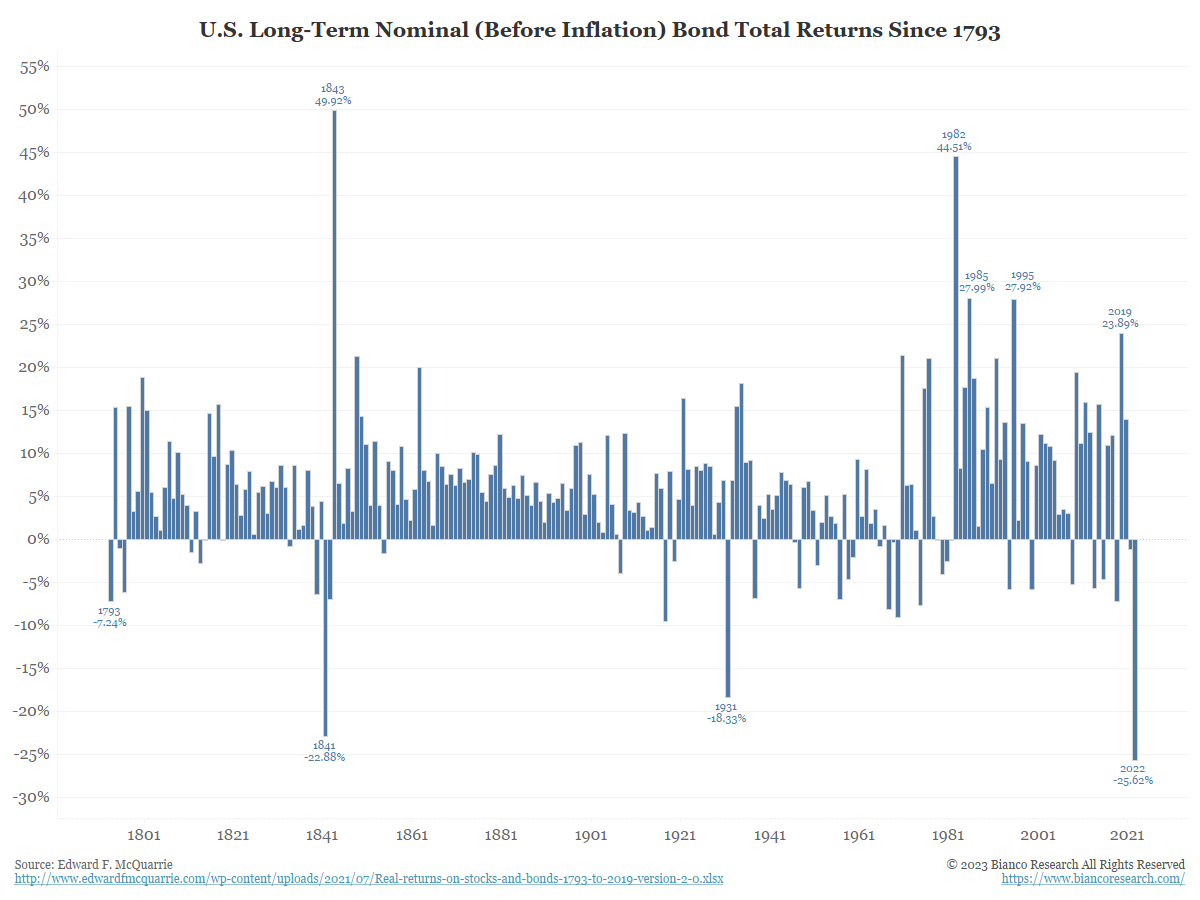

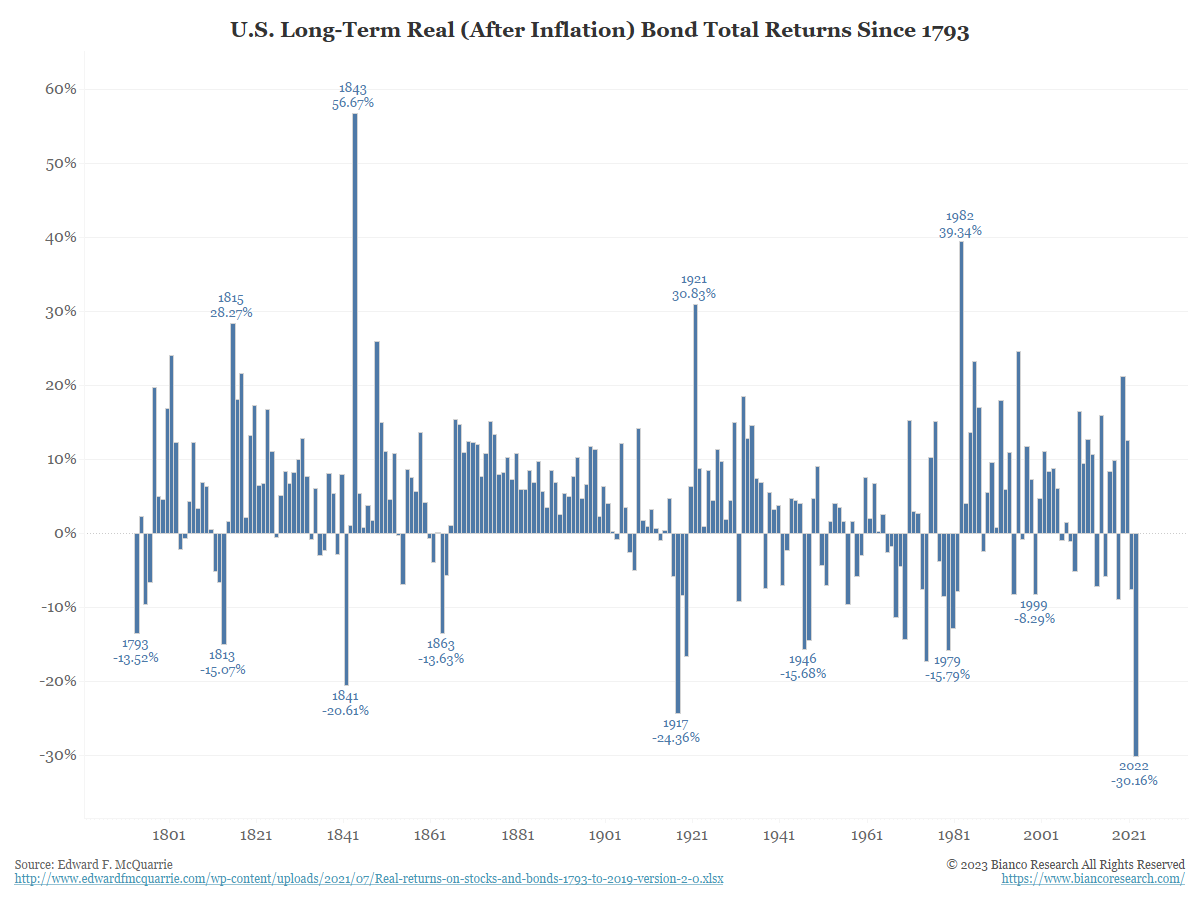

Real Bad, Nominal Worse

While the Fed might have been slow off the mark in fighting inflation in 2021, they marched double-time last year starting in March, taking the benchmark Fed Funds rate from about roughly 0% to 4.5%. This brought extreme pain to the fixed income markets, especially anything with duration. While there was pain in price returns across the fixed income landscape, yield became more attractive, but inflation-adjusted real returns were negative throughout the year.

Source for both images: Bianco. As of 12/31/22

Source for both images: Bianco. As of 12/31/22

Q.E. to Q.T.: Big Shift in Regimes

The transition from Q.E. to Q.T. may be one of the most significant changes to monetary policy since Fed Chairman Volcker decided to target reserves rather than interest rates in 1979. Aggressive policy has