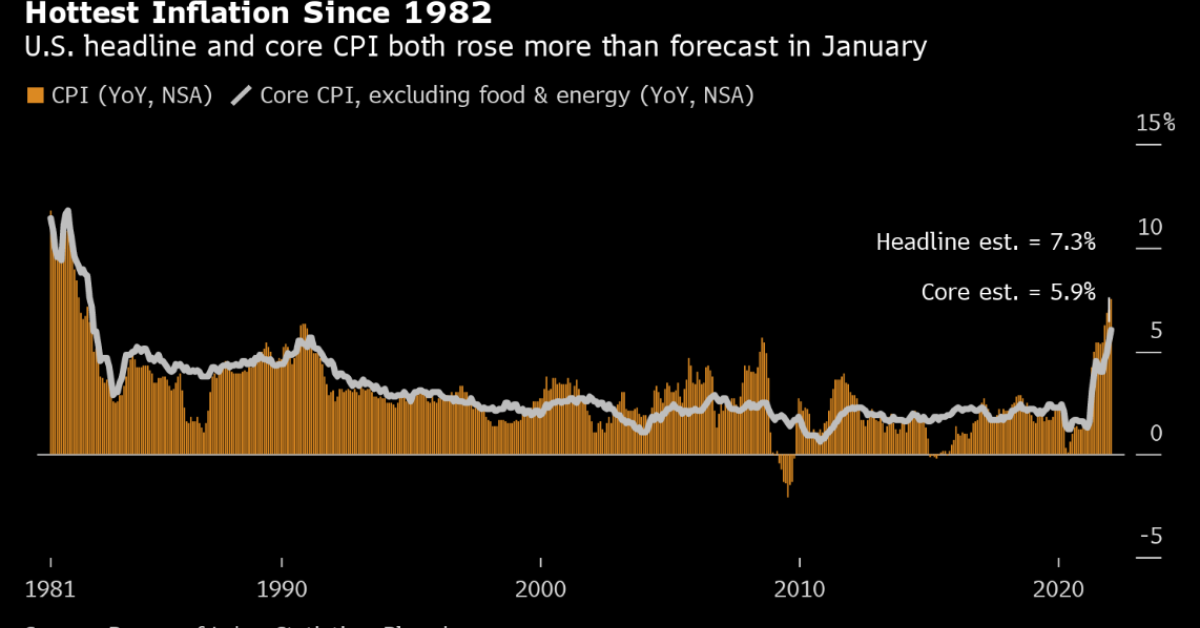

The inflation print was hotter than expected and surprised to the upside AGAIN. The data should reinforce the Fed’s need to begin raising rates next month to combat broad-based inflationary pressures. The continuation of strong inflation data (and job/wage data) likely leads markets to expect an even more aggressive response from the central bank, i.e., Fed President Bullard’s comments. The market certainly responded in accordance yesterday.

Source: Bloomberg. As of 2/10/22.

Source: Bloomberg. As of 2/10/22.

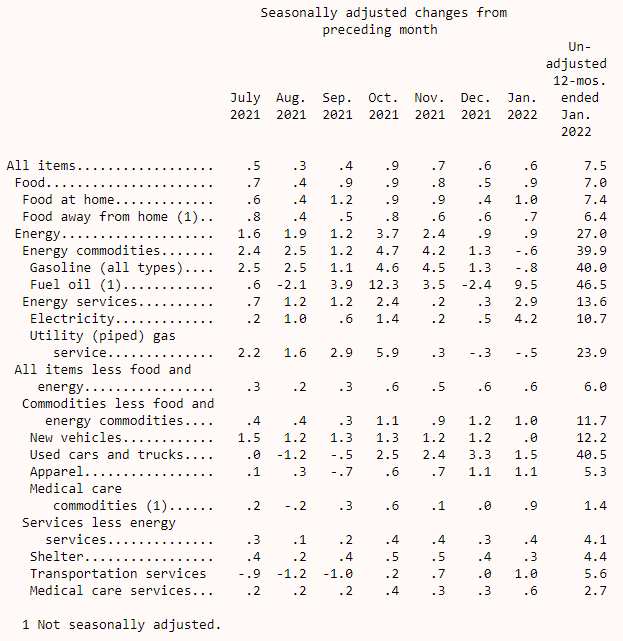

➢ Headline CPI at 7.5%Y/Y vs 7.3% consensus & 0.6 vs 0.4 M/M

➢ CoreCPI at 6.0%Y/Y vs 5.9% consensus & 0.6 vs 0.5 M/M →7th time in 10 months rate has increased by at least 0.5%

Notables:

