4% yields look attractive. Are they?

Rate Environment

We are writing this on 11/2/2022 as markets await the 1pm CST FOMC (Federal Open Market Committee) statement followed by Chairman Powell’s press conference. Another 75bps hike seems to be a given.

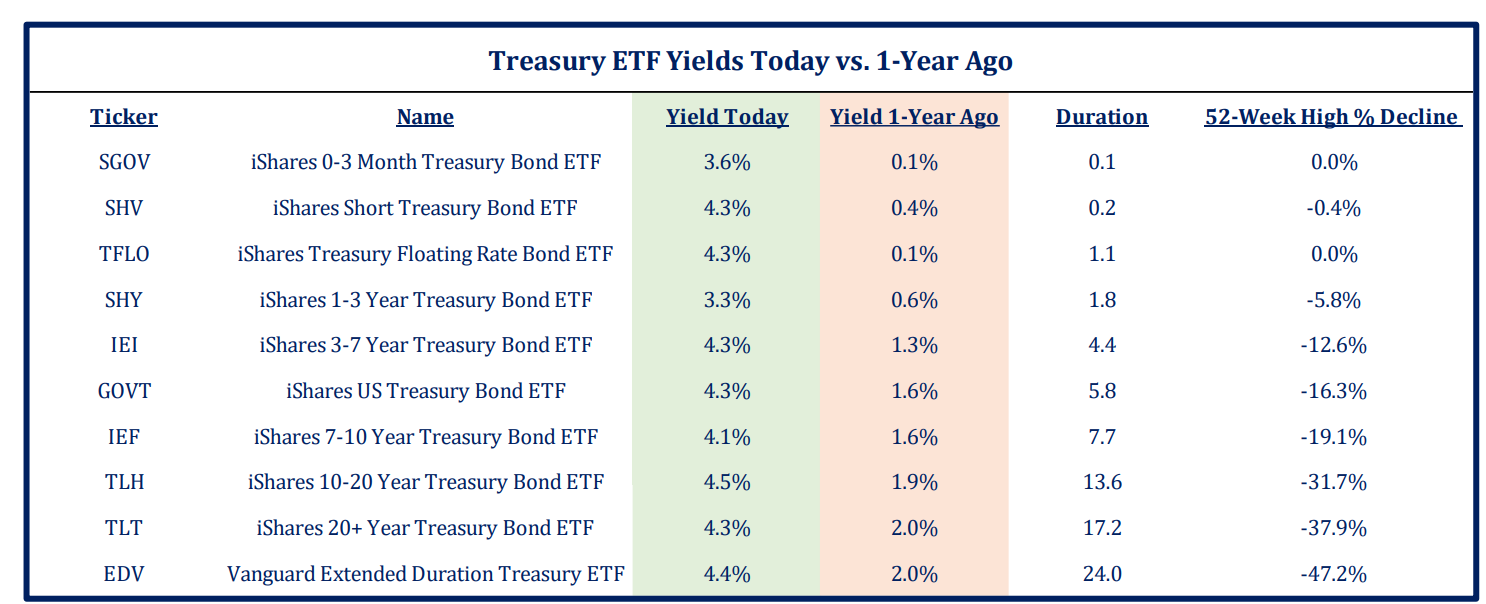

It’s worth reviewing how dramatically our rate environment has changed over the course of the last year. Check out this table from Strategas:

Data as of 11.01.2022

Data as of 11.01.2022

The rate moves across the board have been eye-opening, but the 0-3 month Treasury Bond ETFs (SGOV) change from 0.1% to 3.6% is what truly illustrates how different the world looks today vs a year ago.

Why Rates Matter

Interest rates matter…a lot. A year ago, nobody cared about boring businesses with current cash flows. Everybody wanted the big payoffs later, the long duration stocks that were going to become the next Amazon. The market was priced as if we’d see numerous multi-trillion-dollar companies. Stocks only go up… right?

The world changed in 2022…specifically interest rates have gone up, multiples have come down, and investor’s outlook is shifting daily.

Mark Spitznagel says this about interest:

“It’s the inherent price one must pay to access capital sooner rather than later, which in turn becomes the threshold for determining one’s return and the prudence of making an investment.”

There’s so much to unpack there, but think about rates through these two lenses:

First, asset values and interest rates are inversely related. Low interest rates create high asset values (and vice versa). As we say repetitively – a stock is simply a claim on future cash flows. To determine today’s price, you must discount future cash flows with some rate. Cash flows are the numerator, rates are the denominator. Denominator going up means today’s stock prices come down.

Second, the idea of a hurdle rate for allocating capital. If your risk-free rate is 10%, you must be thoughtful on how you position capital. When risk free rates are 0%…almost everything looks attractive vs. the risk-free rate, and less prudence is required.

We’ve said this before – you can think of the denominator of a valuation analysis as simply the rate required by investors.

