The housing market today is caught in a strange juxtaposition. While home prices and down payments are elevated in dollar terms, they remain within historical norms when adjusted for income. In contrast, mortgage payments have spiked at an unprecedented rate given the abrupt shift in rates, leading many to question if homeownership is becoming increasingly out of reach.

Prices and Down Payments: High, But Not Unusual

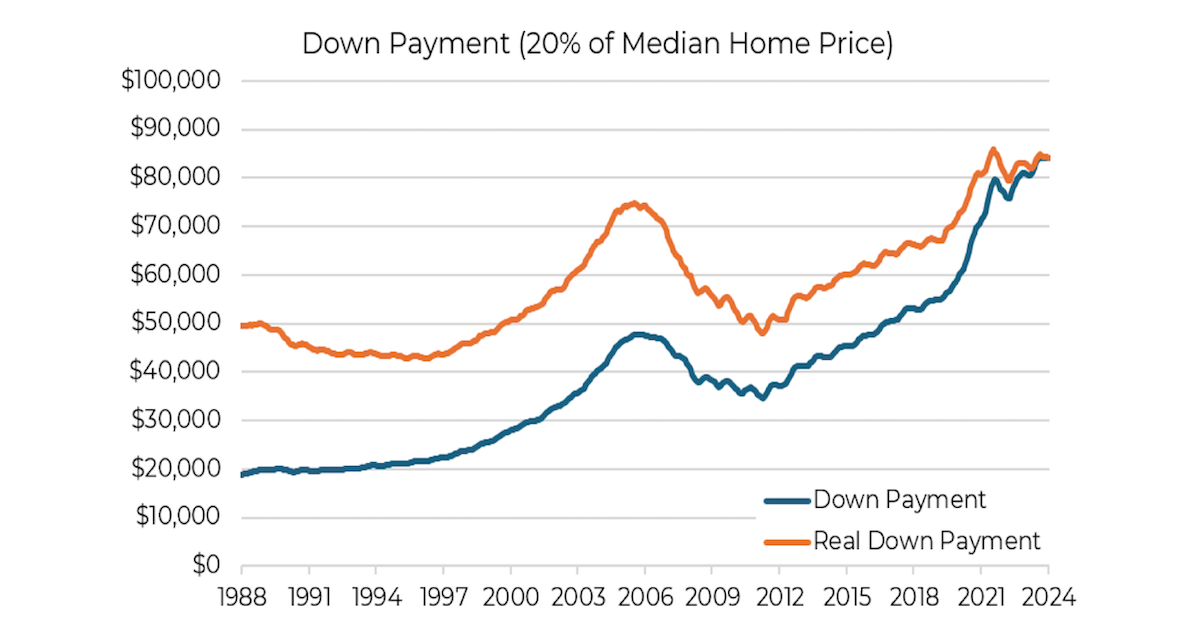

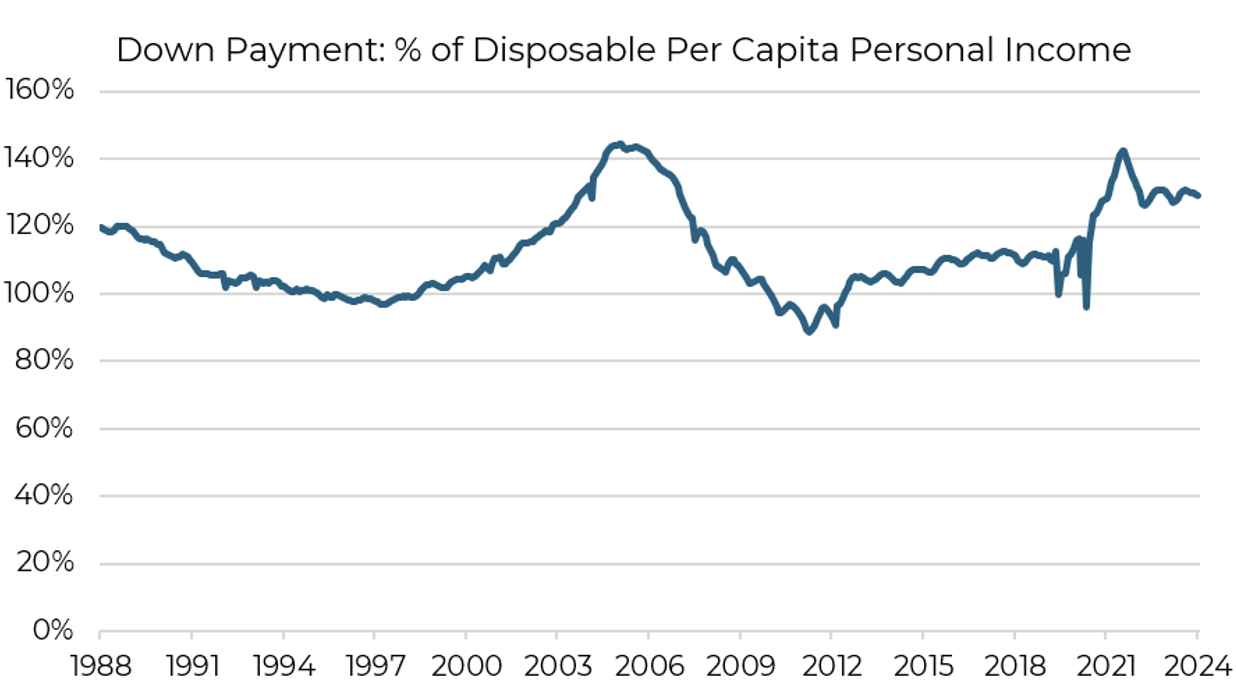

Home prices have gained a reputation for being “too high” in recent years, but a closer look suggests that, in income terms, they align with historical patterns. Down payments, which move directly with home prices, have moved higher in both nominal and real (inflation-adjusted) terms, but remain reasonably in line with long-term trends as a percentage of disposable income.