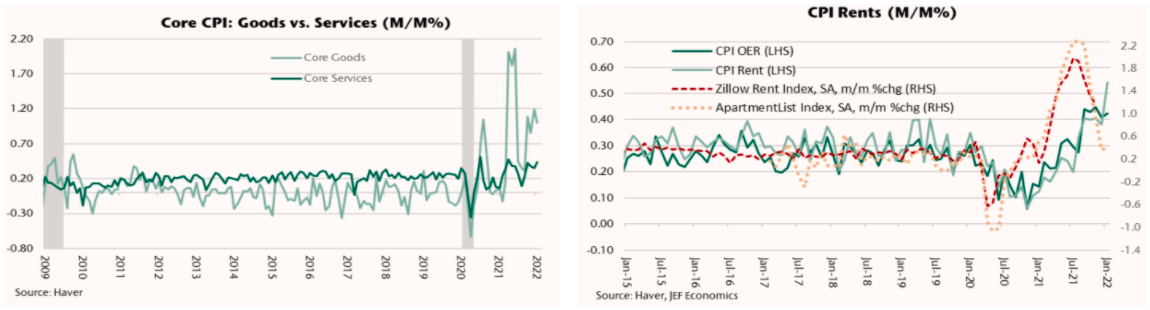

- Owner’s Equivalent Rent was up 0.4% for the fifth consecutive month. This category constitutes 24.25% of CPI so a big factor overall, and one that is not likely to recede anytime soon.

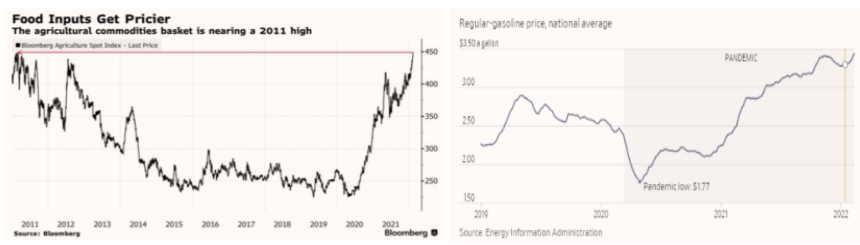

- Energy costs were up 0.9% for the second consecutive month and 27.0% over the year. Energy constitutes 7.35% of the index but still weighing heavily on overall prices.

- Services were up 0.6% after months running between 0.2% and 0.4%. Services constitute ~60% of the index, so again, a big component of today’s gains and reflective of an economy shifting more from goods to services. Today’s report showed prices firming up in the service sector – this is big.

- The food index rose 0.9 percent in January following a 0.5-percent increase in December. Food Inflation, cost of rent, and energy prices make up a huge part of middle- and lower-class budgets which is amplified with Real Wages lagging inflation.

We will sum up the report with a few charts that we believe will be the key to the direction of inflation.

Food Prices hit 2011 highs & Gasoline Prices Rise Well Past Pre-Pandemic Level

Sticky Service Inflation is Trending Higher Shelter Costs Are Rising (Shelter = 40% of Core CPI Calculation)

All Charts as of 2/10/22.

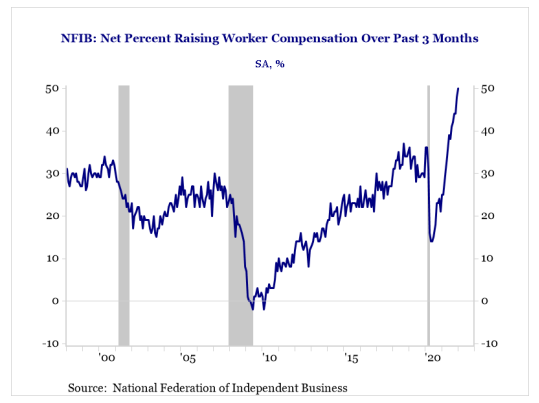

Wages are Rising, Fast

Businesses are being affected significantly by cost increases, specifically wages. The net percentage raising worker compensation has surged and is now an all-time high. This has been passed through to via pricing. As wages continue to remain firm, we’d expect this to have staying power, or we’ll continue to see an above average quit rate, due to workers switching jobs chasing pay.

Feds Response…. Bullard to the Rescue!?

Bullard is currently a hawk, but he is mostly known for changing his views more quickly and more publicly than other members of the committee. That’s why markets like to follow him—because he can demonstrate where the “leading edge” of the committee discussion is pointing. So, he is the one most likely to support a 50bp move and it would have been a big impediment to that argument if he *didnt* come out in support today. A necessary but not sufficient hurdle.

“I’d like to see 100 basis points in the bag by July 1,” Bullard, a voter on monetary policy this year, said in an interview with Bloomberg News on Thursday. “I was already more hawkish, but I have pulled up dramatically what I think the committee should do.”

Bullard’s plan involves spreading the increases over three meetings, shrinking the Fed’s balance sheet starting in the second quarter, and then deciding on the path of rates in the second half based on updated data. He didn’t confirm to a March 50 basis points hike, but he also wasn’t against it. He alluded to deferring to Fed Chair Powell in leading the discussion. To recall, Powell, at a press conference in January, did not rule out the idea either.

