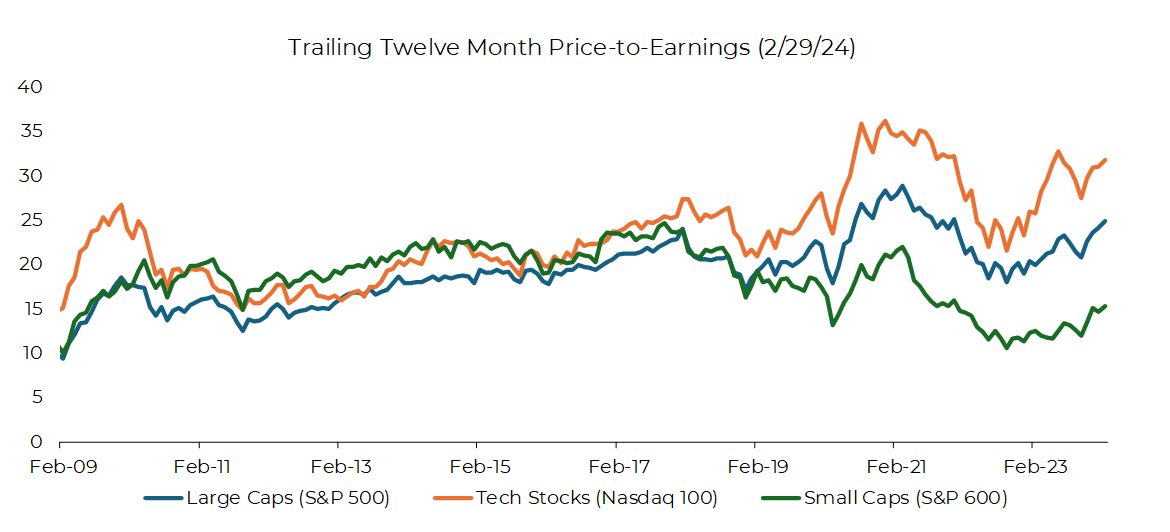

To visualize this, let’s delve into the chart contrasting the trailing Price-to-Earnings (P/E) ratios across market cap segments. US large caps (represented by the S&P 500 Index), with a trailing twelve-month P/E ratio of 24.8x, appear expensive relative to its history, but this is skewed by the tech titans—Alphabet, Amazon, Apple, Meta, Microsoft, Netflix, NVIDIA, and Tesla—part of the ‘MegaCap-8’ that drive the high multiple of Technology (represented by the Nasdaq 100), whose collective forward P/E ratio soars at 31.8x. These companies have reshaped economies and markets with their exceptional growth, which in turn has inflated their valuations and their weight in the index.

Source: Bloomberg

Source: Bloomberg

In stark contrast, small-cap companies, as represented by the S&P 600 SmallCap index, tell a different tale. Its trailing P/E ratio, standing at 14.4x, is not just below its large-cap peers; they’re also at some of the most compelling levels observed in recent decades. Historically, these stocks have often commanded a premium over large-caps, making their current 25-30% discount particularly noteworthy and anomalous.

The chart also illuminates a striking divergence that began around the COVID-19 period in 2020. As the P/E ratios of mega-cap technology stocks soared, they disproportionately influenced the larger S&P 500 index. Meanwhile, small-cap stocks did not witness such expansion in their multiples and currently sit comfortably below their pre-2020 levels.

