“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” Milton Friedman

Friedman’s quote above is historically accurate although since the 1990s and particularly since 2010, the link between money supply and inflation has broken down. Could this time be different?

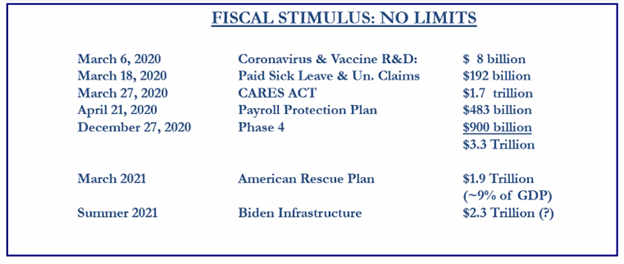

Source: Strategas as of 4/15/2021

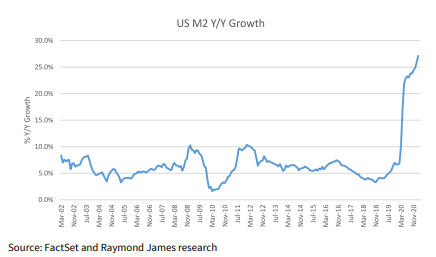

Source: Raymond James as of 4/15/2021

Inflation, the trajectory of prices, has come into the economic picture following global governments’ massive fiscal and monetary response to the pandemic. The graphic above shows the magnitude of the policy response which has become a significant portion of GDP for both 2020 and now 2021. Due to the response, the 25% growth in M2 money supply as well as the one-sided government has brought inflationistas* out of hiding again.

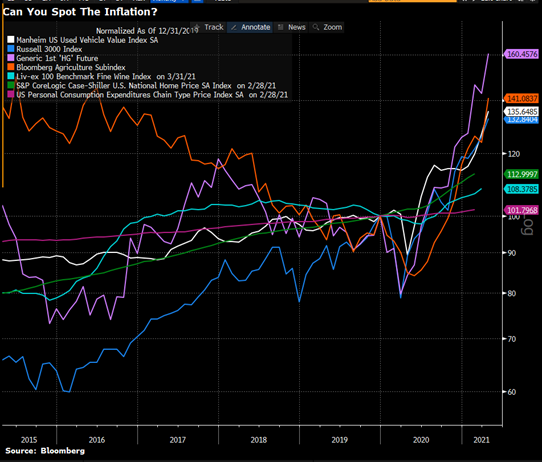

Signs of Rising Prices… Everywhere

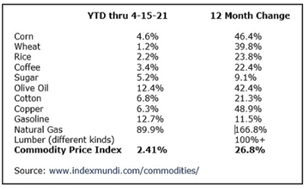

(Graphics as of 4/15/2021)

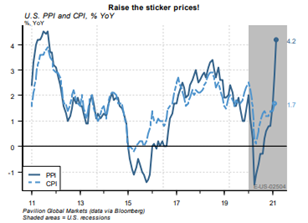

Ultra-loose money, a reopening economy with strong consumer balance sheets, and massive pent-up demand for goods and services have created a perfect storm for rising prices, at least in the near term. Prices are on the rise, just look at commodities. The real question will be what happens after the “transitory” inflation data lapses, and no longer has the weak 2020 COVID lockdown comps from last year when the economy was essentially closed. July ‘21 and beyond will be more telling on whether the inflation will be a persistent theme moving forward or just a blip due to the timing of the data.

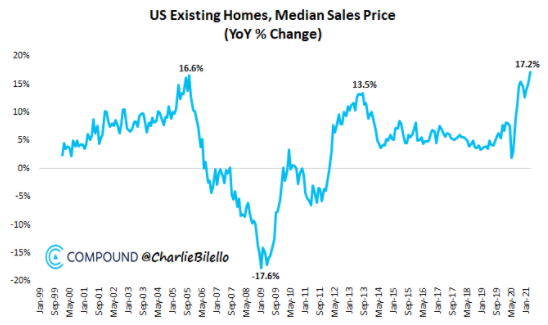

(Graphic as of 4/15/2021)

(Graphics as of 4/15/2021)

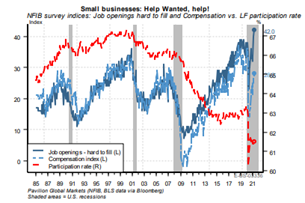

History doesn’t repeat, but often rhymes. Cost-push inflationary pressures (substantial increase in input costs) from the 70s look to be occurring again, specifically in the supply side of the economy. The one thing we can’t disregard is that prices are going up fast, substantially higher than the government’s measurement of inflation (CPI) as represented across the charts above. On top of increasing materials costs at the corporate level, due to generous government unemployment benefits, the labor market is actually tightening.

