If you’re on any form of social media, you’re probably seeing headlines about funds boasting “30 percent yields” and retail investors rushing in. There are even Reddit communities where people claim they can “borrow at 10 percent and pocket the spread” or use these funds to pay back long-term debt by borrowing even more to put in the ETFs. The problem is that the yield in these cases is not really yield in the sense that matters for long-term investors. It is just cash being distributed, often at the expense of the fund’s return, and almost always at the expense of the tax man.

The Illusion of Yield

Traditionally, yield meant the income an investment produced, such as bond coupons or stock dividends. It was real cash tied directly to the underlying asset. With many option-based products, however, what gets labeled as “yield” often comes from option premiums that are distributed even if they exceed the actual returns. If this process continues over time, the fund’s net asset value erodes. In other words, it may look like income today, but it can weaken the investment’s ability to compound over time.

The Tax Trap

These structures often manage to turn “yield” into one of the least-efficient forms of income possible; distributions taxed at the higher short-term tax rate that cannot be offset with capital losses elsewhere, including if the fund itself loses money. This means investors pay ordinary income rates on what was essentially a return of their own money.

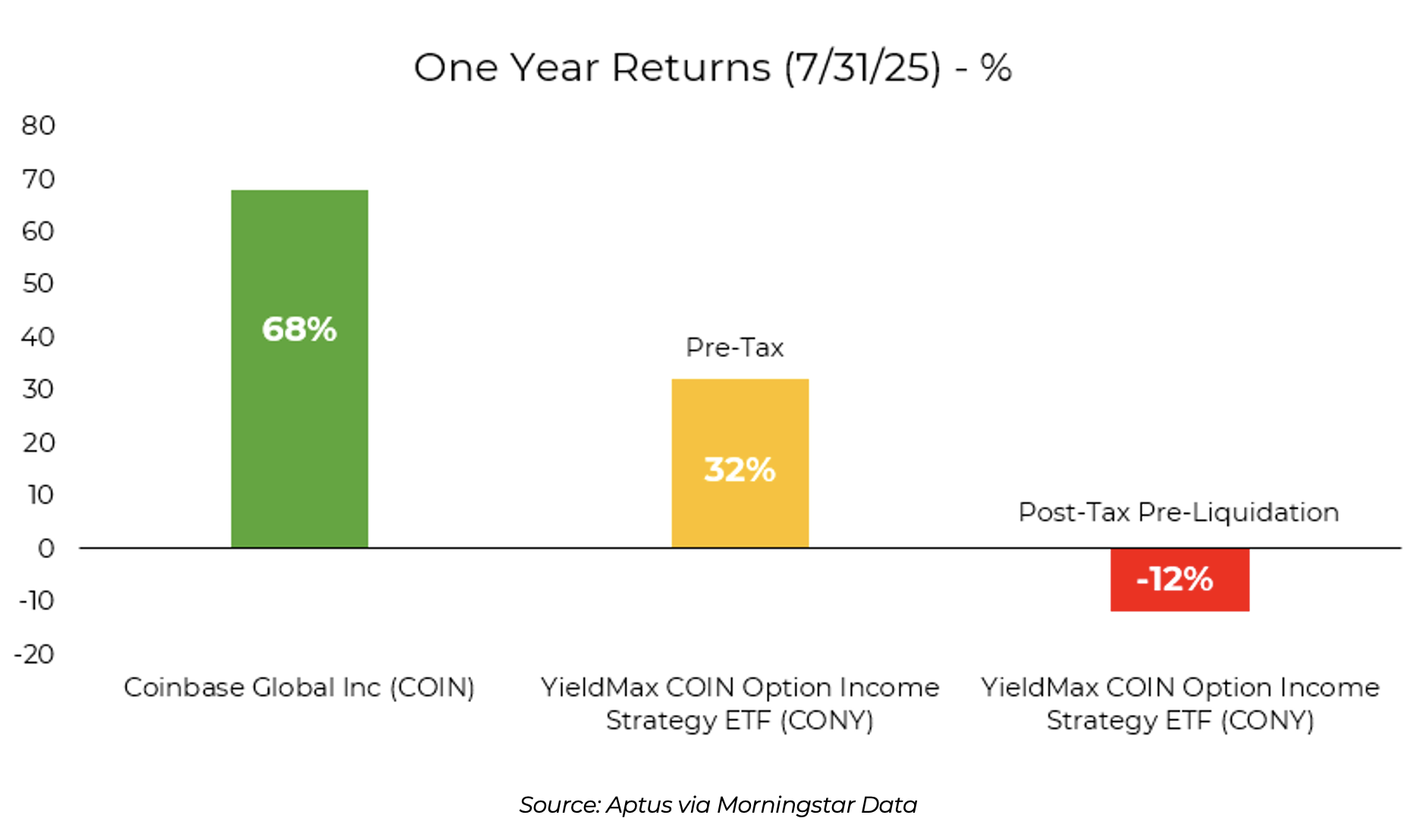

Take this example of the one-year return (as of 7/31/25), selected as it produced almost the exact 30% return investors were hoping for:

- Coinbase stock returned +68%

- An option income fund tied to Coinbase returned only +32%

- After-tax, pre-liquidation returns for that same product were minus 12%!

That is not yield, enhancing your portfolio. That is yield, destroying it.

The Margin Mirage

Some investors take it even further by buying these funds on margin. The logic seems simple, but is highly flawed: “30% yield against 10% borrowing costs equals free money.” In practice, once you factor in the real after-tax return, that “arbitrage” in the example above could leave you down 20% despite the strategy hitting its 30% target! The illusion of yield has become a very expensive lesson.

The Right Way to Think About Yield

We believe yield should mean what your investment actually generates in sustainable cash flow, and should be paid out in the most tax-efficient means possible. This is why we’ve worked hard to develop structures to help achieve greater outcomes pre- and especially post-tax. Distributions should be tied to the real long-term returns from the underlying assets, not engineered in a way that leaves investors worse off after taxes and fees.

For investors seeking income, the focus should be on durability and tax efficiency. The goal is not the biggest headline yield today, but the best balance of cash flow and long-term growth. That is how you compound wealth.

Disclosures

Past performance is not indicative of future results. This material is not financial or tax advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed and all calculations may change due to changes in facts and circumstances.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2508-18.