The Fed is currently scheduled to end its asset-purchase program in early March, ahead of the policy meeting. Powell said discussions over shrinking the balance sheet will be held in upcoming gatherings.

Bullard said he would favor significant reductions relative to the pace the Fed was adding to its securities. Prior to its shift to tapering late last year, the Fed was adding a cumulative $120 billion a month in Treasuries and mortgage-backed securities.

“As a general principle, I see no reason why you can’t remove accommodation just as fast as you added accommodation, especially in an environment where you have the highest inflation in 40 years,” Bullard said.

While the program will likely begin with just a runoff of maturing securities, Bullard said he would favor a second phase to the program as a contingency.

Market Response to Bullard

“That second part might involve asset sales,” he said. “I would very much like the committee to consider that as a possibility, so we can do that if we need to — because inflation is not decelerating as we had hoped.”

The market sold off hard after Bullard’s comments and yields rose dramatically. The spread between 2s and 10s continues to narrow – now 45bps. The spread has narrowed by ~70bps since October (4 months). In addition, the 2YR Treasury was up 25bps alone yesterday – the largest move since 2009. The 10YR finished the day at 2.04%, the highest rate since August of 2019.

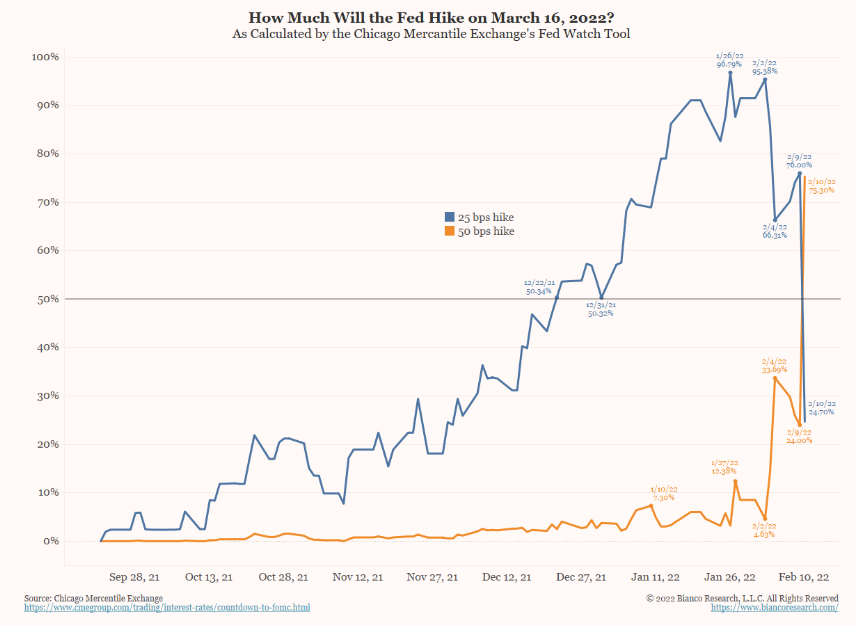

75% Chance of a 50bps Hike Next Month

Source: Bianco Research. As of 2/10/22.

Markets continue to price in a much more aggressive Fed than originally believed. Again, the 2YR UST has moved from 0.25% in September of ’21 to 1.60% today…

CPI Detail

Notables:

Gasoline index fell 0.8 percent in January after rising rapidly in the autumn of 2021. (Before seasonal adjustment, gasoline prices rose 0.1 percent in January.) from -.8 to +.1 after adjustment considered.

- Energy Index +27% Y/Y

- Gasoline Index +40% Y/Y

- Natural Gas +23.9% Y/Y

- Electricity +10.7%

Bureau of Labor Statistics (“BLS”) Adjustments to be Mindful of Moving Forward

The BLS will be doing its annual benchmark revisions, similar to the revisions made to payrolls. This probably won’t make a big difference, but we saw what happened with the Nov-Dec payrolls revisions (much higher). Even though we had an equally large revision in the opposite direction last year, the revisions to those two months got a lot of attention.

More interestingly, the BLS will now calculate its component weights based on 2019-2020 data. It currently bases its weights on 2017-2018 expenditure data. Again, these numbers don’t usually change too drastically, but with the shift to goods expenditures and away from services in 2020, along with the housing market markedly shifting in many ways, it will be something worth watching.

To Sum it Up

Inflation is a political problem at this point. People are angry that costs are rising and for much of America, the rise in prices is starting to impact their lifestyle. The Fed was cavalier about inflation for much of 2021, but shifted hawkish towards the end of the year as the intensity of inflation continued to percolate. We expect inflation to continue to decrease throughout the year but see a rather high likelihood of remaining well above the Fed’s 2% target, even if the Fed begins a rate hike cycle. Put it this way, even if we have an 8% nominal GDP in 2022, roughly half of it could be eaten up by inflation (given the tough start to the year in the January CPI data).

Don’t worry, you’re in good hands, the Fed has a great track record of delivering the proverbial “soft landing”.

We’ll let you take that at face value.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2202-17.