For investors seeking to outpace the standard gains of the broader equity market, leveraging market exposures during favorable conditions presents a compelling strategy. This isn’t just about adding risk, it’s about doing it with a plan; capitalizing on favorable market environments, and dialing back risk during high-volatility drawdowns. Over time, we believe this strategy can offer returns that are both robust and resilient.

Beating the Index

The following are the primary ways to outperform the market:

- Stock Selection: Historically challenging after fees, especially within efficient areas of the market

- Market Timing: While there may be a chance to reduce risk, there’s an even greater chance of reducing returns

- Leverage: Provides an opportunity to maintain or over-weight market exposure during favorable market opportunities and allows for excess returns in all environments

Why Leverage?

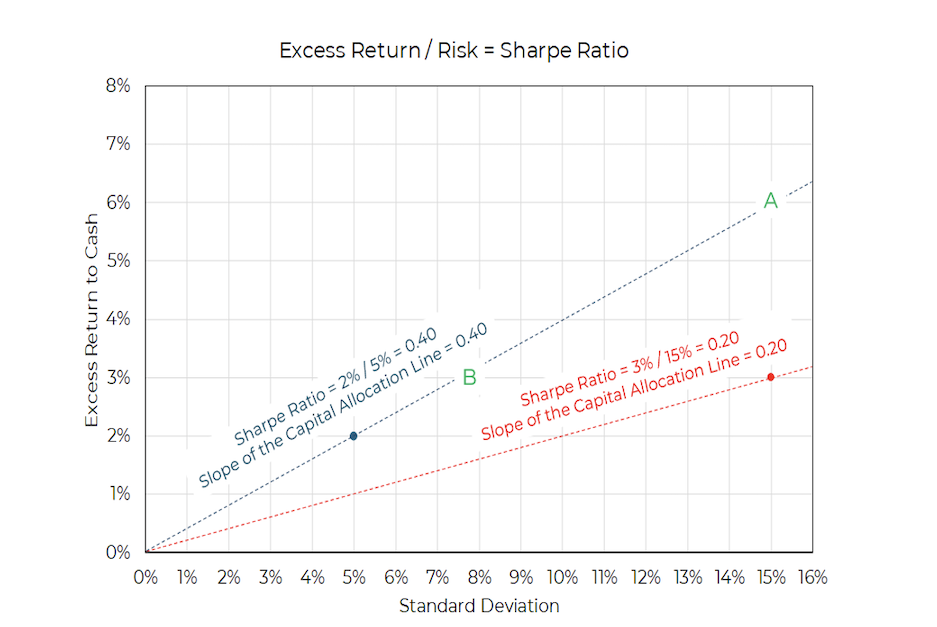

Leverage works by borrowing capital to increase potential return. The key benefit lies in its ability to amplify favorable risk-adjusted returns, often measured by the Sharpe Ratio. The Sharpe Ratio measures the excess performance of an investment compared to a risk-free asset, adjusted for its risk. It simply indicates how much extra return you are getting for the extra risk you are taking. A higher Sharpe Ratio signifies a more attractive risk-adjusted return.

However, the Sharpe Ratio alone can be insufficient if absolute returns are low. If an investor requires a 10% annual return to meet retirement objectives but the best risk-adjusted investment yields only 5%, it will fall short. Or will it?

The key is that the Sharpe Ratio remains unchanged with leverage; therefore, applying leverage to an investment with a high Sharpe Ratio can result in (A) higher returns with the same level of risk or (B) the same returns with lower risk, versus a strategy with a lower Sharpe Ratio.

Using Leverage to Eat Higher Sharpe Ratio (i.e. Risk-Adjusted) Returns

For example, consider a scenario where stocks return 8% annually and cash yields 5%, resulting in a 3% excess return over cash, and a 15% standard deviation. This gives stocks a Sharpe Ratio of 0.20 (3% excess return divided by 15% standard deviation) represented by the red dot below. Now, imagine a strategy that returns 7% annually, providing a 2% excess return over cash, with a 5% standard deviation. This strategy achieves a Sharpe Ratio of 0.40, represented by the dark blue dot below. If an investor requires at least a 3% excess return from their allocation, the new strategy will likely be viewed as inadequate despite better risk-adjusted return, as it only returns 2% excess.