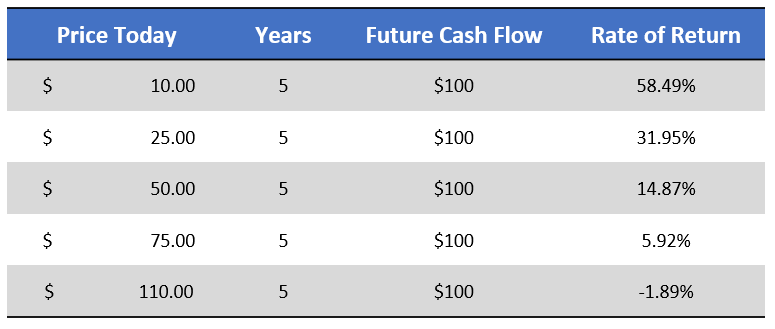

Let’s say you were to offer me an investment that pays $100 in 5 years. I’m giving you capital TODAY for $100 LATER. If my required return is low, I’m willing to pay you more today. If my required return is high, the amount of capital I’m willing to pay today is lower.

Since the financial crisis, we’d argue investors’ required rate (the denominator) has been suppressed, as interest rates have been held too low for too long.

Simple example to illustrate that as investors’ required returns go up, the price of the investment today should go down.

Conceptual Illustration

Conceptual Illustration

Information presented above is for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. These figures are entirely assumed to illustrate the concept of discounting cash flows. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flows.

Today’s Market

Investors are seeing a rising interest rate environment that’s providing significantly higher yields than in the recent past, while simultaneously reminding investors that stocks carry risk, and certain types of stocks carry more risk than others (Greg Oden Post).

This combo is leading to more “Should we just lock in 4% and reduce risk?” types of discussion. Let’s think through bonds and stocks …first bonds:

We’d immediately point to the inflationary pressure that is at the forefront of the Fed’s decisions. Just because rates are higher, doesn’t mean it’s a great buying opportunity in bonds. The world seems to be hoping for the Fed to simmer down its hawkishness.

We aren’t sure that’s in the cards, as a 5% terminal rate (and indication of where the market expects policy to peak) appears to be sticky through the end of 2023. Especially considering the most recent CPI (measure of inflation) print of 8.2%!

Nominal yields have gone up but real yields are still negative. If inflation is 8% and a bond yields 4%, that bond carries a negative 4% real yield. Real yields are what matters.

As for stocks:

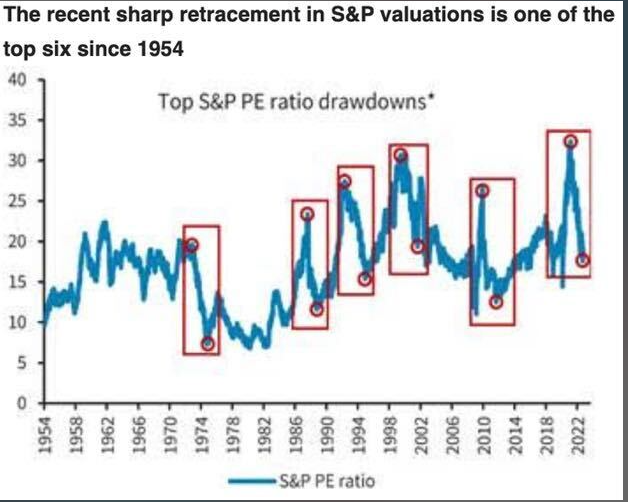

Valuations across the board have dropped. Again, rising discount rates (driven by the Fed and investors requiring higher returns on capital) have brought multiples lower. Multiples is shorthand for valuations. The chart below, from Barclays, shows the Price to Earnings (P/E Multiple) ratio drop vs other years.

Data as of 10.31.2022

Data as of 10.31.2022

The silver lining is that lower multiples can lead to better future returns with less risk. It’s just painful going from high multiples to a lower one. One caveat is that earnings have been resilient. If this continues to be the case, then multiples have indeed dropped and the future could look brighter.

To summarize what we just said, investors are at the point where stock market exposure is concerning them and fear for more downside is making a 4% nominal yield look pretty enticing. This is happening while that 4% is actually a negative real yield, and future returns in equities seem to be improving significantly. And people wonder why there’s a behavior gap…

Portfolio Planning

It’s no surprise, we think traditional portfolio construction is a thing of the past – for now. Diversification as the only line of defense relies on bonds having a low volatility of return streams AND low to negative correlation to stocks. We don’t see that world existing anytime soon.

We do think bonds have far less risk than they did a year ago, but continue to think positioning for positive real returns is the only way to provide clients with the outcomes they require.

We are leaning into volatility as an asset class and different ways to harness it, to improve the yield + growth of portfolios. More stocks, less bonds (in the traditional sense) – this is still the allocation shift we think these markets demand.

We are entering into the remainder of the year postured for protection…especially under the hood of specific strategies. Please don’t hesitate to reach out with any questions on portfolio specifics.

This market demands proactive communication with clients. Let us help where we can. As always, thank you for the trust.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

When a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2211-3.