Pulling up to the bank in a gold Cadillac with my grandad when I was 7, I was excited. The chance to open my first bank account and make my first deposit. Not sure if it was the smell of fresh money or the idea of the account having my name on it, but it was a fun experience for me. I had zero idea what interest on a savings account was then. I probably asked the same question 5 times on why my $100 was $104 after not making any deposits. Honestly, the reason why didn’t matter, that $4 was free money to me, and I understood the more I had in the account, the more it would grow.

Although my $100 didn’t grow to make me a millionaire by age 20, it instilled the fundamental principle of saving, and later, I would understand that savings + interest is the value of compounding capital.

Regardless of the economic environment, the same principles I grew up to learn at a young age, should be part of the fundamental backdrop of building a strong financial plan. And today, after multiple decades of little risk-free interest to be found, we finally have yield thanks to our friends at the Fed. Also, thanks to inflation, technically.

Encouraging our clients to take advantage of this new interest rate environment should be very high on the priority list in 2023 client meetings. This can be done in a variety of ways: embracing yield within your portfolio construction, encouraging high yield savings accounts, and even building a custom cash alternative for clients. Large balances in checking accounts should be a thing of the past.

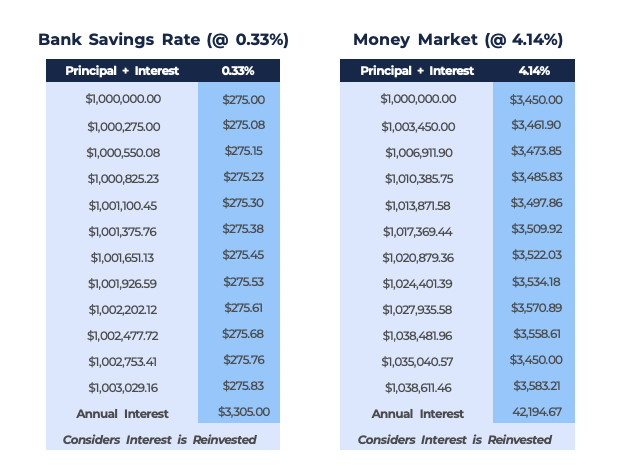

According to the Federal Deposit Insurance Corporation, the average traditional savings account as of January 31st, 2023 is yielding 0.33%. Let’s compare that to the average money market rate of 4.14%. In as little as 1 year, look at the opportunity cost for your clients:

Source (left): FDIC as of 01.31.2023 and Source (right): Charles Schwab as of 01.31.2023

Source (left): FDIC as of 01.31.2023 and Source (right): Charles Schwab as of 01.31.2023

It is probably safe to say most clients do not have a million dollars sitting on the sideline in a checking account. If they do or if it’s a number north of 3-6 months of their annual income, they most likely are saving for a short-term purchase, have excess cash from business operations, or are simply paranoid about the stock market. If the money will be used next month or next year, don’t let clients miss out on earning interest on these funds.

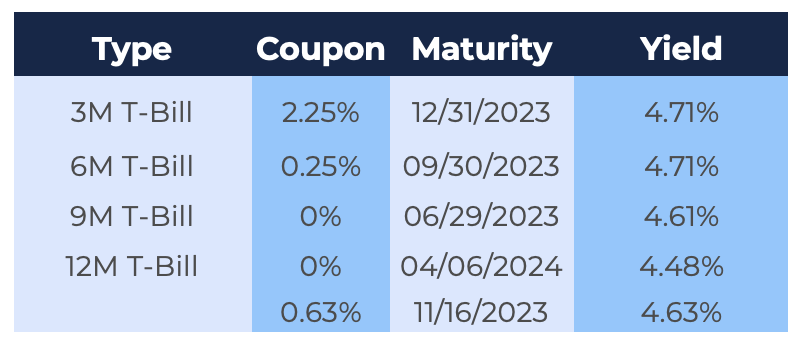

Designing the right cash alternative is very specific to the client and advisor. The timeline and risk associated with each may be different. The spread between what a client can get at a traditional bank and your solution is what matters. Based on rates today, a T-Bill ladder with an 8-month average life would yield 4.63%:

Source: Bloomberg as of 01.31.2023

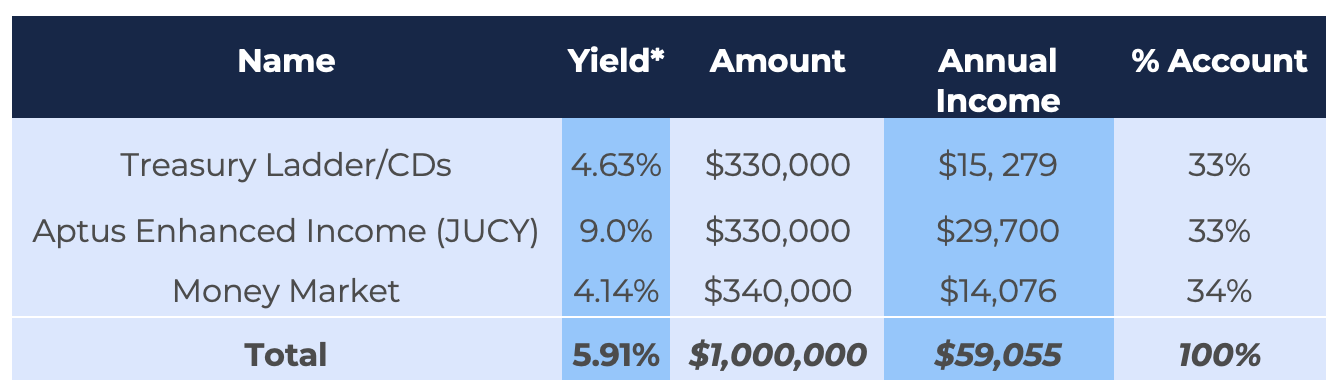

We have introduced the Aptus enhanced income strategy to compliment your money market and T-bill portfolio to increase that spread between what a client can get through their respective bank and potentially through you the advisor.

The overall portfolio is showing a 5.91% yield as of January 31st, 2023. There are certainly other ways to design the client’s portfolio here, possibly opportunities to utilize Munis for tax free income as well. The goal is simply to illustrate that shorter term cash on the sidelines should be put to work in some fashion as who knows how long this rate environment will last.

*As of 01.31.2023

Conceptual Illustration

Information presented above is for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. These figures are entirely assumed to illustrate the concept of hedging during an assumed 10% drawdown in equities. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flow.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2302-22.