Aptus Conceptual Illustration Information presented in the above charts are for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flows.

Aptus Conceptual Illustration Information presented in the above charts are for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flows.

However, by leveraging this strategy (i.e. ramping up its excess return and risk), the investor can optimize their return-to-risk ratio along the dotted capital allocation line. This allows them to achieve either (A) a much higher 6% excess return over cash with a similar risk to stocks, or (B) a similar 3% excess return over cash with significantly less risk than stocks.

How Can This Be Accomplished Using Traditional Asset Classes?

The main challenge with leverage is the increased risk it brings, especially during periods of turmoil. However, this risk can potentially be mitigated by leveraging exposures during favorable environments (such as those with low volatility) and by reducing exposure during less favorable (i.e. high-volatility periods). This dynamic approach allows investors to pursue higher returns while protecting against significant downturns.

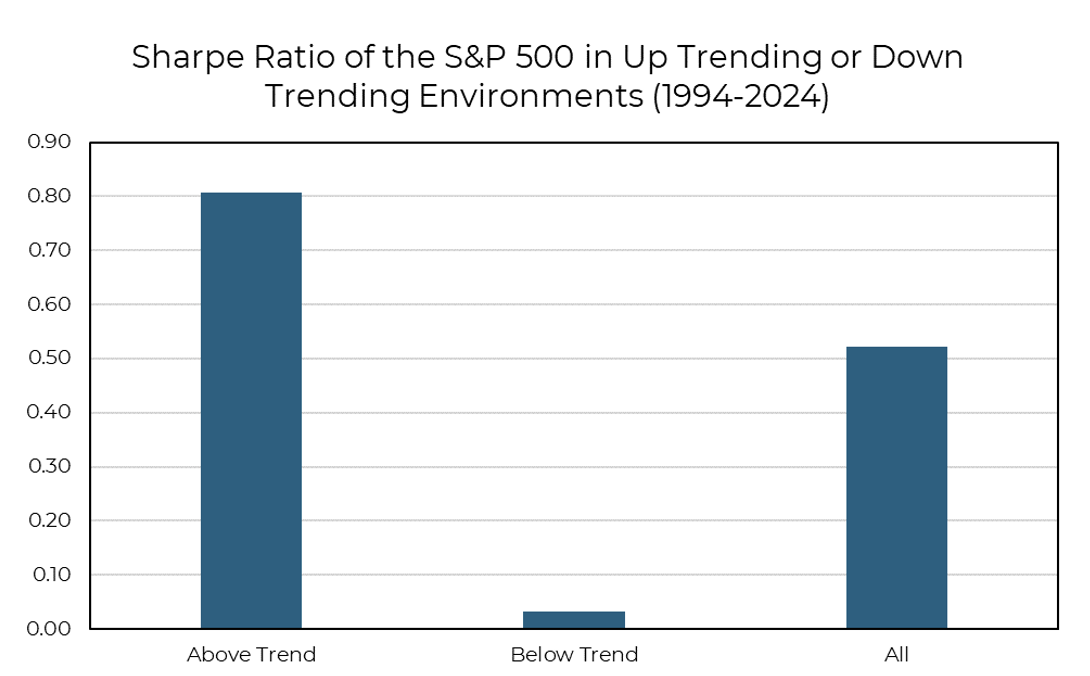

The S&P 500, for instance, has a clear bifurcation in Sharpe Ratio depending on whether the market is trending higher or lower.

