Retirement planning is a critical aspect of financial management, and understanding how to manage savings can make a significant difference in financial stability during your clients’ golden years.

The Path-Dependent Nature of Longevity Risk

Longevity risk is highly path-dependent, meaning that the sequence of returns and the timing of withdrawals significantly affect the sustainability of your retirement fund. It’s vital to strike a balance between achieving stable returns and aiming for higher returns that have a better chance of meeting retirement spending needs. Focusing solely on one aspect, either seeking high returns without regard for volatility or settling for lower, more stable returns, can jeopardize financial security in retirement.

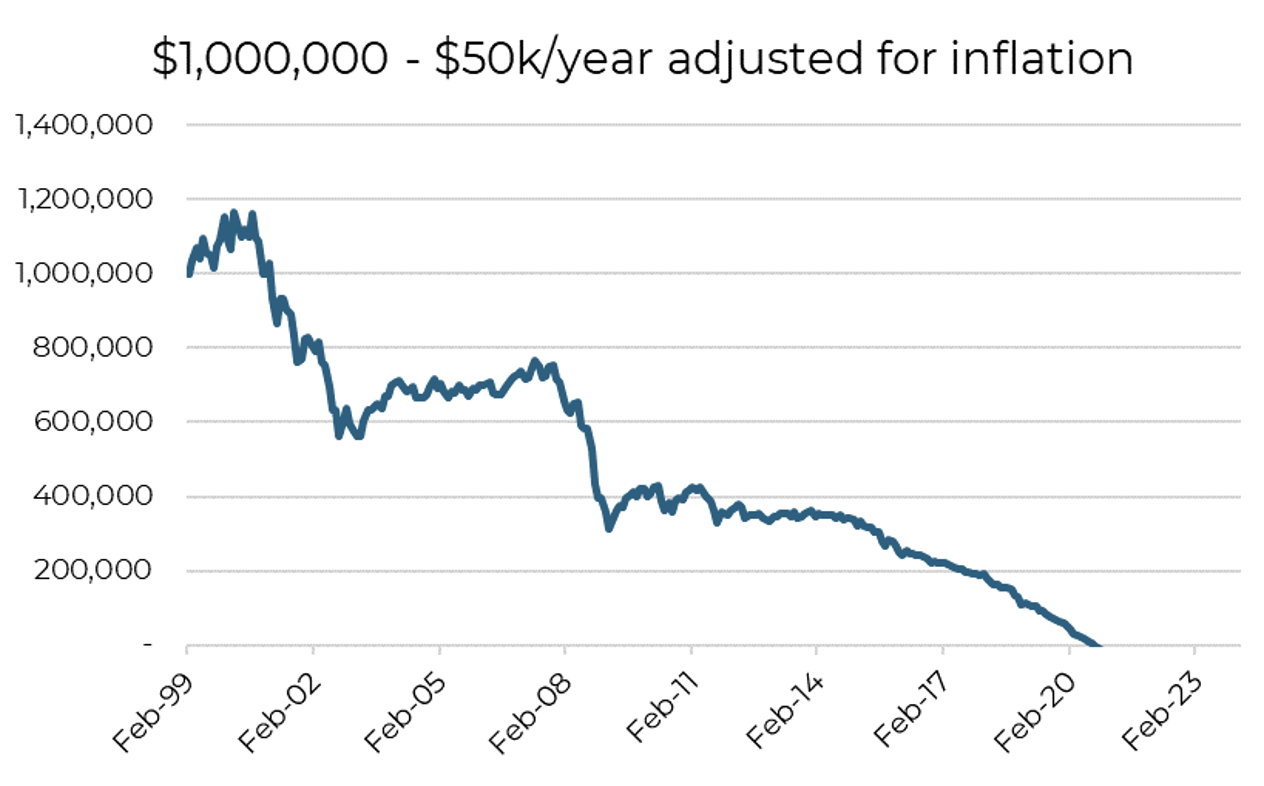

Consider a retiree who began with $1 million 25 years ago and withdrew $50,000 annually, adjusting for inflation. Different investment strategies would yield varying outcomes for this retiree, illustrating key financial planning trade-offs. Let’s see how that would have played out.

Equity-Driven Strategies: High Returns vs. High Risks

Opting for an all-equity portfolio might seem beneficial due to the potential for high returns. Yet, significant market downturns, like the dot-com bubble and the global financial crisis, could have depleted the retirement fund by 2020. This scenario underscores the importance of not just saving a substantial amount for retirement but also carefully planning how to manage these funds to last through your retirement years.

