This Aptus Musing will piggy-back John Luke’s take on the yield curve inversion. As we all know, it’s one thing to know what is going on in the market, but another to know how to position off of it. Given that every situation tends to be slightly different, the latter tends to be a moving field goal. Though, it pays to do research, as history tends to repeat or rhyme. The million dollar question is – will it cause a recession?

“Because I Was Inverted”

The curve inversion process relentlessly continues, as the market pushes up its expectations of the Fed tightening cycle in the near term and continues to expect cuts in ‘23 and/or ‘24. That is because it sees the Fed hiking above neutral and going above neutral has been a historically dangerous environment for the health of the economy.

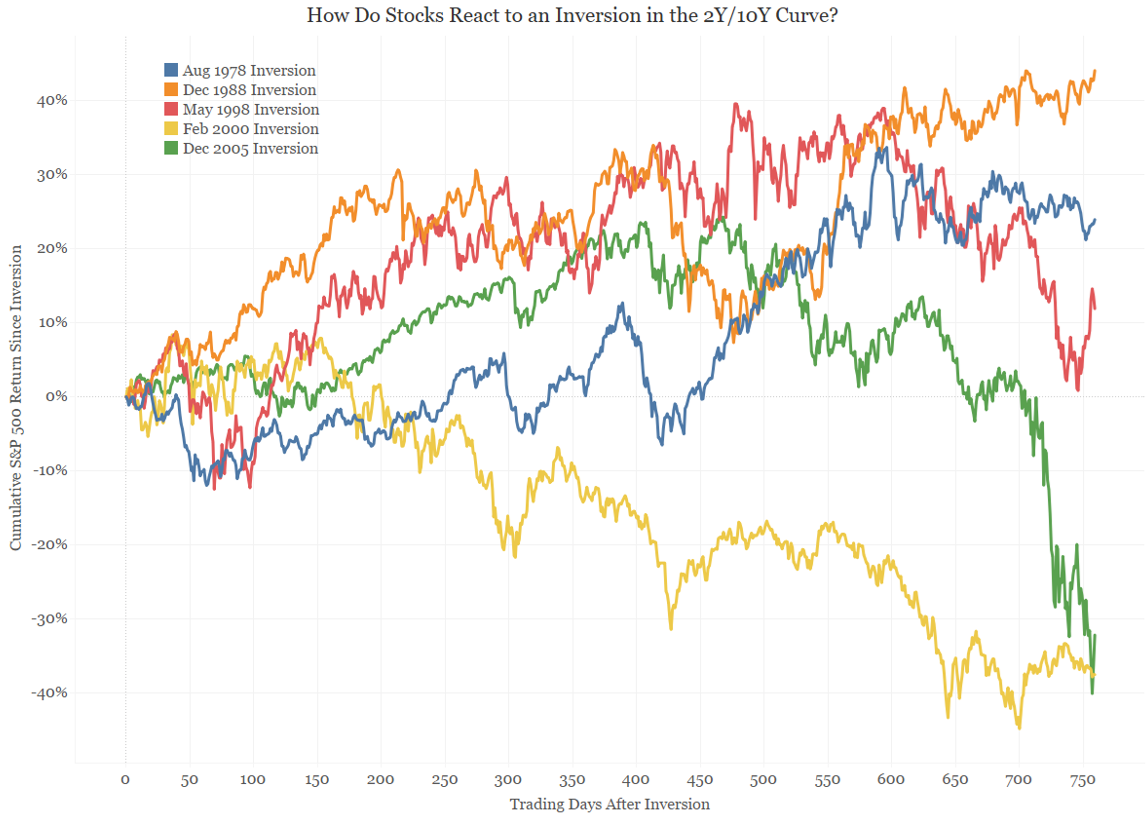

An inversion of the 10-2 spread does not mean a recession is imminent. Historically speaking, stocks rally for about a year after a 10s-2s inversion, with an average return around 15% (heads up, this is a different range than shown in a below chart). A curve inversion is not a reason to sell—it’s a signal that the time on the bull market and economic expansion is now limited, and to prepare for both to end.

