In our recent piece Enhancing Your (Portfolio) Engine, we walked through our logic:

- Own more stocks, in a risk-neutral way

- Embrace beta to capture the ups

- Use volatility to mitigate the downs

We think the math behind that combo is a great recipe for successful client outcomes. Let’s continue that discussion, with a real but harder-to-measure benefit of that allocation structure.

Investors are known for chasing the latest winners and running from the latest losers. It’s a real and damaging tendency known as the behavior gap.

Rearview Look

As we like to say, investing takes place looking forward, through the windshield. But sometimes perspective can be gained by recognizing what we’ve passed in the rearview mirror. Let’s look back two years and consider ways we can help clients understand the opportunities at hand.

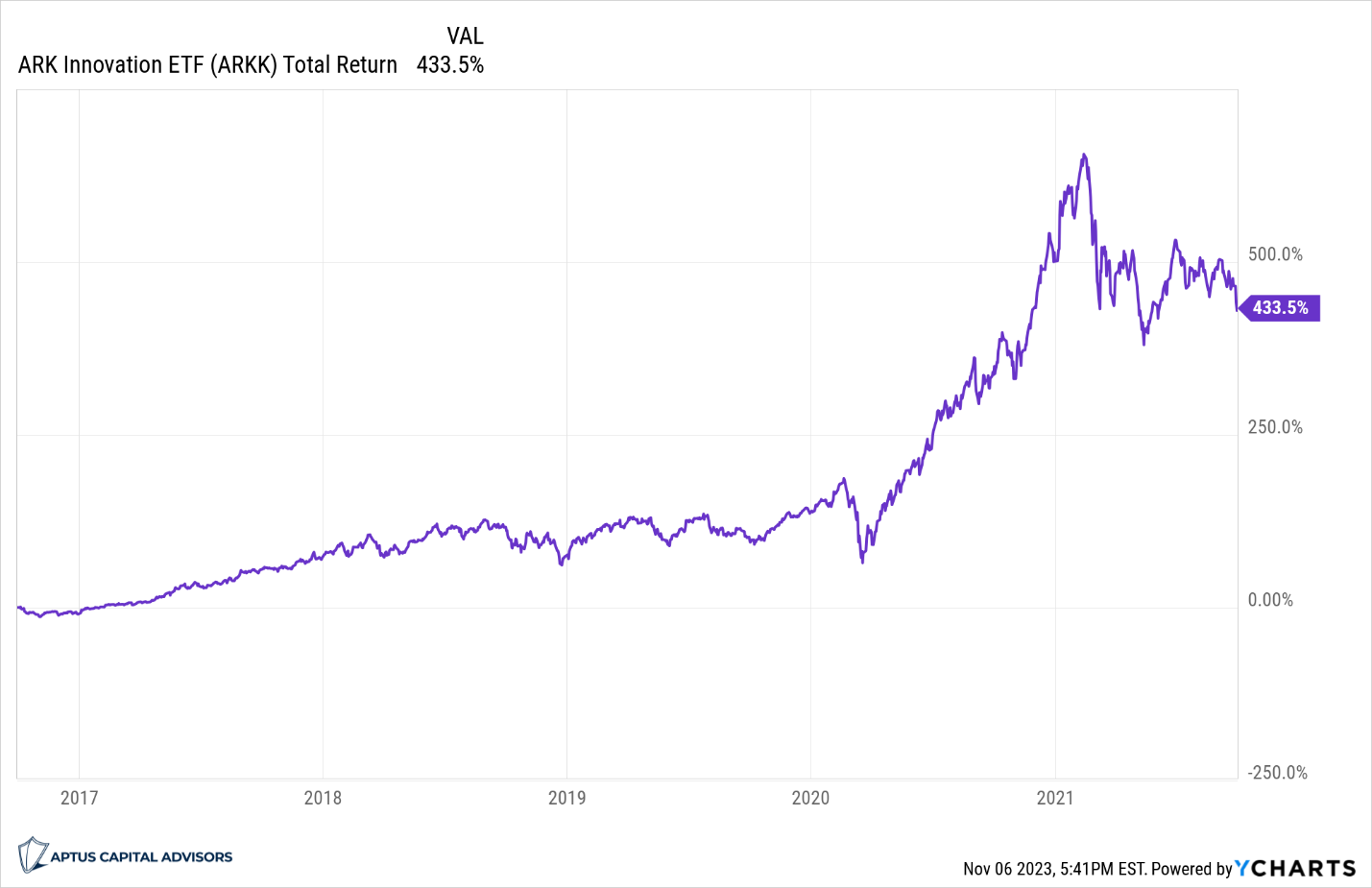

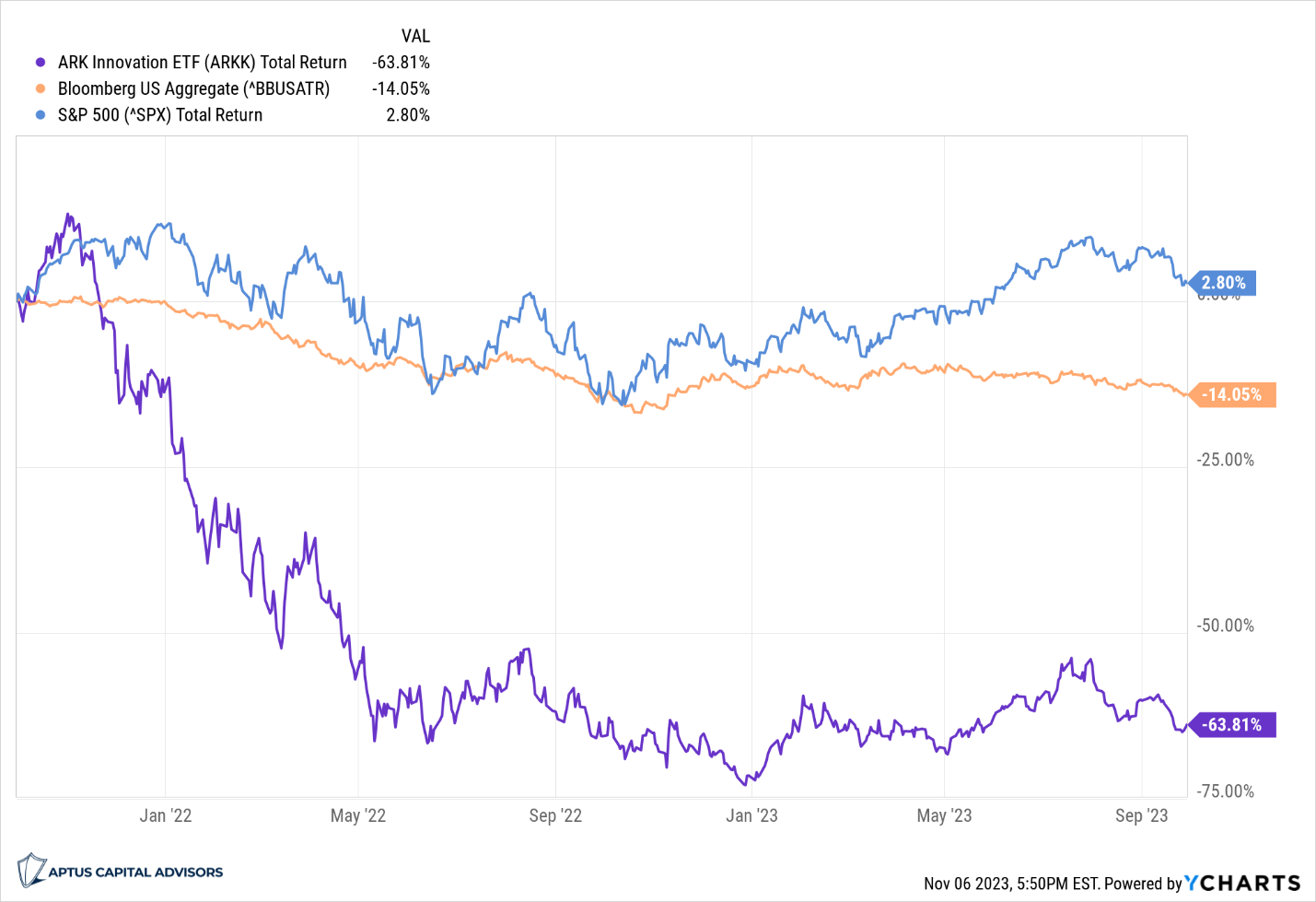

In the Fall of 2021, FOMO investing had taken hold. 10-year Treasuries yielded less than 1%, the S&P 500 had an earnings yield of 3%, and money was plowing into Ark’s Innovation Fund after a 5-fold rise in the prior 5 years. Very little thought towards future returns just a whole lot of performance-chasing.

