Jim Simons, the mastermind behind Renaissance Technologies, recently passed away at 86. Simons, a brilliant mathematician and former codebreaker, founded Renaissance in 1982 and revolutionized quantitative trading. The firm’s flagship Medallion Fund achieved an astounding average annual return of 40% net over more than three decades.

His contributions to the world of investing are immeasurable, and he will be remembered as a legend who transformed quantitative trading. Simons’ innovative approaches and unprecedented success have left an indelible mark on the financial industry. His passing is a significant loss to the investment community, and he will be sorely missed.

The Medallion Fund’s Phenomenal Returns

The Medallion Fund is often hailed as the greatest moneymaking machine in history. Achieving an almost 40% net annual return (in later years after a 44% performance fee!) over 31 years (1987-2018) is nothing short of extraordinary. To put this into perspective, most hedge funds and mutual funds would be ecstatic to achieve one-third of that return.

That said, Renaissance’s strategy was unique in that it returned profits to investors each year rather than reinvesting them into the fund. But what if I told you that an investor, with a strategy with much lower returns, could potentially achieve even greater results? Let’s delve into the magic of compounding.

Compound Returns vs. Average Returns

Compounding is the process of earning returns on both the original investment and the accumulated returns from previous periods. This concept is fundamental to long-term investing and wealth accumulation. The effect of compounding can turn modest returns into substantial gains over time.

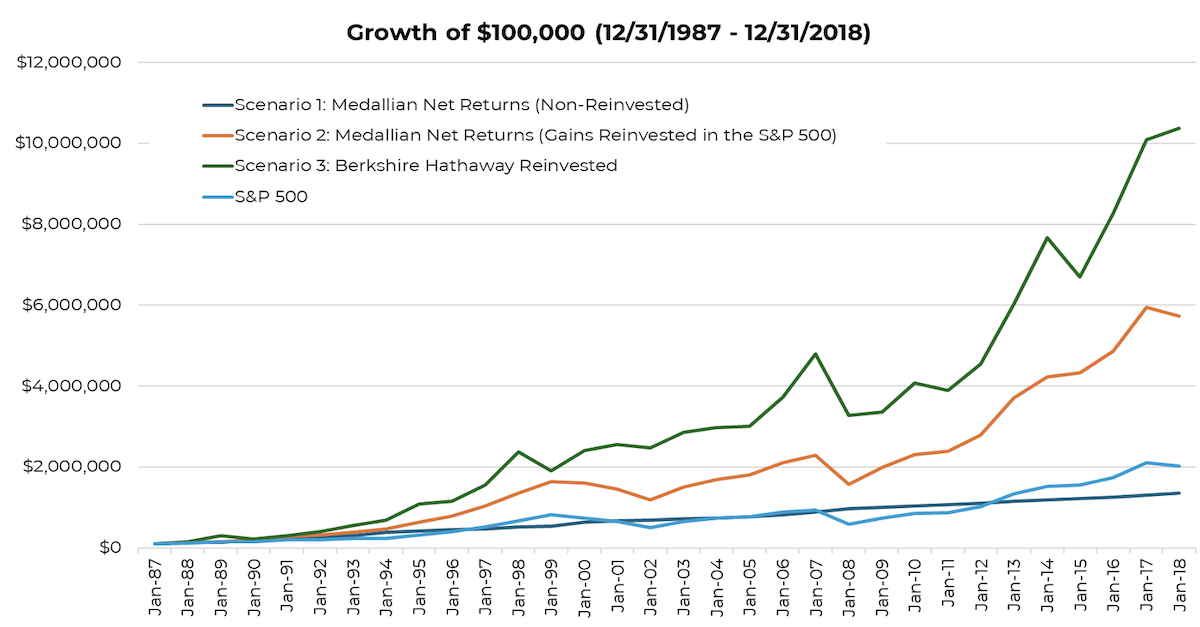

To illustrate the power of compounding, let’s compare three investment scenarios.

Scenario 1: Renaissance Returns with No Compounding

Suppose you invested $100,000 in the Medallion Fund at inception at the start of 1988, but the profits were distributed each year without reinvestment. Over 31 years, you would receive (on average) ~$41,000 in profits each year, totaling a bit more than $1.2 million in profits by the end of the period. In this scenario, your original $100,000 investment remains unchanged.

Scenario 2: Renaissance Returns with Gains Swept to US Equities

In reality, an investor has the opportunity to redeploy the capital (i.e. the $40,000 coupon) into something like equities. Over that 31-year period, the S&P 500 compounded at a much lower (but not so bad) return of 10.18% annualized, thus an investor starting with $100,000 in the Medallion Fund that swept the returns into the S&P 500 would have ended up with a whopping $5.7 million (compared to just $2 million if invested solely in the S&P 500).

Scenario 3: 16.15% Annual Return, Compounded

Now, consider an investment that returns 16.15% annualized with returns generated that can be reinvested—which just happens to be what Berkshire Hathaway returned over the same time frame—with all profits reinvested each year. Using the formula for compound interest, A = P (1+r)n, where:

- P is the principal amount,

- r is the annual interest rate, and

- n is the number of years

The investment would grow as follows:

A = 100,000(1 + 16.15%)^{30} = $10.4 million

The stark difference between these three scenarios highlights the profound impact of compounding. Even with a substantially lower annual return, the compounded investment significantly outperforms the higher, non-compounded return of 40%. If we were to include the tax impact on the annual distributions, the gap would be markedly higher.

Source: Aptus via Morningstar Data

Source: Aptus via Morningstar Data

The Takeaway

While the extraordinary success of Renaissance Technologies is a testament to their trading prowess, the opportunity for everyday investors to earn compounded returns is incredibly powerful. Our focus should be not on the headline annual returns but on the ability to compound those returns over the long haul, as even modest annual returns can lead to significant wealth accumulation over time.

Leaning on growth assets to (tax-efficiently) work their magic sets a high bar vs. strategies that fail to reinvest their gains. As the years pass, even the most attractive yield payouts will fall short of investments that can snowball year after year. There’s a reason compounding has been referred to as the “8th wonder of the world.”

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2405-15.