From a risk-premia perspective, equities and high yield both provide exposure to corporate earnings, albeit in a different manner. While equity is a purer exposure to corporate profits, high yield provides exposure to default risk.

Source: Cornerstone Macro. As of 2/7/22.

Coming off the COVID lows, credit spreads have tightened drastically on the back of extremely strong corporate earnings and robust consumer spending. In fact, spreads hit their ‘07 lows the middle of last year.

As of 01/31/22.

As of 01/31/22.

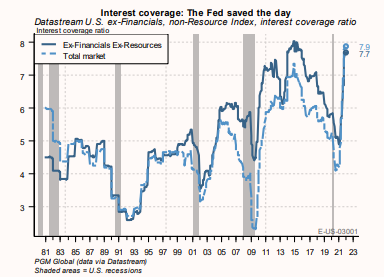

Interest coverage ratios (EBIT/interest charge) which measure a company’s ability to service its debt, have increased substantially as companies’ profitability rose in 2021 due to higher operating margins. Keep in mind that back in October of 2019, with a Fed rate of 1.75%, interest coverage was more troublesome than pre- Great Financial Crisis when the Fed fund rates were at 5.25%. This was mostly due to a steady rise in debt levels. However, since COVID, interest coverage has popped to nearly 40-year highs.

One explanation could be that firms took advantage of rock bottom rates to re-finance their debt. However, that would be mostly wrong as corporate interest charges (i.e., corporate interest expense) are near record highs. It has been the parabolic surge in EBIT that has improved debt-service ratios. The surge in EBIT looks to have followed the similar rise in durable goods consumption (stimulus fueled). Parabolas in financial and economic data catch our eye, as they typically aren’t sustainable. As the surge in EBIT starts its trajectory back to Earth and the Fed starts to tighten monetary policy, credit spreads will likely widen.

What matters most for investors is the timing of an EPS slowdown. Consensus estimates for EPS growth show that the pace of normalization is accelerating. This will feed into EBIT and credit spreads. Given the pace that EPS expectations are rolling over by, we think HY investors should be wary. While defaults aren’t imminent, wider credit spreads are likely!

As of 2/8/22.

As of 2/8/22.

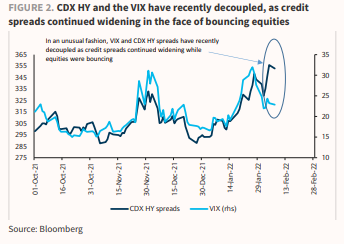

While relatively calm during the initial phase of the YTD equity turmoil, credit is showing signs of increasing nervousness. CDX HY (index to measure HY Credit Spreads) and the VIX decoupled, as credit spreads continued climbing in the face of bouncing equities. Credit ETFs recently experienced relatively outsized outflows compared to equity ETFs.

As of 2/8/22.

As of 2/8/22.

Remember the 2nd Order Effects

As of 2/8/22.

As of 2/8/22.

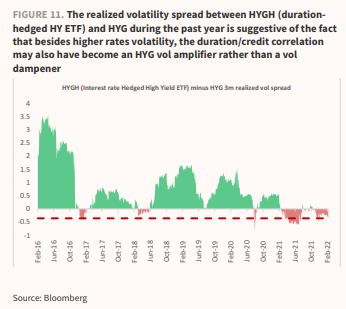

HYG (High Yield Bonds) offer exposure to both duration and credit risk. Historically, HYG volatility has typically been lower than pure credit, given the negative correlation of bonds vs credit/risky assets in the past few decades, i.e., declining interest rates.

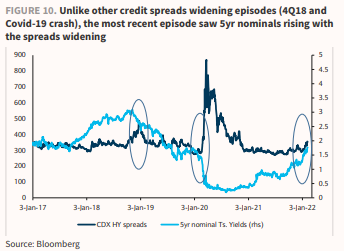

However, as rates come-off record low levels, and bonds struggle to provide as much hedging benefits going forward, HYG volatility may stand to benefit rather than being hurt by the positive duration/credit correlation. Indeed, credit spread have recently widened together with rising nominal rates (i.e., anti-Risk Parity). This was not the case in the 4Q-18 sell-off or the Covid-19 crash.

To prove the point further we look to the duration-hedged version of HYG which is now less volatile than HYG, which historically has not been the case. This is suggestive of the fact that besides rate volatility being particularly elevated vs credit volatility, their correlation may have also conspired in amplifying HYG vol. In plain terms, losing on both widening credit spreads AND rising rates has the potential to hurt HYG from both sides.