Two years removed from that period of free money and speculation, the opportunity set looks much more appealing. Diversified investors now have a baseline of 4.5% yields in Treasuries, and a 5% earnings yield in the S&P 500. A bumpy road to get here but a much clearer path to future returns.

The challenge for advisors is convincing clients that this means prospects for a diversified portfolio are significantly higher than back then. A basic 60/40 portfolio had just compounded by nearly 10% per year from 2017 through 2021; few did the math to wonder how that could continue with Treasuries yielding 1%.

Windshield Look

For the first time since the financial crisis in 2008, a new risk has been introduced… behavior risk. The March 2020 selloff was a bit of a test, but the selloff and recovery were almost over by the next quarterly statement. The grind of 2022-23 has been a tougher test…you can do all the Monte Carlo illustrations you want, but time tests investor patience, especially a retiree taking distributions.

The S&P 500 is up this year on the back of the Mag 7, but not much else. The average stock is at best flat in 2023, and certainly below where it was in Summer 2021. Tack on a bond market that’s down double-digits since then, and a typical client has seen no progress in two full years.

If you’re young and contributing funds, that’s not terrible; you’re accumulating assets at lower valuations, a recipe for long-term success. But if no new funds to contribute? Tough conversations, especially when banks are pitching 5% CDs.

Strategic Diversification Wins

This is when it makes sense to remind clients why they allocate to a diversified portfolio. You’re stewarding their savings with an eye on reducing two major risks:

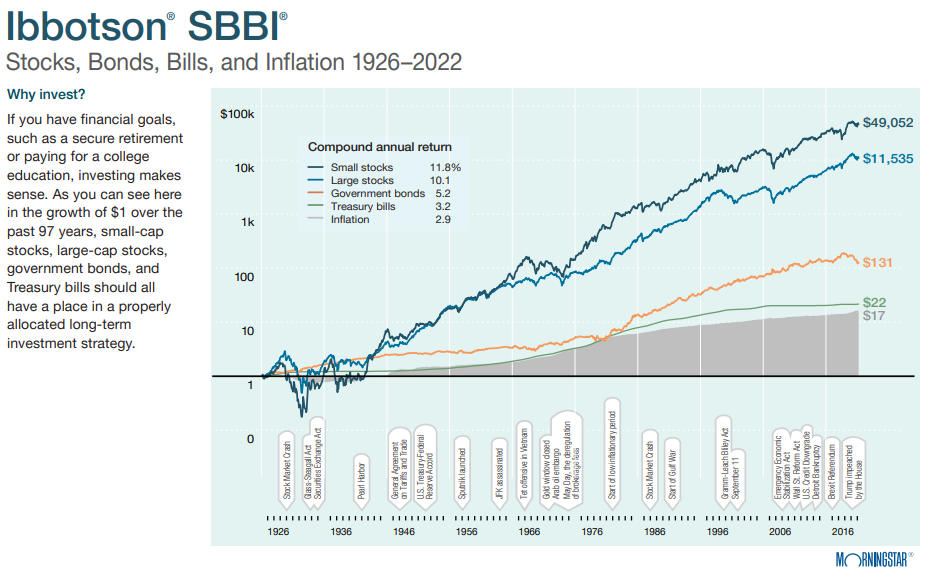

- Outliving their money through lack of upside exposure (Longevity risk)

- Losing money through too much downside exposure (Drawdown risk)

While “T-bill and Chill” may sound appealing, it is no recipe for long-term success…where do you reinvest if rates go down? Just look here at how poorly T-bills have treated investor capital relative to stocks and bonds:

