As we put a wrap on another tax season, can we reflect? Savings and retirement Income planning, which are really at the core of every financial plan, tend to always have taxation as the common consideration.

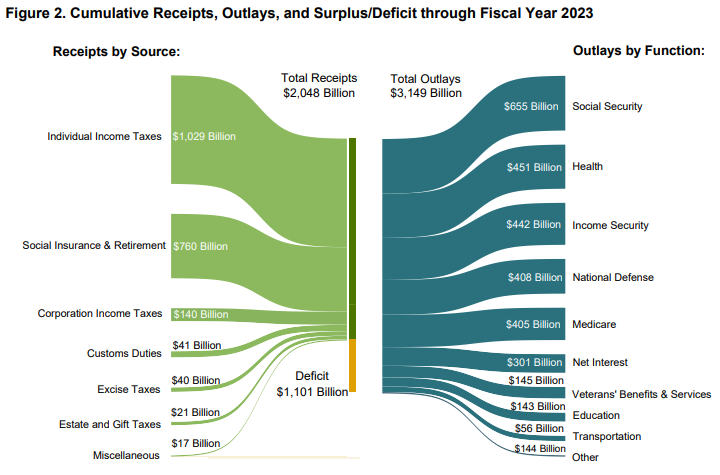

We naturally want to pay the minimal amount of taxes today. As our income increases, the amount we pay in taxes becomes more and more apparent and for most, painful. Especially as you start to understand where our tax dollars are going or nowhere to be found in the case of the defense department.

Source: US Treasury Monthly Report as of March 2023

Source: US Treasury Monthly Report as of March 2023

Regardless of where your values lie in government decisions, taxes are a certainty in life. Death and Taxes as they say. The strategic decisions you make on the tax side make more and more of an impact to your long-term plan as your net worth and income increase.

Today, let’s discuss a few strategic tax considerations that we believe will make an impact to your ability to compound over the long run.

Property Taxes

Although property taxes vary state by state, they typically are a big tax bill each year. If you have kept up with your county appraisals over the last few years, the appraised or taxed value has skyrocketed given the moves in real estate. Regardless how great it might feel to have the government tell you your property is worth way more than you paid, please do not just settle with their conclusion. Protest it. They may ask you to come in and make a case, but occasionally everything is handled online.

Another consideration is paying your property taxes for two years in one calendar year. Usually you have between December and February to pay your property tax bill. Given that most people lean on the standard deduction when filing taxes, there may be a chance to itemize if you pay your property taxes in the same calendar year.

Capital Gains/Losses

If you have a taxable brokerage account, you are probably familiar with dividends and other transactions which each year impact your taxes. Given the recent volatility in markets, harvesting losses can help reduce your tax liability. Although you are limited to $3,000 per year, if you had a larger loss, those dollars can carry over to the next tax year. Be aware of the wash rule when taking any losses, you must avoid repurchasing an equivalent security for 30 days.

As painful as it may be, taking gains is not a bad thing either. Minimizing tax liability is one thing, managing your risk to align with your plan is important too. Do your best to not let taxes be the ultimate decider if you sell a security. It is better to pay taxes on gains than just lose your money. Although your profit is less, you actual win in this scenario.

Roth vs. Traditional

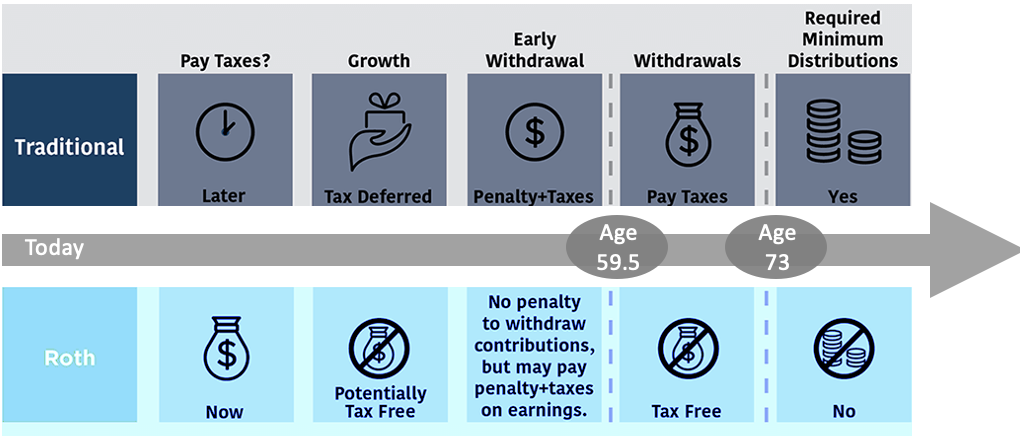

A common consideration we run into is saving in Roth vehicles such as Roth IRA or Roth 401k vs. traditional IRA or 401k. One gives the ability to reduce taxes paid today as it would be a deduction and the other (Roth) you pay taxes today to avoid taxes on gains later.

Source: Hills Bank March 2023

Source: Hills Bank March 2023

Both a Roth and Traditional are tax deferred, meaning no taxes on gains/losses as you accumulate. You receive a deduction today if you contribute to Traditional IRAs or 401ks. No deduction with your Roth. The big difference is when you retire, Roth funds are tax free (contributions and any gains) while traditional vehicles are fully taxed at ordinary income.

This may not seem like a big difference on the surface, in both scenarios you pay taxes on your income. There is no way around that. If you contribute 100k and that money compounds at 7% over a 30-year period with no additional contributions, your ending balance is $761,225.50. This return stream is not reality, but bear with me. You have ~660k in gains. In your traditional accounts the full amount will be taxed. Roth IRA you pay taxes on the 100k today and nothing more.

The impact of paying taxes today can ultimately be the biggest trick to compound capital and give your plan the flexibility it needs. If you exceed the limits to contribute to a Roth IRA, your employer may have a Roth 401k option, or you could consider a backdoor Roth conversion. Ultimately the time you have to accumulate matters in addition to your income bracket now vs. what is anticipated for retirement. The more time you have, the more favorable the Roth can be for your tax management.

Conclusion

Think of taxes as debt on your balance sheet. Whether it is in the calendar year and you understand there will be taxes owed when you file or longer term when you retire. A prudent investor looks for a strong balance sheet when investing in a company. The same principles can translate to your personal balance sheet. Traditional debt management obviously is important, but a future tax liability matters as well.

We didn’t cover everything on taxes today, this is more what we commonly see as opportunities. At the end of the day taxes are no fun, even for accountants. They are here and will unfortunately always be a part of our lives. Control what you can and although it pains me to say it – paying taxes isn’t always bad. Especially if it helps with reducing longer term debts you can avoid.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2304-22.