* For the purposes of this post “cash” is meant to be synonymous with 3-month treasury bills*

Investors face a dilemma. Should they embrace the incremental risk of bonds, when cash could potentially match or even exceed their returns? This post aims to provide historical context, helping investors in framing and resolving this decision. But before we begin, please consider these questions:

1. What’s your projected average cash yield for the next decade?

2. What do you anticipate the average inflation rate to be over the same period?’

Feel free to ponder these questions now. Later, we’ll delve into an analysis that might shift your perspective, as well as provide guidance based on your view of interest rates and inflation.

Backdrop: Market Yields Drive the Performance of Cash and Bonds

The tug-of-war between cash and bonds has gained traction lately, particularly among professionals focused on asset allocation. To simplify the trade-off:

- Cash provides stability in price, appreciating at short-term yields, potentially outperforming if inflation stays high.

- Bonds shine in deflationary times, offering more clarity in long-term returns, albeit with more price volatility.

A Reversal of the Historical Benefit?

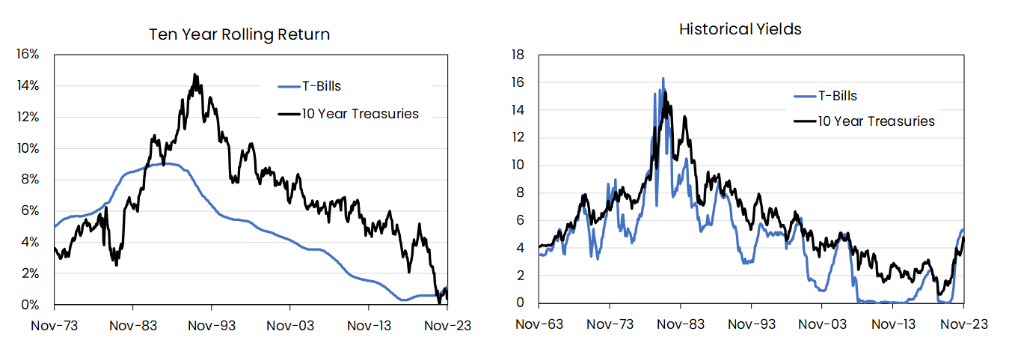

Bonds have historically rewarded investors who have taken on duration risk, as a traditionally steep yield curve and a declining interest rate environment have led to higher returns for bonds than cash. But the shift away from a zero-interest rate policy and an inverted yield curve has placed cash as the higher-yielding option, a deviation from the past 40 years that drove much of the outperformance of bonds.

