As advisors often see, high-income investors love municipal bonds. And for the most part we’ve shared that love. Tax-favored income and low correlation to equities, what’s not to love?

But it seems investors are piling in with little regard for price, even with tax-equivalent yields lower than their Treasury counterparts. The rich pricing can likely be attributed to a limited supply of bonds as state and local governments have received significant government funding on top of record tax inflows from increasing property values.

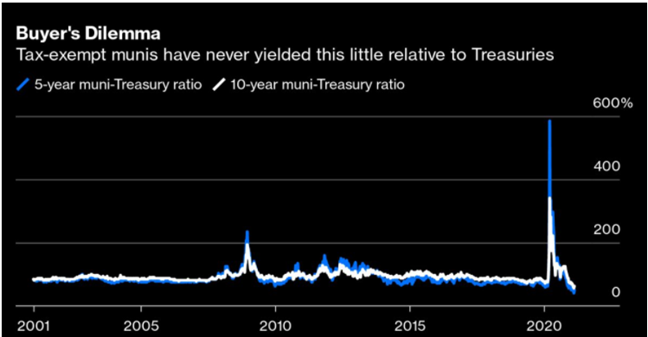

And we’re not alone; Bloomberg’s Muni Bonds Are the King of Costly cites the raging inflows and extreme muni-Treasury ratios as danger signs. One chart from that piece below:

Source: Bloomberg (as of 2/22/21)

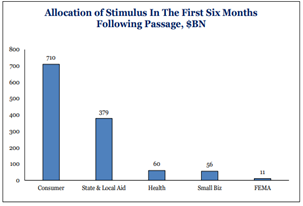

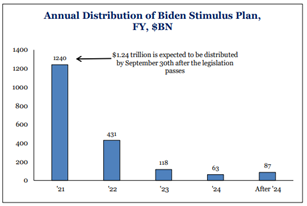

Simply put, these groups are flush with cash with even more stimulus on the horizon as Biden’s $1.9bn stimulus plan is substantially front-loaded. As new issuance has temporarily decreased, investors are working with limited supply and in turn bidding up prices.

Projections via Strategas (As of 2/23/2021)

While we’ve generally encouraged high tax bracket investors to look to municipal bonds as anchor positions, the value prop from here looks limited. Even given the higher probability of higher tax rates for both individuals and corporations under a Democratic government, we’re no longer sure the math adds up and we expect spread to Treasuries to normalize.

Historically, the muni space has shaken investors with painful reversals when trends are overdone, as seen following the 2016 presidential election and after the Puerto Rico credit crisis in 2013. We’d tread carefully in municipals as this plays out.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

Projections or other forward looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2102-15.