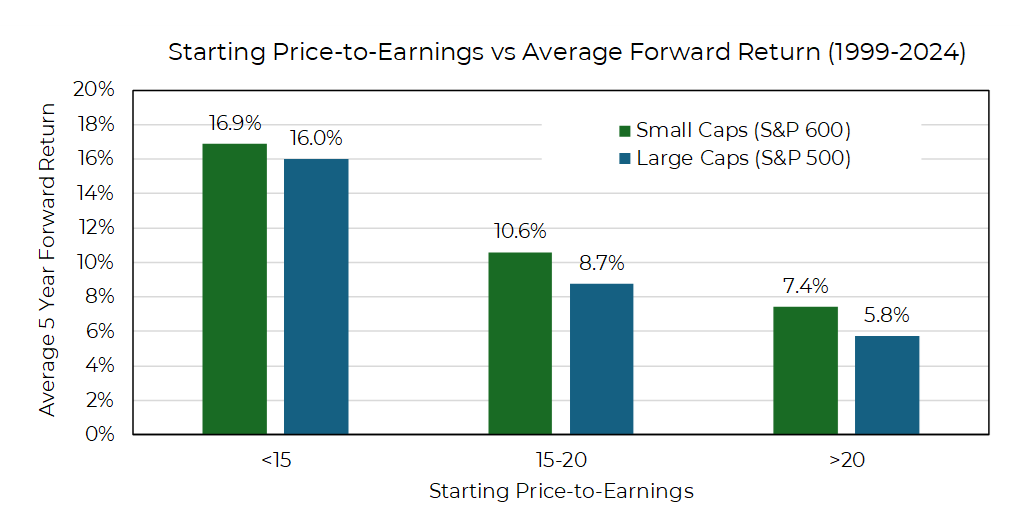

The importance of these historical valuations can be seen in the following chart of starting price-to-earnings relative to forward average returns. Small- and large-cap stocks have had similar average returns from similar starting valuations, but the current valuations of small-cap stocks with a price-to-earnings slightly under 15x seem poised for better forward returns relative to large-cap stocks with a price-to-earnings of ~25x.

Data as of 02.29.2024

Data as of 02.29.2024

This differentiation within the market is crucial for investors to recognize. The media and general investor base are captivated by the largest names whose fundamentals have indeed been impressive. But just a step away from the spotlight lies a landscape rich with variety, where small-cap stocks offer avenues for value, growth, and diversification that are often overlooked.

Non-US is Not the Only Value Stock Option

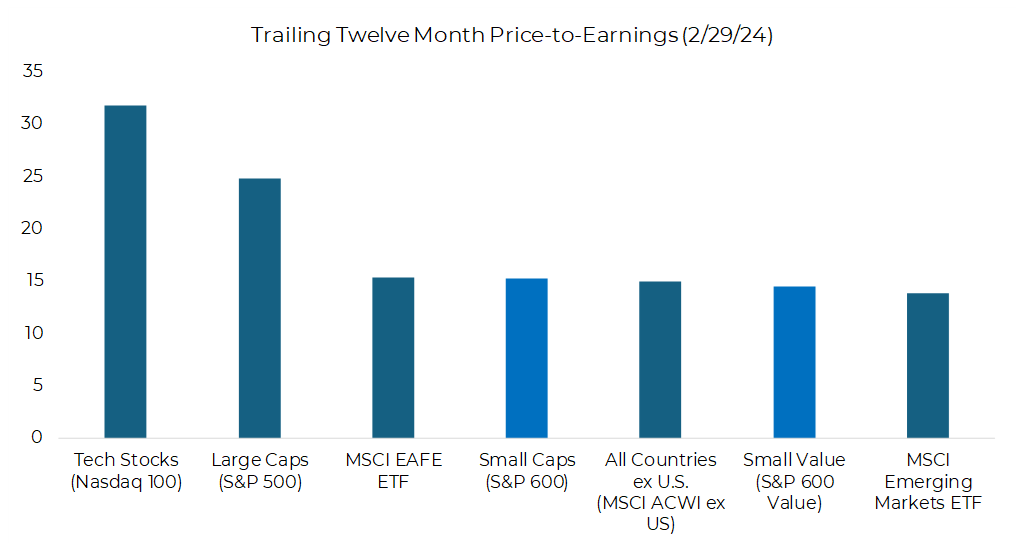

Furthermore, the notion that greater value exists outside the United States becomes less convincing when these foreign stocks are evaluated alongside U.S. small-cap stocks of comparable market capitalizations and sectors, as observed with small-cap value stocks. When compared to these smaller American firms, which offer appealing valuations and benefit from the strong infrastructure of the U.S. economy, the prospects of investing overseas appear less enticing.

Source: Bloomberg

Source: Bloomberg

To sum up, the perception of the U.S. equity market as uniformly expensive is a misconception. The extraordinary valuations of the leading tech companies skew this view. A diligent investor who looks beyond the gleam of the tech giants will find a market ripe with potential, particularly within the realm of small-cap stocks, which are currently shining as pockets of value in an exuberant equity market.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2403-23.