One question we’ve gotten a lot recently is how can investors position portfolios if we see some inflationary pressure… are Treasury Inflation-Protected Securities (TIPS) a good idea?

What are TIPS?

Straight from the Treasury… “The principal of a TIPS increases with inflation and decreases with deflation, as measured by the Consumer Price Index. When a TIPS matures, you are paid the adjusted principal or original principal, whichever is greater.”

Simple concept, and seemingly helpful to protect investor spending power, but does the Consumer Price Index accurately reflect the true change in prices?

Consumer Price Index (CPI)

From the Bureau of Labor Statistics… “The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.”

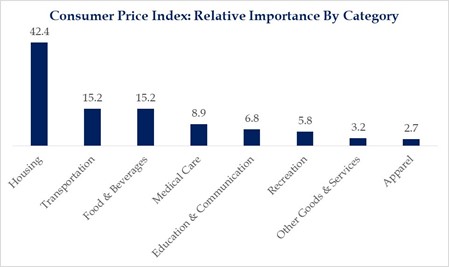

Lot to unpack, but here’s a breakdown of the weights within the CPI calculation.

Source: Strategas. As of February 2021

Much attention is often given to the housing component since it makes up more than 40% of the overall index which is based on a “rental equivalency approach”. This essentially measures what someone would pay to rent their home today, not changes in the cost to buy it.

Remember, assets are intentionally omitted from the calculation, making CPI a poor proxy to measure asset inflation, specifically in this case accounting for the rise in housing prices. However, transportation and food & beverage make up just shy of 1/3 of the index, and both the transportation and food categories are pointing to higher prices.

We believe the CPI calculations of housing likely depresses the overall CPI number given its weight and also the systemic challenges created in the housing market where house prices are quickly rising across many areas of the United States. At the same time, rents are being depressed due to government-mandated rent memorandums and the exodus of people from large cities.

Given that information, is CPI an accurate gauge of inflation? Also, if the Fed’s mandate to control inflation matters to them, would a measure of inflation that may undershoot actual inflation be beneficial towards that mandate?

TIPS & Breakeven Rates

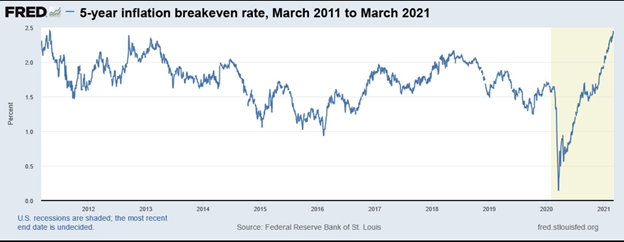

Inflation expectations measured by the Breakeven Inflation Rate, indicates investors’ perception of how future inflation will translate into pricing decisions. Breakeven rates are measured by the spread between the yields on US Treasury bonds and on TIPs. For example – if the 10 year treasury is at 1.50% and TIPS current yield is -0.80% (yes that’s a negative number), the breakeven rate would be calculated by subtracting a negative 0.80% from 1.50% to give you 2.30%.

Source: Fed Reserve Bank of St. Louis, As of March 8, 2021

Currently, the market is forecasting that U.S. inflation will run at 2.43% over the next five years, the highest rate of market-predicted inflation since the 5-year breakeven rate hit 2.63% on July 7, 2008.

Breakevens continue to trend higher, where the market is pricing in a likelihood of higher inflation to come, especially in the nearer term. A rise in interest rates and inflation expectations lead to concerns of how equity markets will digest the changing environment and in turn, how will the Fed will respond. While we believe near-term inflation is likely, we think inflation is likely to be more short-lived as the economy reopens.

Where this Gets Fishy

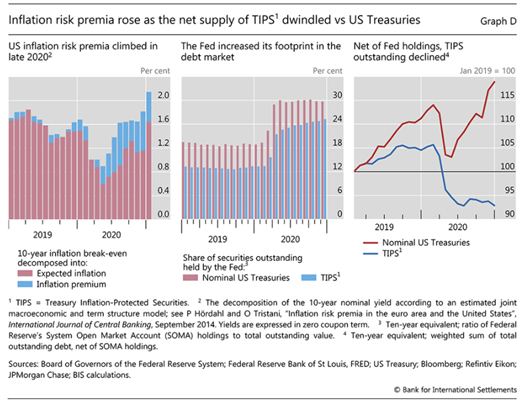

Breakeven Rates can be decomposed into 2 things:

- Pure inflation expectations

- An inflation risk premium (premium for uncertainty).