As of 2/8/22.

As of 2/8/22.

Near Term Implications

Historically, HYG tends to sell off after a 10%+ sell off in Small Caps. As of now, Small Caps are down nearly 20% from the highs, dropping as much 23% while HYG is down just 3% off the highs.

Example: If 5YR rates are 2% and the HYG spread is 600bps for an 8% yield, HYG price = $76.00, which seems like a reasonable floor (HYG is currently at $83.62). For reference, back in Dec 2018 HYG spreads widened to ~550bps.

What is happening in the global rate markets?

We saw some big moves in European rates last week – The German 2-year saw an 8 standard deviation move, and a 4 sigma move for the German 10Y.

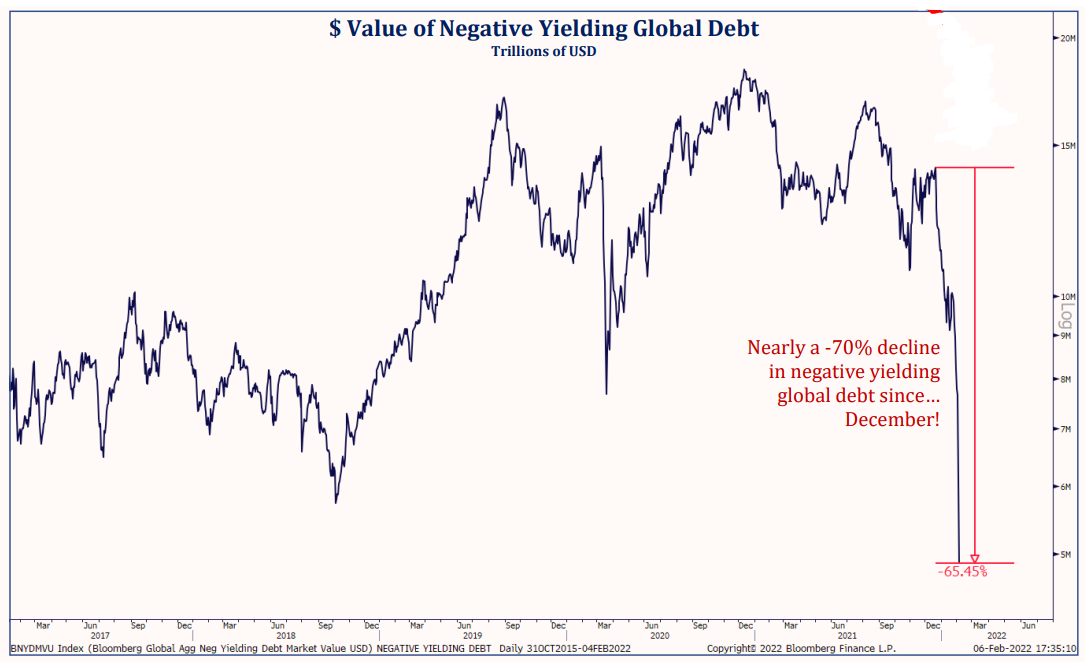

Japanese 10YR rates have broken out of their massive base to over 20bps, while the German 10YR is now above 0% for the first time in three years. The U.S. 10YR is through its pre-COVID level of 1.90%. The dollar value of negative yielding debt is down nearly -70% since late-December! Macro tends to move like a tortoise until suddenly things change FAST. It will be important and interesting to see how the yield market plays out moving forward, as things could be different than what we’ve seen the last 13 years under QE policies.

Strategas. As of 2/8/22.

Strategas. As of 2/8/22.

Bottom Line

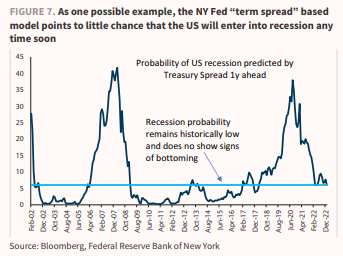

In our view, global central banks are removing accommodation much more quickly than expected, pressuring the overall market multiple and the multi-quarter positive earnings revisions that helped stocks rally in 2021. Rates are rising globally and in turn so are credit spreads. While we wait and see how the Fed and other CBs globally react to inflation and record low interest rates by tightening policy, more dicey areas of the credit market likely face headwinds.

We’d be wary.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2022-12.