Source: Aptus, Federal Reserve, BLS

Source: Aptus, Federal Reserve, BLS

Source: Aptus, Federal Reserve, BLS, BEA

Source: Aptus, Federal Reserve, BLS, BEA

Mortgage Payments: The Unprecedented Spike

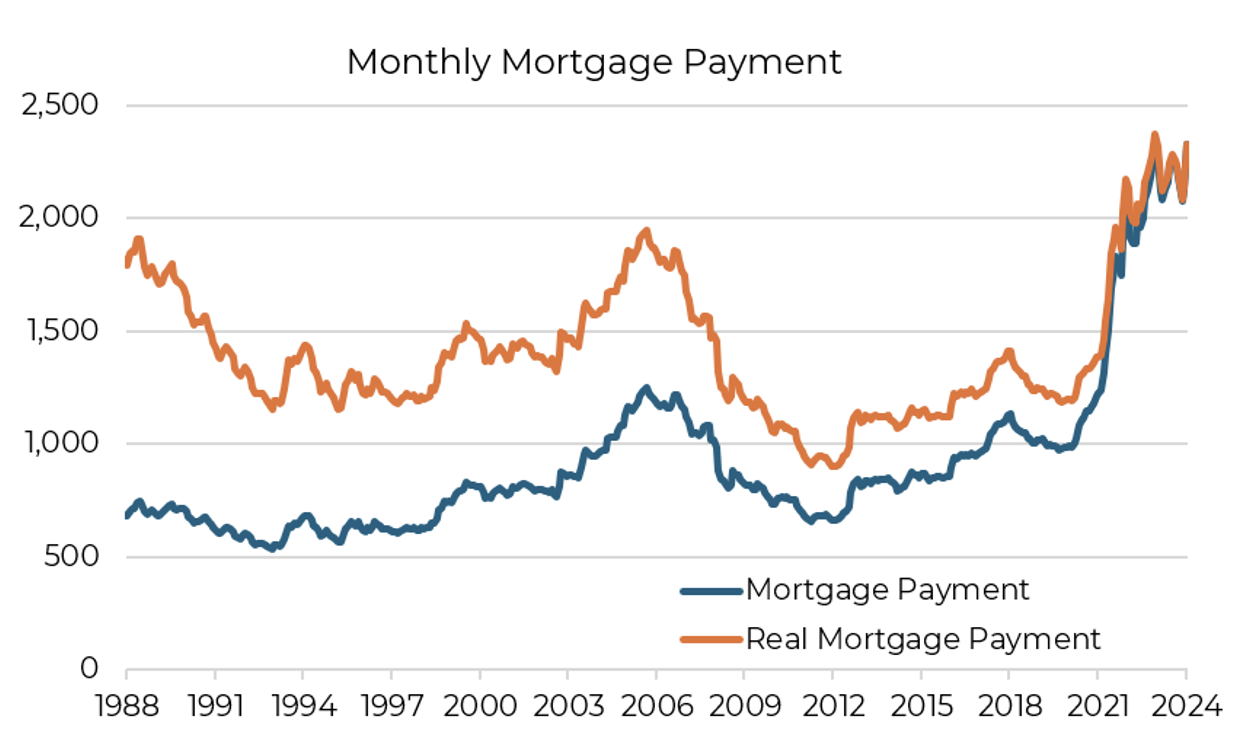

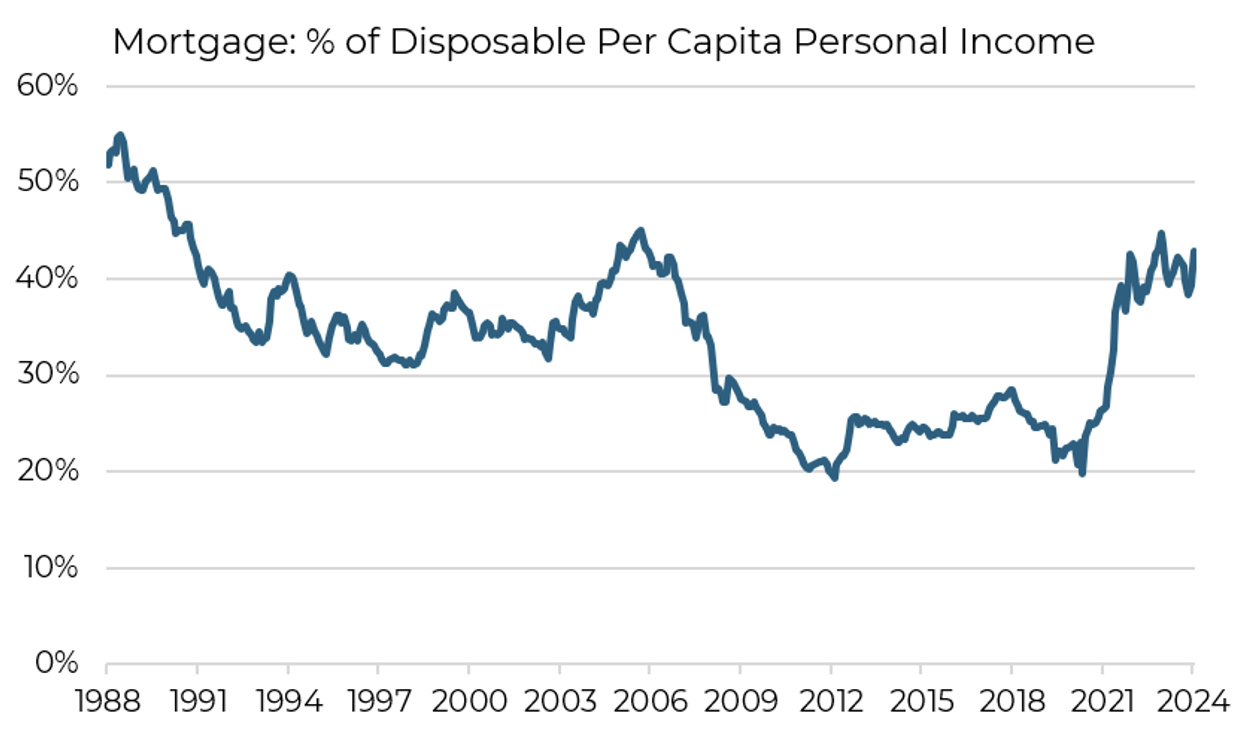

The real affordability strain today comes from mortgage payments. With interest rates previously sitting below 3%, mortgage payments were at historic lows in real terms. With rates in the 7% range, monthly costs have more than doubled in just a few years, relative to disposable income. Surprisingly, mortgage payments relative to income are only back to mid-2000s levels, highlighting how affordable housing was following the global financial crisis.

Source: Aptus, Federal Reserve, BLS

Source: Aptus, Federal Reserve, BLS

Source: Aptus, Federal Reserve, BLS, BEA

Source: Aptus, Federal Reserve, BLS, BEA

Unlike in the mid-2000s, many current homeowners have mortgages locked in at sub-3% rates, which drastically reduces the incentive to move and take on a higher rate. This is helping to keep home prices elevated, even as housing transactions hover near all-time low levels.

The Affordability Equation

This dynamic raises a critical question: What’s driving these record-high monthly costs, and will they persist? The Federal Reserve’s actions—first reducing rates to zero and then sharply increasing them to curb inflation—have not only slowed rapid home price growth but also created a new affordability hurdle by making mortgage financing significantly more expensive and limiting transaction volume.

This disconnect underscores the difficulty of attaining homeownership in today’s market. So, which factor might shift first—rates or prices? The answer to this question will likely shape whether housing remains a worthwhile investment in the coming years.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2411-17.