Both characteristics have attributed to the rather large rise in inflation expectations since March 2020. We believe that the inflation risk premium has likely been overstated due to removal of supply within the TIPS market.

Central Bank Asset Purchases Likely Skewed Breakeven Rates

Notice the 3rd chart below. The outstanding amount of TIPS declined dramatically because the Fed bought more TIPS than they issued. To put into perspective, the Fed bought about 35% more of the supply of TIPS than the Treasury issued (~$190bn bought vs ~$140bn issued). The combination of higher supply of Treasuries and lower supply of TIPS likely contributed to the higher measured risk premium.

Source: Bloomberg. As of March 1, 2021

Source: Bloomberg. As of March 1, 2021

To go further, we believe the run up in TIPS was likely further exacerbated given the macro and policy backdrop where investors flocked to TIPS for protection against potential inflation, all things together contributed to a rise in breakeven rates. Econ 101, less supply with higher demand raises prices and reduces yields impacting the breakeven calculations from above.

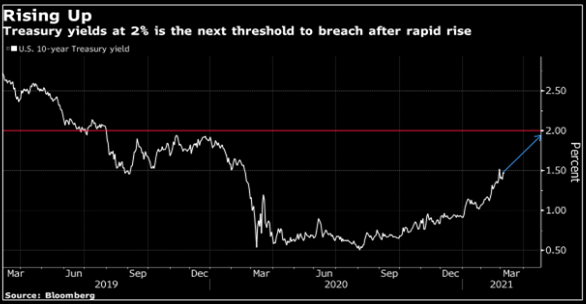

Yields Have Risen… Although it is Mostly Normal

We believe the recent rise in interest rates from the August lows is a normalization of interest rates that can be equated to healthy factors occurring in a recovering economy. We continue to see strong evidence supporting normalization such as strong global reflation, vaccine deployment (i.e. herd immunity), strong household balance sheets thanks to government support, and wide spread pent-up demand from a reopened economy.

Source: Bloomberg. As of March 8, 2021

The $1.9bn stimulus package working its way through Washington and the $2 trillion in cash on the sidelines likely further support more reflation and cyclical outperformance as the yield curve normalizes (i.e. Steeper Yield Curve). Bottom line, if inflation is pushing nominal growth higher, any attempt by the Fed to suppress interest rates is likely to be rejected by the bond market.

Buyer Beware

We would argue that tying up a significant portion of your portfolio to an index that is, in our opinion, debatably undershooting real inflation could lead to outcomes substantially worse than you expect as the investor. Since the end of ‘08 following the GFC and quantitative easing programs, CPI has averaged just 1.5% per year. Meanwhile, we’ve all experienced substantially higher inflation when considering cost of education, healthcare, insurance on top of the big one… inflation in asset prices (i.e. bonds, stocks, real estate, hard assets, etc).

When considering that the basket used for measuring inflation could be an imperfect metric, it’s worth considering if any security whose price is related to this metric is worth depending on to drive returns.

It’s our opinion that the CPI is a bad measure for inflation and the TIPS market in general is reliant (manipulated may be more appropriate) on a single player…the Fed. As you can see in the charts above, they own over 20% of the entire market.

To quote a recent blog post on the current backdrop regarding pricing within the TIP market:

“Of course, no one is cheering for strongly higher future inflation, but a strongly higher inflation breakeven rate does indicate that TIPS overall are starting to get “pricey” versus nominal Treasuries. An inflation breakeven rate over 2.5% is expensive for the TIPS investor. Historically, TIPS have usually under-perform nominal Treasuries when inflation expectations get very high, as investors anticipation of higher inflation doesn’t come to fruition.” (Paraphrased. Source: https://tipswatch.com/)

As investors are faced with the need for assets that can diversify equity risk while also protecting against higher inflation (bonds cannot), we’d champion long volatility strategies over TIPs. Things to think about when wading in the TIPS water.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary contains information and links to third party sites not affiliated with Aptus Capital Advisors (“ACA”). This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2103-7.