Source: Aptus as of March 2024

Source: Aptus as of March 2024

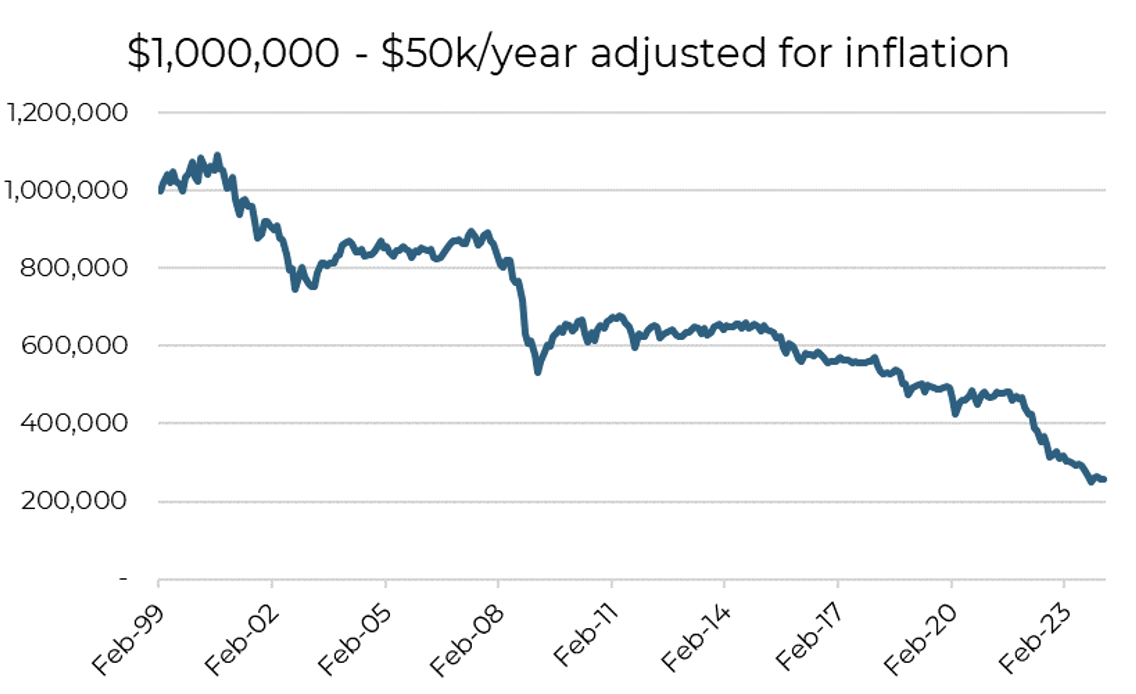

The Potential Double-Edged Sword of Diversification

Now let’s consider an alternative scenario where your client diversified into a portfolio comprising 60% stocks and 40% bonds. Despite the historically lower returns from bonds compared to stocks over this period, this diversified approach would have offered better sustainability given the reduced drawdowns.

But, while the investment balance has not yet run dry, your client would only have around $200,000 remaining. This outcome illustrates that while diversification may extend the longevity of financial resources during periods highlighted by market drawdowns, allocating a sizable amount of your wealth that does not have the ability to preserve purchasing power can present its own challenges.

Source: Aptus as of March 2024

Source: Aptus as of March 2024

Strategic Asset Management: Combating Longevity Risk

To combat longevity risk, it’s essential to invest in assets that can outpace inflation and grow capital while managing withdrawals judiciously. This objective can be achieved through various strategies, all aimed at minimizing the impact of significant drawdowns while maintaining exposure to asset classes likely to surpass inflation over time.

While potentially easier said than done, a strategy that captured 75% of the S&P 500’s gains during its up months, and limited downside returns to 60% during its down months, would have safeguarded during risk-off markets, while capturing returns during bullish phases, allowing a portfolio to withstand the turmoil and maintain a strong balance even after 25 years of withdrawals.

Source: Aptus as of March 2024*

Source: Aptus as of March 2024*

In Summary: The Art of Retirement Financial Management

Managing retirement funds is a complex, strategic endeavor. It requires not just a significant initial savings but also a thoughtful approach to investment, risk mitigation, and withdrawals. Through a balanced strategy that considers both a level of return with consistency, retirees can address longevity risk and strive for a financially secure retirement.

*Information presented is for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. These figures are entirely assumed to illustrate the concept of hedging during an assumed 10% drawdown in equities. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flows.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2404-1.