led to the era of negative real interest rates coming to an end. This brings along with it significant implications for business models built to grow revenues at any cost. Interest rates dictate the pricing of just about everything. So, a structural move higher in rates on top of draining liquidity from the global system is likely to continue to lead to both volatility and press on asset prices.

Source: JPM. As of 12/31/22

Source: JPM. As of 12/31/22

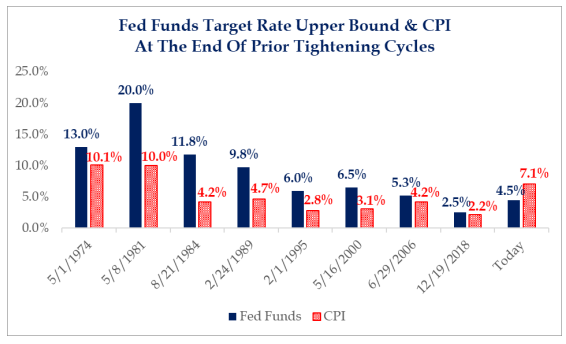

Fed Funds Rate > Inflation?

The Fed typically tightens until the Federal Funds rate exceeds headline inflation. If inflation continues to decelerate as expected (remember YoY data is working off massive comps and is naturally headed lower) and the Fed continues to hike rates 50bps at the next couple meetings, we should get there by sometime in Q2. We don’t expect the Fed to stop until this objective is met.

