NFP February 4th, 2022

We are always in tune with the job data that comes across our screens the first Friday of each month, but we don’t typically dedicate a post to respond. Following Friday’s January release (February 4th), given the surprise of the strength of the data and potential long-term implications, we figured it was worth a deeper dive.

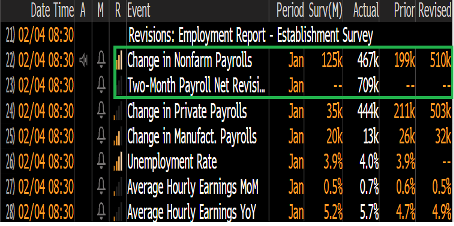

Source: Bloomberg LP. As of 2/4/22.

Source: Bloomberg LP. As of 2/4/22.

The 467k increase in January payrolls was a big surprise as it flew in the face of countless indicators (claims, Kronos, Homebase, Census pulse survey, ADP) which all pointed to a decline. We even had the White House come out earlier in the week to lower the bar for jobs given the Omicron variant. The market had braced itself for a poor report. However, the actual numbers showed quite the contrary.

The employment report is the combination of two monthly surveys—the household survey (from which the unemployment rate is derived) and the establishment survey (from which payrolls are derived). In recent months, the household survey was very strong, and the establishment survey seemed to lag behind. Today, including all the revisions, the establishment survey seemed to catch up to the household survey, but the household survey did not show much improvement.

Highlights From the Report:

- Two-month payroll net revisions were +709K (no typo!!) December went from 199k to 509k (again no typo). Essentially, the jobs number and revisions were more than 1.1 million better than expected. For a month that was heavily impacted by health concerns, these are big numbers.

- The U.S. unemployment rate rose slightly to 4.0%, but labor force participation increased to 62.2%.

- Average hourly earnings rose +0.7% m/m and 5.7% y/y, but this could have been impacted by mix shifts as lower-paying (in person service) jobs were affected by health concerns in January. Average weekly hours also dipped slightly. We’ll treat most of the m/m moves here as noise, though the general trend in pay has been higher.

The Good News is the Job Market is Strong

The U.S. looks close to being in a short-to-medium term full employment position and does not look to have been derailed by the latest virus variant issues (prior to concerns). This should encourage the market that the longer-term growth picture for the country (and recovery) is still intact.

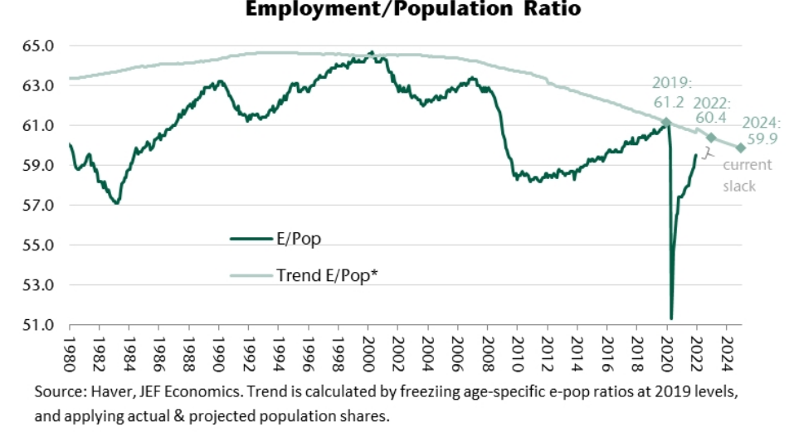

As of 2/4/22.

The improvement in labor force participation is encouraging because it raises the odds of improving labor supply, which will make it easier to sustain strong employment growth in 2022 and help extend the cycle (and eventually slow wage growth). As shown above, the employment/population ratio, which improved by 0.2% in January, is still below its trend. On that basis, the economy should be able to create at least 3 million more jobs before the economy runs into genuine labor shortages.

The Bad News is Wage Inflation is HOT!

A key to understanding medium-term fluctuations in inflation is labor costs, which represent more than two-thirds of all costs across the economy. Everyone wants a raise, but periods when wages rise rapidly can also be periods when workers’ purchasing power falls sharply due to inflation — as this past year illustrates (i.e., real wages decreased).

Labor costs are rising at close to 5% and accelerated throughout 2021 according to the Employment Cost Index, which accounts for private-sector workers after taking out the highly volatile incentive-pay component. This should not be surprising, given the unprecedented ratio of job openings to unemployed workers. Wage growth is likely to keep accelerating unless productivity skyrockets or businesses cannot pass on cost increases to customers — all contrary to recent experience or the testimony of business leaders. This could create more pressure on sustained wage pressure.

So Does This Change Things for the Fed… Maybe?!

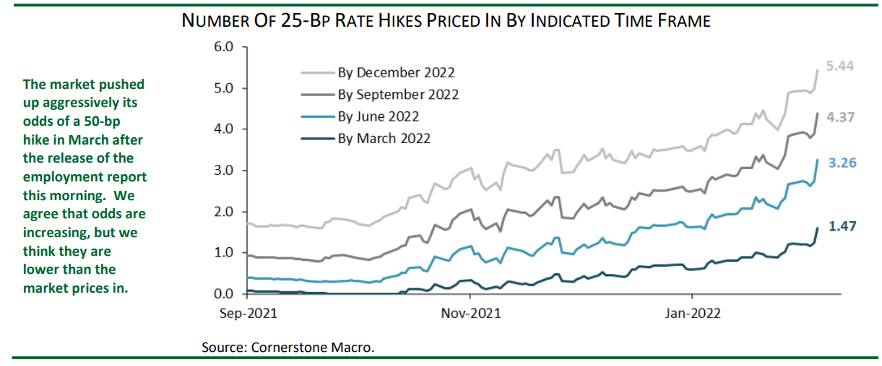

We still think a 5-hike scenario for this year is still a reasonable base case, and we continue to expect 25bps hikes in each March, May, June, September, and December. Labor market pressures create an argument for a more sustained tightening cycle rather than a more front- loaded one. The Fed will be encouraged by the rise in the participation rate (i.e., labor supply) and a steeper Phillips curve (i.e., a more sustainable long term job market). In addition, we believe today’s labor market data is unlikely to alter the near-term inflation trajectory while supply chain issues still exist, wage pressures are high, energy prices are higher and shelter costs likely move to higher. All of which further support a longer and sustainable hiking cycle.

As of 2/4/22.

Bottom Line

We believe the labor market is close to maximum employment and the Fed will start its hiking/ tightening cycle soon. Given a more sustained outlook for growth and employment (and inflation), the Fed can begin attempting to remove the training wheels off the economy. Although, it’s very important the policy changes are well communicated to markets. Following Friday’s report, the concerns of a policy mistake have decreased (i.e., hiking too quickly into a slowing economy). We expect, in usual fashion, the Fed will wait until the next employment report before making a final decision as to how much to hike in March (25 or 50bps). More than anything they will be trying to see if Friday’s report reflected a real trend or just the convergence between the household and establishment surveys.

And of course, the labor market is not the sole determinant of the size of the first-rate hike— we think given the job market strength, inflation matters more. There will be two more CPI reports (next one is 2/10) and one more PCE report before the March meeting, and the decision of how much to move will be informed by those reports even more so than today’s numbers. We will be closely watching several speeches by key FOMC members to guide us to the likely size of the March hike.

Stay Tuned!!

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2202-8.