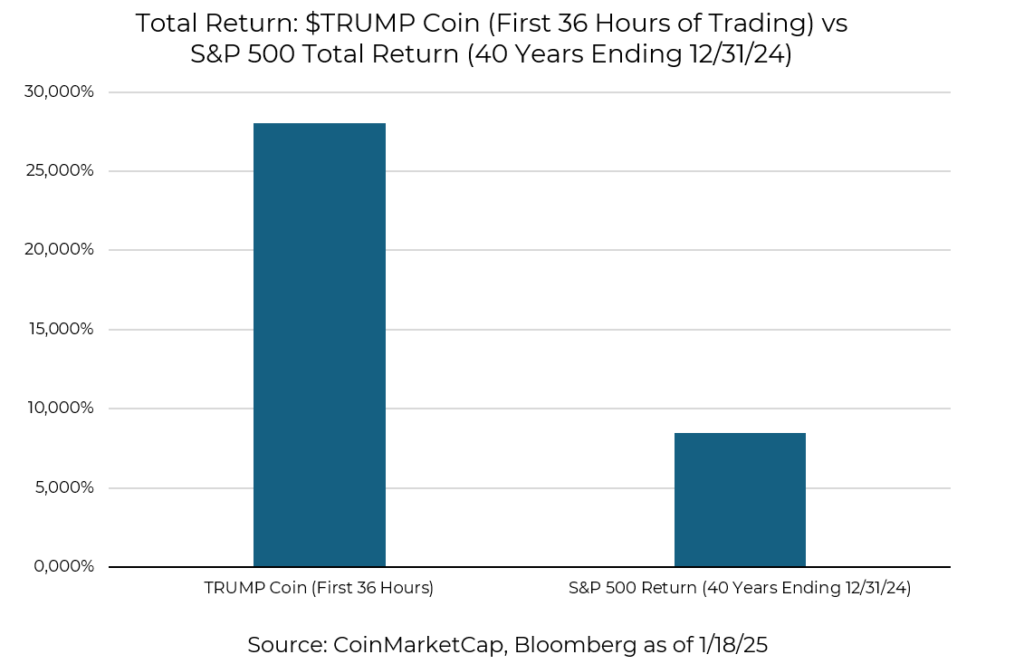

Cryptocurrency has transformed from a niche innovation into a cultural phenomenon, with Bitcoin emerging as the original and most widely recognized digital asset. In its wake, meme coins—cryptocurrencies often driven by popularity rather than intrinsic value—have captured significant attention. From Dogecoin and Shiba Inu to Donald Trump’s recently launched meme coin, these assets evoke both fascination and skepticism. The Official Trump coin delivered an astonishing 28,000% return to insiders within the first 36 hours of trading—nearly three times the total return of the S&P 500 over the past 40 years!

The question remains: Do meme coins and speculative crypto assets contribute to economic output, or are they simply a wealth transfer mechanism in a zero-sum game?

The Meme Coin Economy: Hype Over Substance

Meme coins thrive on virality, humor, and the willingness of individuals to jump on the bandwagon. They represent a cultural moment as much as a financial one. Yet, despite their entertainment value, their economic impact is questionable.

At their core, meme coins are speculative instruments. They have no significant utility, produce no goods or services, and lack the infrastructure or adoption to serve as functional currencies. Their rise and fall are often fueled by social media trends and celebrity endorsements, creating bubbles that benefit early adopters and leave latecomers holding the bag.

Donald Trump’s recent foray into meme coins is a case in point. The coin’s launch capitalizes on the President’s brand and cult-like following, but it raises a critical question: Does this endeavor add value to the economy, or is it another example of “the financialization of BS”?

The Perils of Prioritizing Speculation

The proliferation of meme coins and speculative crypto assets underscores a trend: the growing prioritization of the financialization of non-productive assets over fostering real economic growth. Here’s why this matters:

- Erosion of Trust: As speculative bubbles inflate and inevitably burst, trust in financial markets erodes. When meme coins collapse, they leave behind disillusioned retail investors, making it harder to channel capital into productive enterprises.

- Resource Misallocation: The energy and resources dedicated to creating, promoting, and trading things with no utility that could be redirected to innovations that genuinely improve lives—such as renewable energy, medical research, or education.

- Wealth Transfer, Not Creation: Meme coins don’t create wealth; they transfer it. Early adopters and influencers often profit at the expense of latecomers, amplifying economic inequality rather than addressing it.

The Fallacy of High Valuations

Advocates of Bitcoin and meme coins often argue that rising valuations signify success or societal value. But the reality is more nuanced. True wealth isn’t measured by the price of a digital asset; it’s measured by what society can produce and consume.

Whether it’s Bitcoin at $100,000 or a meme coin trending on social media, the economic impact of these assets hinges on their productive use. If their value is simply a speculative tool rather than a means to facilitate innovation or the creation of goods and services, their rise offers little benefit to society at large.

This principle extends beyond cryptocurrencies. Imagine a meteor crashing into Earth, depositing $100 trillion in gold. While it might create excitement, it wouldn’t increase societal wealth; it would merely devalue existing gold and redistribute wealth. Similarly, high meme coin valuations don’t generate wealth—they represent a speculative reshuffling of it.

Meme Coins as a Cultural Phenomenon, Not an Economic Driver

Meme coins like Donald Trump’s cryptocurrency have their place in the cultural zeitgeist. They capture attention, spark conversations, and even provide entertainment. But they shouldn’t be mistaken for economic drivers.

If speculation continues to replace productive work, overall economic activity could decline, even as asset valuations soar. Society’s focus should shift from celebrating speculative bubbles to fostering real innovation and productivity.

The rise of meme coins underscores the need to distinguish between financial hype and economic substance. True wealth isn’t created by dollar signs or crypto valuations—it’s created by productive activities that generate goods, services, and innovation. Meme coins may have cultural significance, but their economic impact is limited unless they are tied to real-world output.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2501-33.