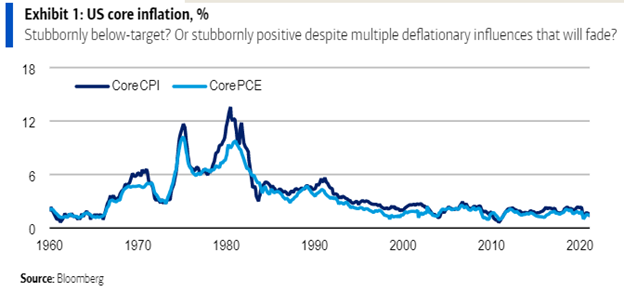

After Years of Deflation, Are the Tides turning?

(Graphic as of 4/15/21)

The US hasn’t seen meaningful inflation since the very early 1970-80s. There have been many attributes to this, but we’d pinpoint the main reasons to this: Globalization, Growing Debt, & Technology.

#1 Globalization/ China entrance to the World Trade Organization (WTO)

- Since the 1990s, and particularly since 2010, the link between money supply and inflation has broken down. Mostly due to globalization and China’s entrance to the WTO.

- As China became the world’s workshop following its WTO admittance in late 2001, the country has exported disinflation, if not outright deflation, to the U.S. for most of that time.

Inflationista stance: If China’s role as the world’s workshop was disinflationary, re-jigging supply chains away from China will be equally inflationary.

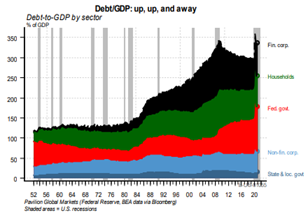

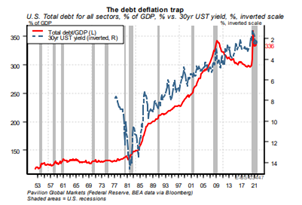

#2 We Live in a Very Levered Global Economy

Graphics as of 4/15/2021

- Rates can normalize somewhat but ultimately interest rates are limited due to excessive leverage. Simply, companies can’t afford the debt service if refinanced at higher rates.

- More debt hasn’t been productive. It’s created a long cycle of falling rates with less and less of a multiplier effect of the debt on GDP growth. 30yr yields, which proxy the longer-term growth and inflation outlook—have collapsed (globally, not just the U.S.). As debt increases, the productivity of that debt falls. This is disinflationary and requires ever lower interest rates to make the debt serviceable. The 1970s was the last decade during which each unit of debt was accretive to growth.

Inflationista stance: Rationally thinking (sometimes difficult when it comes to government and central banks) investors buy the government and corporations debt… if they stop buying, rates will have to go up, right?

#3 Technology Advancements/ Aging Demographics

- Technology has been the ultimate disruptor: more transparency, improves efficiency and reduces consumption.

- Technology replaces a chunk of the labor force.

- Developed economies globally have an aging population (think baby boomers). On top of producing fewer kids.

Inflationista stance: Technology and aging demographics will probably always be deflationary.

Bottom line: We don’t blame investors for fearing inflation might be here this time. Inflation can be the thief in the night when it comes to taking purchasing power from household wealth. For example, as CPI averaged a 7% CAGR (compound annual growth rate) in the 1970s, it doubled the price level of the index in just 10 years; every dollar of savings lost 50% of its purchasing power.

With that in mind, the Fed has beaten the dead horse that inflationary pressures in the near term will be “transitory” as the economy reopens fully, supply chains catch up, and employment recovers to pre-COVID levels. While there are many arrows that could be pointing to higher inflation moving forward, we are in the camp to follow the data and looking through the recent cost pressures building across the global economies as things normalize.

*Footnote: “Inflationista” is a bit of a media meme, labeled on economists that express doubts about the ability of central banks to print money without eventually creating inflation

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2104-19.