August PPI and CPI and Fed Survey Update… QE Taper Coming late ‘21

Boy did we get the tale of two reports from the August inflation data. The PPI report was modestly higher than expectations whereas the CPI report was modestly lower… so which one is right?

As of 9/14/21

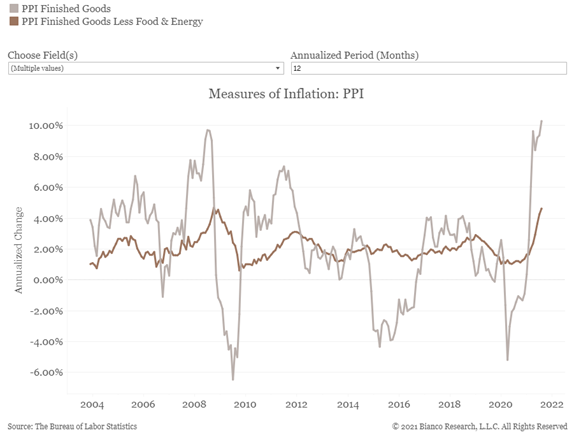

Friday’s PPI report was hotter than expected. Headline PPI rose 0.7% vs. (E) 0.6% in August and the year-over-year number was yet another record (up over 8%). Additionally, “Core” PPI rose 0.6% vs. (E) 0.5% in August. To be clear, these numbers aren’t horrible and there is some evidence that the pace of inflation is starting to slow, but the bottom line is these numbers will help reinforce the Fed’s desire to begin to taper QE this year (likely starting in November or December).

Our biggest takeaway from the PPI report is regarding the supply chain bottlenecks and logistical challenges created by the shutdowns (and now the Delta Variant restrictions). The bottlenecks have created shortages and in turn pressured prices higher… will the pressures ease as things normalize?!

One caveat…the PPI, as currently calculated, only has a 10-year history due to changes made in 2011. The previous way of calculating the PPI had a 60-year history and under that methodology indicators would have been up 10.3%.

Source: Bloomberg (as of 9/14/21)

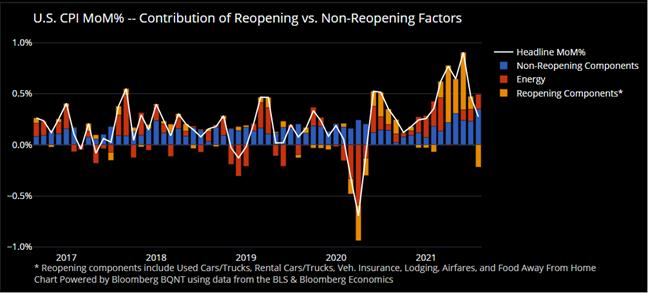

Today’s CPI report was slightly weaker than consensus. August Headline CPI rose +0.3% vs. (E) +0.4% (5.3% YoY); August Core CPI (ex-Food & Energy) rose +0.1% vs. (E) +0.3% (4.0% YoY).

Reopening components of CPI acted as a drag on MoM headline inflation for the first time in six months. We believe the inflation debate will boil down to how fast the more transitory measures fall in relation to how fast higher rents are reflected in the shelter inflation component.

- Some notable decliners from the August report: airfares dropped 9.1%, used cars were down 1.5% and vehicle insurance costs decreased 2.8%. Hotel stays and car rentals also fell, which likely point to softening demand from the delta variant.

- Some notable gainers from the August report: Rents and Owners’ equivalent rent both climbed 0.3%, whereas prices of household furnishing jumped by a record 1.2% from July as well as both the cost of motor vehicle parts/ equipment and men’s suits posted unprecedented advances.

Lastly, we had the release of the Fed’s survey of inflation expectations yesterday which showed a notable increase. The one-year inflation expectations rose to 5.18% (up from 4.84%) while the three-year inflation expectations rose to 4.0% (from 3.7%). Remember inflation is very psychological and rising inflation expectations can cause an acceleration in real inflation. A continuation of heightened inflation could lead to the Fed accelerating QE tapering and pull forward potential rate hikes from late 2022 to mid-2022 (bad for equity markets).

Bottom line: We’re not seeing the conclusive peak in inflation pressures the Fed and markets were looking for earlier this summer. We believe inflation isn’t likely to go back to pre-Covid levels any time soon.

The PPI data last Friday and the Fed survey numbers yesterday reinforce that as supply chain bottlenecks remain persistent, inflationary pressures likely linger. For inflation fears to lessen, we think the market needs to see data that points to a virtuous cycle of stable inflation and a solid recovery.

Looking Ahead to Next Week:

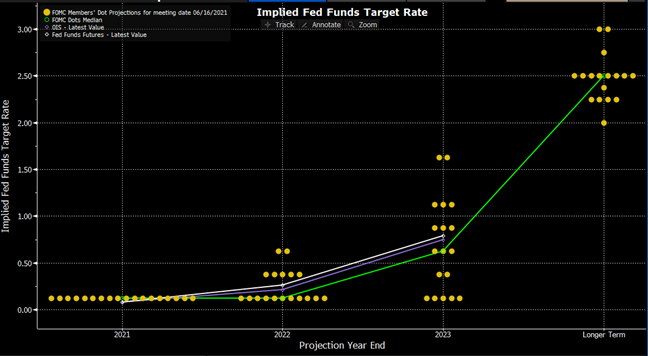

There is a BIG (our emphasis) FOMC meeting on Wednesday next week. There will be a lot on the FOMC table, including QE tapering discussions, forecasts, and 2024 dots (seen for the first time).

Current Dot Plot

Source: Bloomberg (as of 9/14/21)

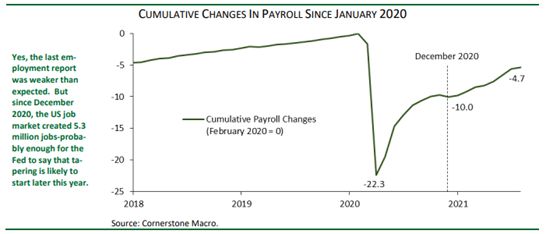

The July minutes as well as Powell’s speech at Jackson Hole created a strong presumption that tapering will start this year, either in November or December. While the August employment report was weaker than expected, we don’t believe it is enough to derail the tapering. We continue to believe that next week the FOMC will indicate tapering will start later this year, conditional on the economy and the labor market remaining on a solid track (graphic below showing employment improvements).

As of 9/14/21

Regardless, our base case is that tapering will proceed at $15 bn per month ($10bn Treasuries & $5bn MBS), through next summer starting in November or December. From a market perspective, we are skeptical that tapering news will generate much action. The risk resides more in the dots, which will provide a window into the pace of rate hikes the FOMC is penciling in.

While Jay Powell > Fed Committee…. Their Opinions Still Matter

On the committee dynamics front, several members are more worried about inflation expectations, and believe inflation will be less transitory than what is generally assumed. These members are pushing to start tapering sooner rather than later in order to start raising rates sooner.

The leadership cannot ignore these members, especially if their number grows. A logical compromise is to start tapering a bit sooner, even if the latest labor market data might suggest prudence, and to proceed relatively slowly.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2109-13.