Source: Strategas. As of 12/31/22

Source: Strategas. As of 12/31/22

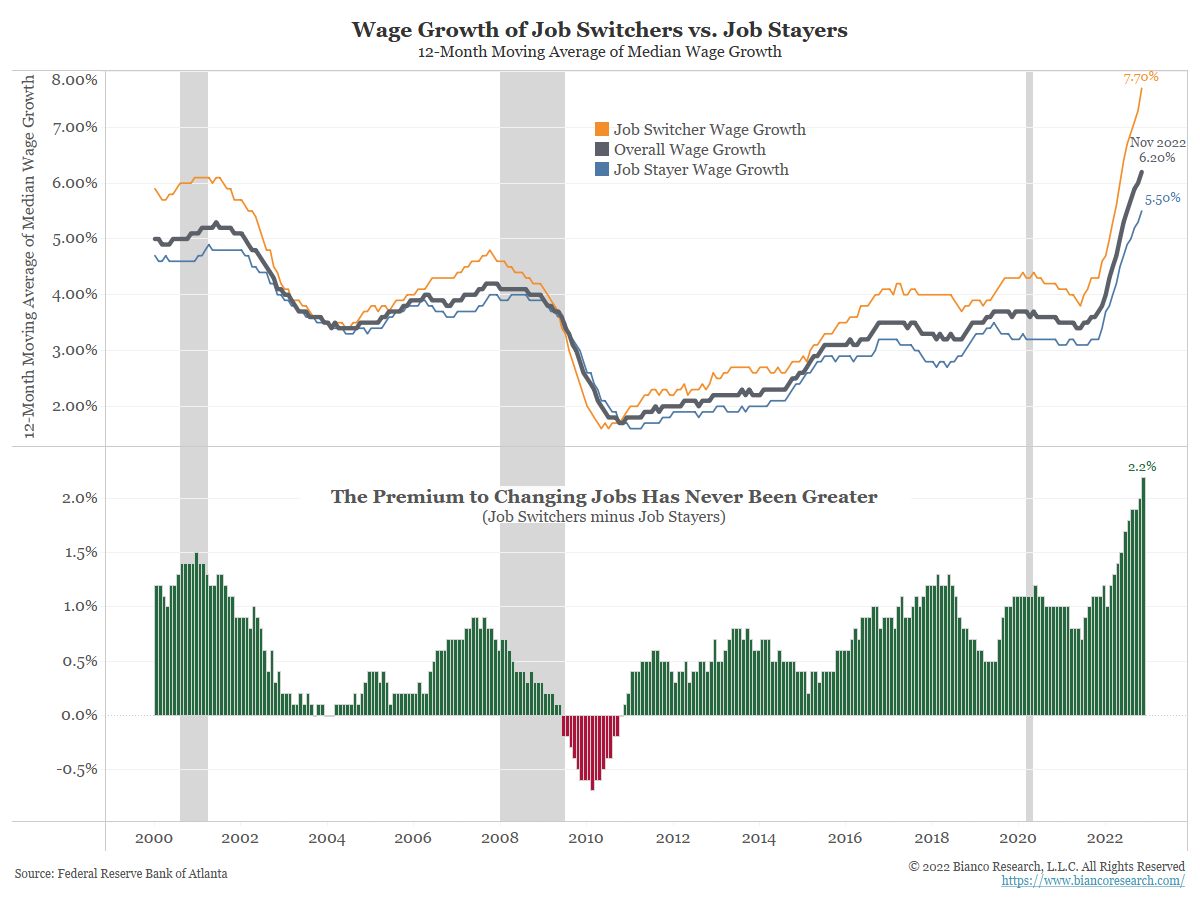

Sticky Wage Growth

On the other hand, we think it will be unlikely that the Fed will pivot to easier monetary policy until it is convinced that the Fed Funds rate is positive in real terms (point we just made) and also that the labor market is cooling.

We’ve pointed consistently to the job stayer vs job switcher wage growth differential. According to the Wall Street Journal, employees who changed companies, job duties, or occupations saw even greater wage gains of 7.7% in November from a year earlier. The prospect that employees might leave for bigger paychecks is the main reason companies are raising wages for existing employees. This is likely to continue the spiral of higher wages as companies can’t afford to lose talent and pay up for them. All in all, even after higher wages, employees are still losing in real terms as inflation is eating away at their “raise”.

Source: Bianco. As of 12/31/22

Source: Bianco. As of 12/31/22

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

When a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2301-7.