Improved Value in Bonds

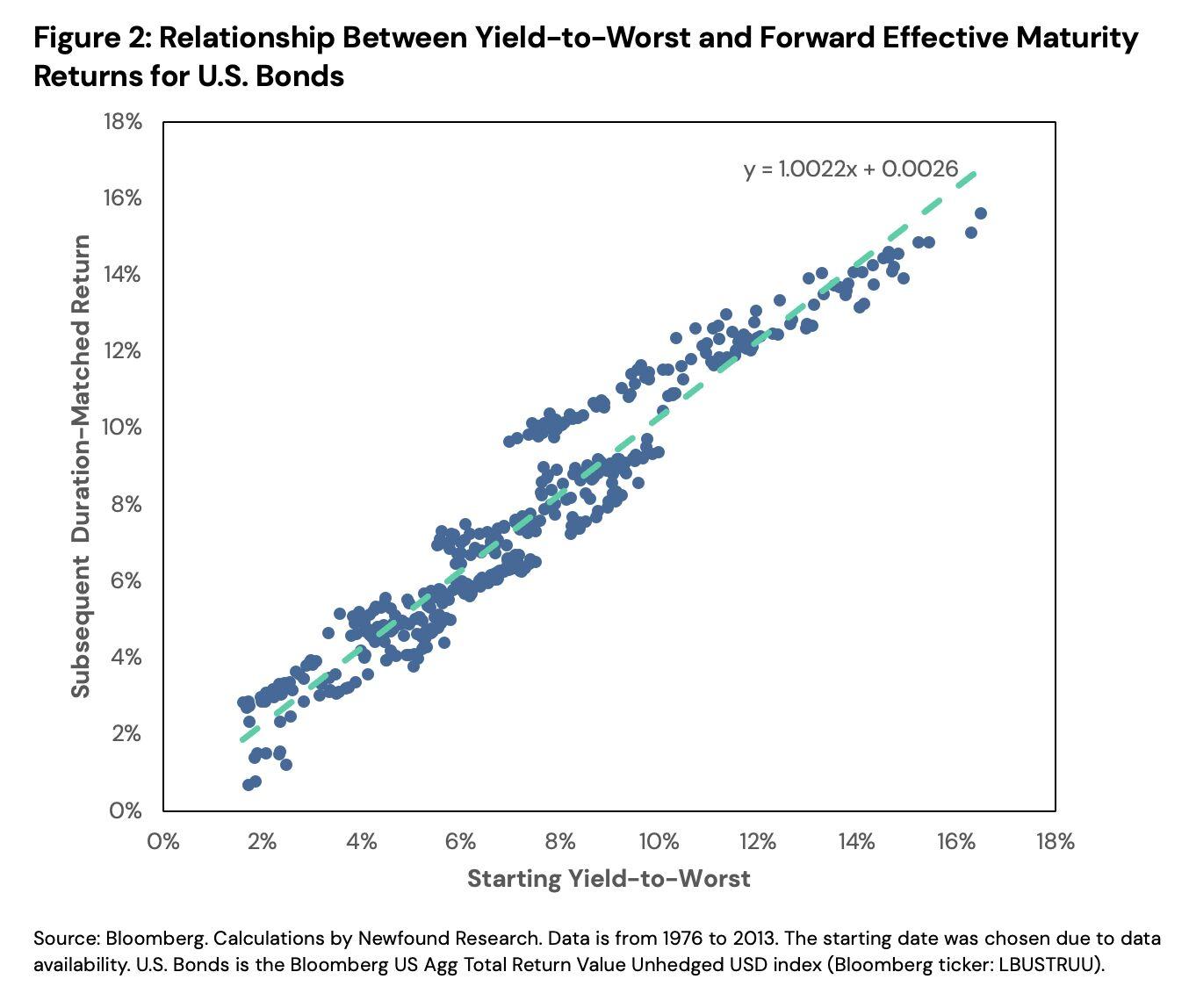

The clearest thing we can bank on is that bonds have historically earned somewhere around their coupon rate.

Depending on where you sit on the credit and duration spectrum, that’s in the 4.5% – 6.5% range from your bonds. At a time when broad-based bond funds have returned 1% annualized over the past decade. Pretty much a mirror image of the situation faced in Fall 2021 before the Fed hiking cycle, in a good way.

Which number makes more sense to use, the windshield number (4.5%-6.5%) or the rearview number (1%)? Most investment software uses the rearview number; we think that makes zero sense, just like two years ago when those inputs were flipped!

Improved Value in Stocks

While the equity risk premium (ERP) may not be as high as it was in recent decades, the earlier graphic shows the significantly higher compounded returns in stocks vs. bonds. And valuations may not be historically cheap, but they’re a whole lot cheaper than they were two short years ago.

So, while investors might have a wandering eye toward “safe” CDs and T-bills, let’s remember that the cost of living goes up every year. And the facts at hand are that the past two years have:

1. Restored rates to a level that actually compensates fixed-income investors

2. Removed the “free money” speculation that enabled SPACs and “themes” to attract 100s of billions of dollars

3. Created more sustainable conditions for estimating future returns

Future Expectations

Despite the uncertain market backdrop, we think the math for investors is far better today than it was at the 2021 peak. Our job is to help you lead clients to the best outcomes, and part of that is taking in the full perspective and reminding them of the value of looking ahead and thinking well.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material, we recommend the citation be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies, and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2311-8.