Source: Wright Patterson Air Force Base, Picture as of 1986

Source: Wright Patterson Air Force Base, Picture as of 1986

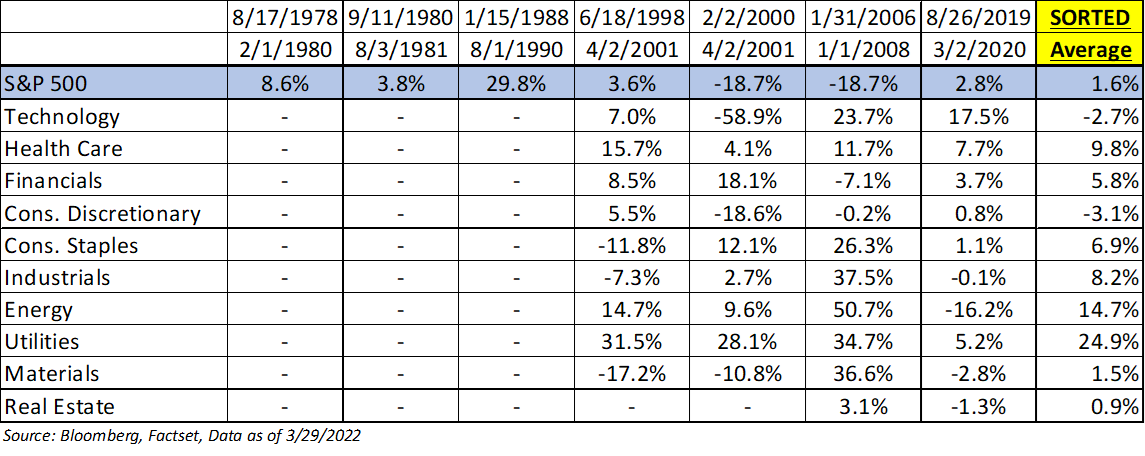

Market Performance Following Yield Curve Inversions

With likely more flattening and inversions of longer portions of the curve coming (the two- to ten-year sector is just a handful of bps away from inversion), we think it’s useful to go back and look at how different asset classes performed post inversions. Let’s look at a few equity sectors and a variety of fixed income assets during these periods.

Stocks

Not all ETF data was available during historical yield curve inversions, thus, we’ll focus on the more recent occurrences.

Here are the two takeaways on the above table:

- The stock market tends to outperform between the first inversion and the subsequent recession. The only exception was in 2000, which the inversion was followed by the dot-com bubble, but the first inversion was actually in 1998.

- The general message is that defensive sectors tend to perform better after curve inversions; however, the ranking is not perfect and the variability across episodes is large. This makes sense, as investors tend to get more defensive towards the end of the cycle – think 2015 – 2019.

Furthermore, when you zoom out and compare relative inversions, we believe that the one certainty is – there tends to be more volatility in the market after an inversion.

Source: Bianco Research, Bloomberg, Data as of 3/29/2022

Source: Bianco Research, Bloomberg, Data as of 3/29/2022

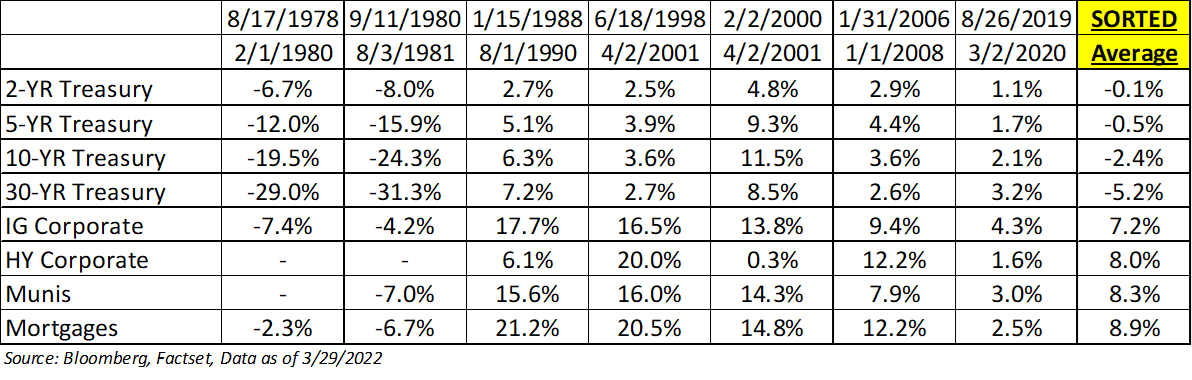

Fixed Income

The story remains interesting for fixed income. Investors can discern this performance into two distinct periods – The Volcker-era and the post-Volcker era. With no surprise to many, the Volcker-era returns made investors feel as if they just made a G.I. Jane 2 joke in front of Will Smith and his wife – slapped across the face. For those too young, including myself, Paul Volcker had a huge inflation problem to deal with and he raised rates very fast knowing that it would cause a recession. For the fact checkers at home, Volcker raised rates to 20% in ’80 & ’81.

Interestingly, fixed income assets tend to perform very well between inversions and the official recession – a flight to safety. This shouldn’t be a surprise for Treasuries, as inversions tend to happen after the Fed was done tightening – the bulk of the underperformance was already behind investors. The big question today is – how does the market react when the inversion happens before the Fed really starts tightening?

Nowadays, it appears that we may be between the Volcker years and the post-Volcker years. Inflation is not as high as it was in the 70’s and early 80’s, but it’s the highest level since that period. Inherently, the Fed may have to hike faster and higher than previous tightening schedules, which could put fixed income assets under more pressure.

Conclusion

Overall, the message seems clear for equity and fixed-income investors alike: Don’t get too gloomy as soon as the yield curve inverts—doing so is very likely to leave performance on the table. As we mentioned at the beginning of this musing, inversions don’t tell us when a recession will happen – it could be a long time until one finally materializes.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The company has been selected to help illustrate the investment process described herein. A complete list of holdings is available upon request. This information should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the holdings listed have been or will be profitable, or that investment recommendations or decisions we make in the future will be profitable.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2203-20.