Source: FRED as of 11.30.2023

Source: FRED as of 11.30.2023

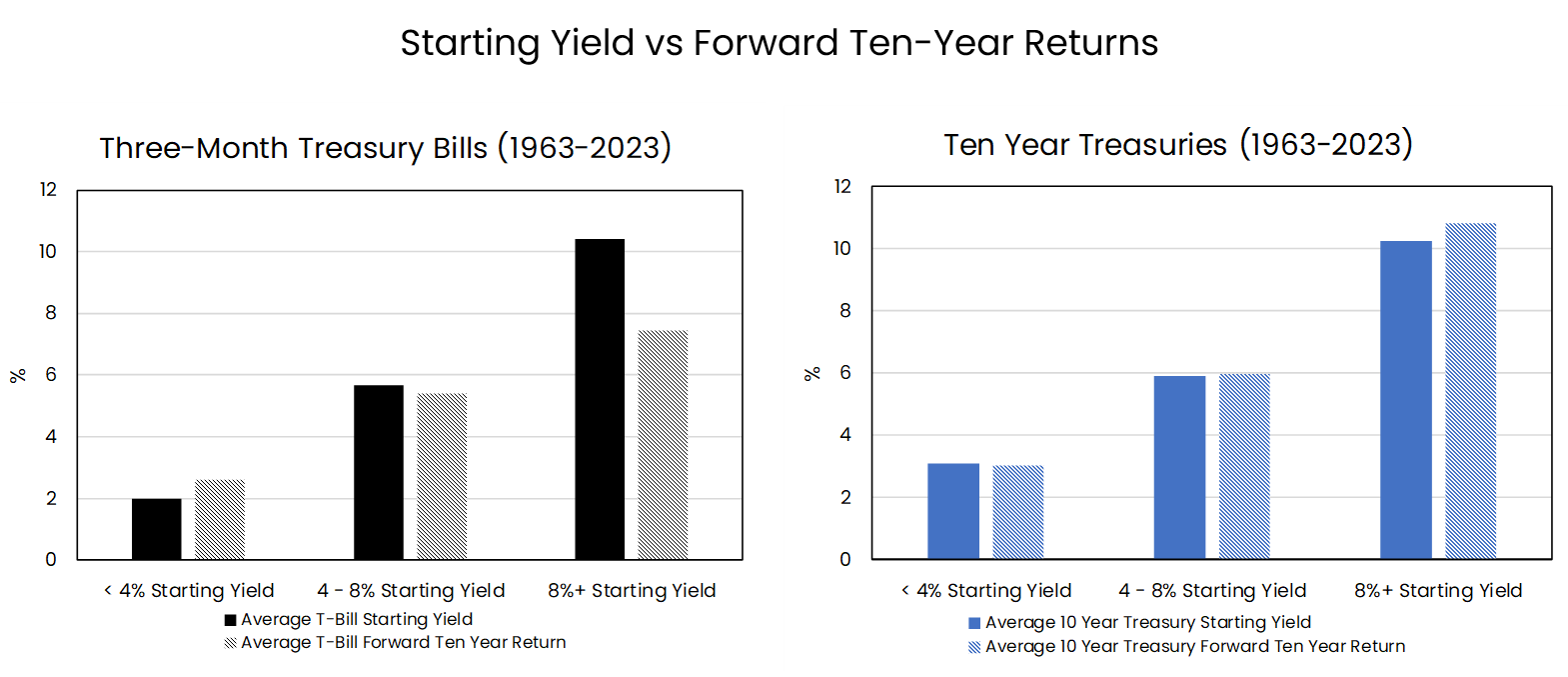

Starting Yields as a Predictor of Forward Returns

The starting yield has been a strong predictor of forward returns for both cash and bonds, especially at low and intermediate yields. Historically, it was only when interest rates were elevated (north of 8%) that investors in cash were materially punished for not locking in interest rates that swiftly moved lower.

Source: FRED as of 11.30.2023

Source: FRED as of 11.30.2023

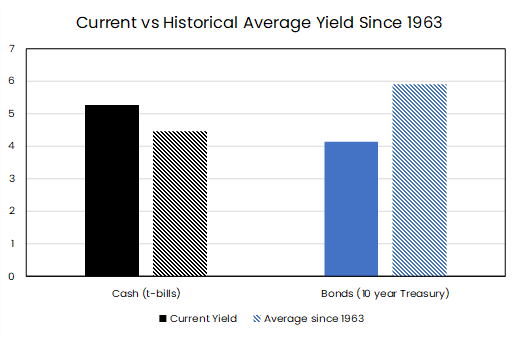

The Current Opportunity Set

Cash currently yields significantly more than bonds, a shift from the norm, but also over 1% higher than the average yield of cash over the last sixty years. Treasuries on the other hand yield almost 2% less than the average over the same period.

Source: FRED as of 12.11.2023

Source: FRED as of 12.11.2023

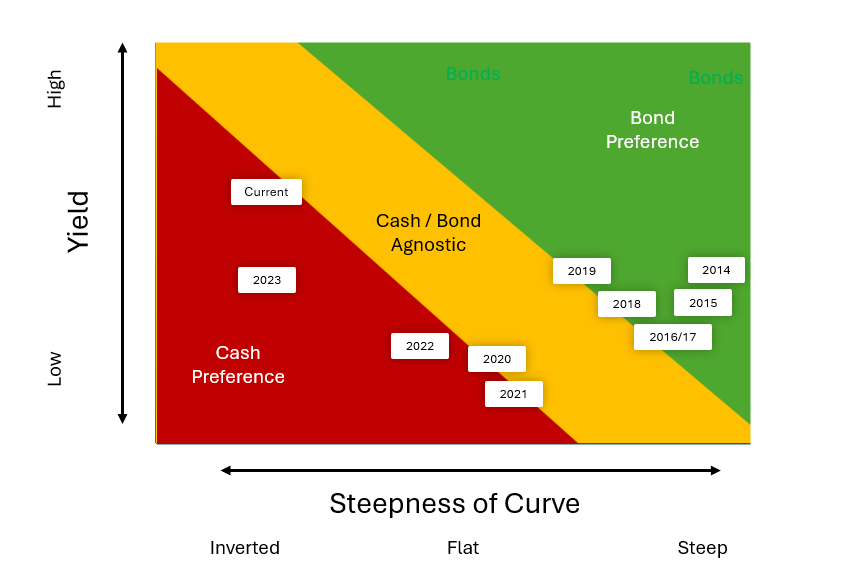

This substantial lead of cash over bonds provides an unusual advantage for cash, at least in the short term. But is it enough? Here’s a visual to help think through the recent interplay of yields and the curve:

Source: Aptus as of 12.11.2023

Source: Aptus as of 12.11.2023

Final Review

Have your previous answers changed?

1. What do you project as the average cash yield for the next decade?

2. What’s your expected average inflation rate during the same period?

Based on your answers, consider your allocation choice taking your projected cash returns (A) and inflation expectations (B):

- If (A – B) > 2.5%, lean towards allocating more to cash.

- If (A – B) = 1.5-2.5%, balance between cash and bonds.

- If (A – B) < 1.5%, consider favoring an allocation to bonds.

For instance, assuming starting cash yields of 5.25% and bond yields of 4.15%, a potential normalization or flattening of the yield curve could adversely impact future cash returns relative to bonds. Hence, an investor might opt to conservatively reduce the expected cash return by approximately 50 basis points, despite historical yield-to-return relationships being less conservative.

Assuming accurate embedded inflation forecasts of 2.15%, this results in a forecasted real cash return of 2.60%, compared to the 2.00% real yield available through TIPS (Treasury Inflation Protected Securities). For an investor projecting higher real returns for cash compared to bonds, does it make sense to take on as much duration risk? In our view, it might be prudent for these investors to tilt portfolios towards lower-duration securities.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2312-17.