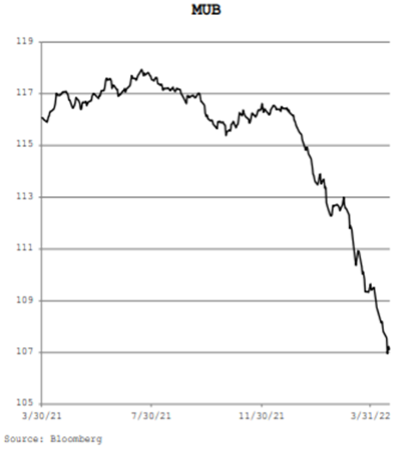

This bond bear market has taken down Munis hard. Yields on Munis (measured by MUB) are around 2.45%, which is ~3.5% tax-free on a 4.25yr duration. Higher Yield Muni funds are around 4% yields (5.7% TEY).

Market Recap

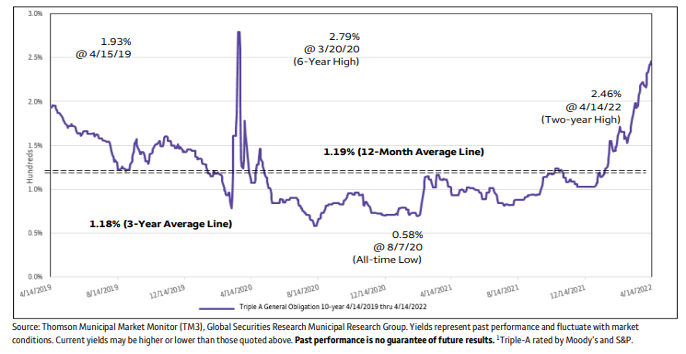

Year to date, 10yr AAA Munis have risen from 1.04% to 2.46%. Even after the move they remain 33bps below the 6- year high of 2.79% set during March of 2020 (liquidity crunch). Concerns over inflation and the Fed raising rates have sent the value of all fixed income securities lower this year.

Over the longer run we expect support in the municipal sector from federal infrastructure spending, slightly lower supply, and investor demand for tax free income.

As a relative value indicator, we measure the AAA Muni to Treasury ratio (AAA Muni Yield (pre-tax benefit)/ Treasury Yield). The current ratio sits at 89% as of mid-April which is in line with its 5-year average. The ratio started the year at 64% so using this quick reference, relative to recent history, municipal bonds are attractive. For a fun fact, the ratio was at 369% during the March 2020 unraveling.

We prefer the 2–10 year part of the Muni curve (max steepness) meshed with higher coupon offerings (less rate sensitivity). We also prefer A rated or higher securities with either an essential service or general obligation backing (higher quality/ higher likelihood of gov’t backing).

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Municipal bonds can be significantly affected by political and economic changes, including inflation, as well as uncertainties in the municipal market related to taxation, legislative changes, or the rights or municipal security holders. Municipal bonds have varying levels of sensitivity to changes in interest rates. Interest rate risk is generally lower for shorter-term municipal bonds and higher for long term municipal bonds.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2204-26.