Source: Aptus via Bloomberg as of May 2024

Source: Aptus via Bloomberg as of May 2024

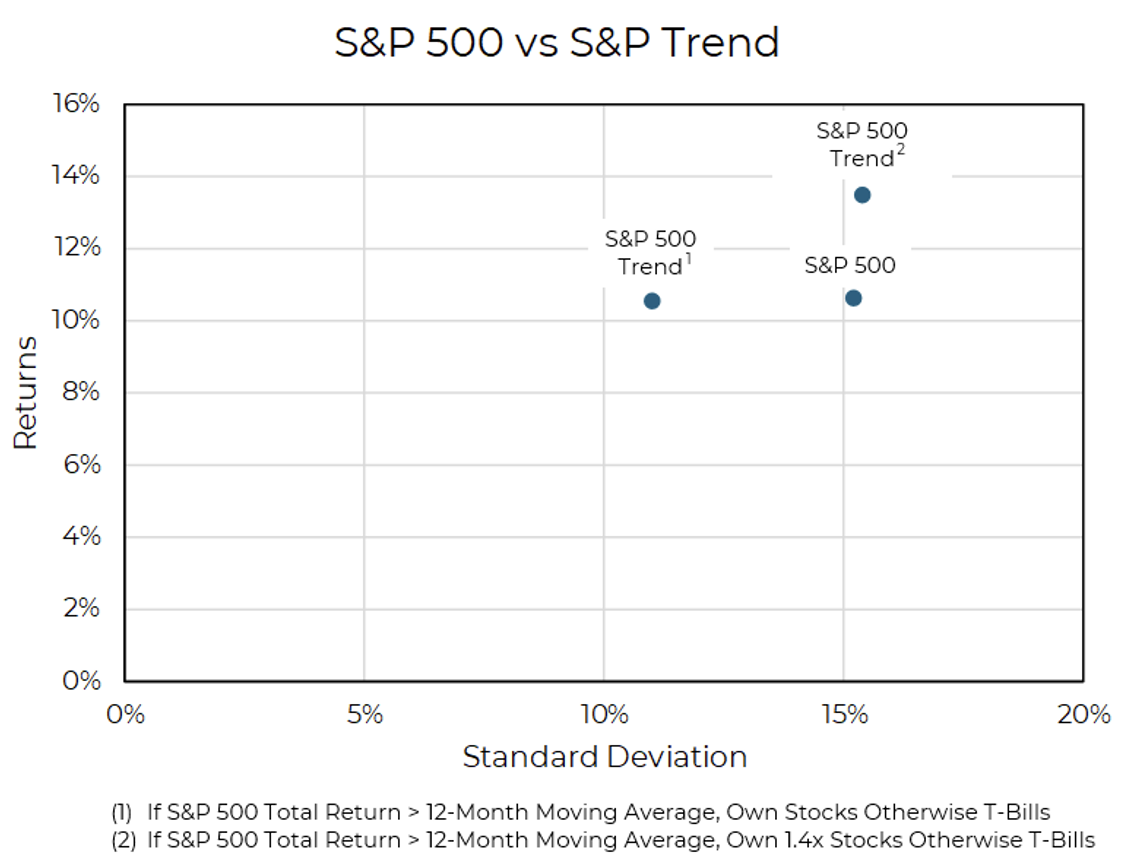

Using this information to make allocation decisions, an investor choosing to own stocks only when markets were in an uptrend were rewarded with returns in line with the broader market over a 30-year period, but with less risk. However, an investor choosing to leverage exposure to the S&P 500 during uptrending markets may have ended up with higher returns with the same level of risk.

Source: Aptus via Bloomberg as of May 2024

Source: Aptus via Bloomberg as of May 2024

So, You Can ‘Eat’ Risk-Adjusted Returns

Understanding and applying concepts like the Sharpe Ratio can provide the flexibility to choose options that balance both returns and risk. By strategically leveraging market conditions and volatility, investors can aim for higher returns while managing risks effectively. This dynamic approach requires vigilance and adjustment but offers the potential for significant rewards.

Leveraging favorable conditions, while mitigating risk during adverse periods, can create a robust investment strategy capable of outperforming traditional market benchmarks. Strategically utilizing these investment principles to improve portfolio efficiency can enhance the ability to secure desired outcomes. With a few additional ingredients, you can indeed ‘eat’ your risk-adjusted returns.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2406-16.