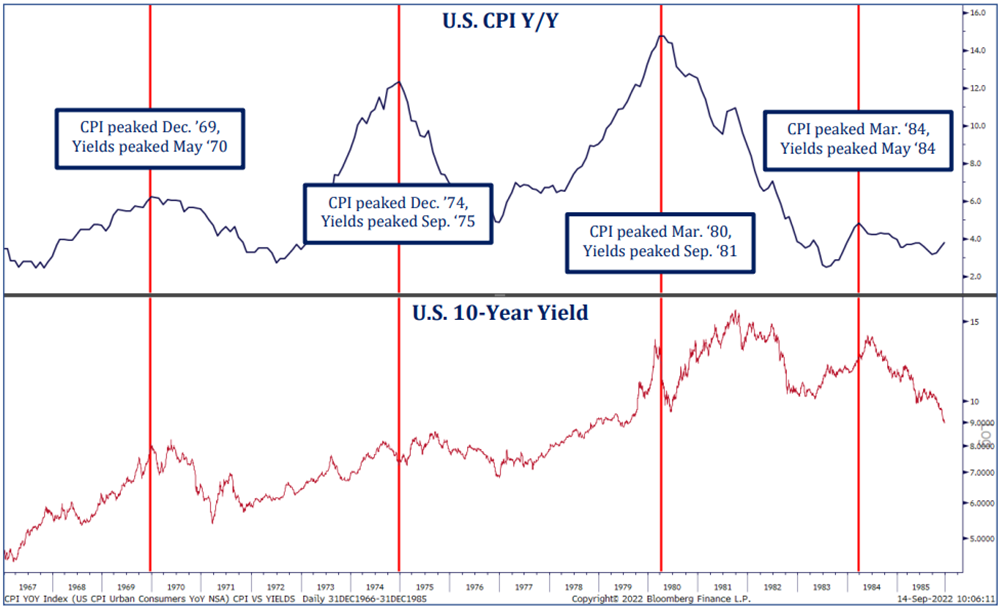

As interest rates continue their hockey stick move higher, we looked back to history for guidance on when we might see peak rates. We discovered a valuable nugget of information: before Volcker, interest rates actually tended to peak after the CPI peaked (often well after). It’s a disorienting revelation for those (like us) that believe the market is often a few steps ahead of the data, but it’s been an important clue for an unusual time. Contrarily, the consensus view has been that bond yields would roll over before the inflation data does (as has generally been the precedent in recent decades). Thus far this has not been the case!

Source: Strategas. As of 9/25/22

Source: Strategas. As of 9/25/22

We think rates will continue to be driven by aggressive central bank rate hikes (i.e., higher). Given the macro backdrop of sticky (but likely peaking) inflation, peak inflation will not directly equate to peak yields as market participants will need to determine whether inflation expectations STAY anchored after the hiking cycle completes sometime in ’23. The Fed says they are committed to avoiding the error of Stop and Go rate policy from the 1970s, however the market will want to “Trust but Verify”.

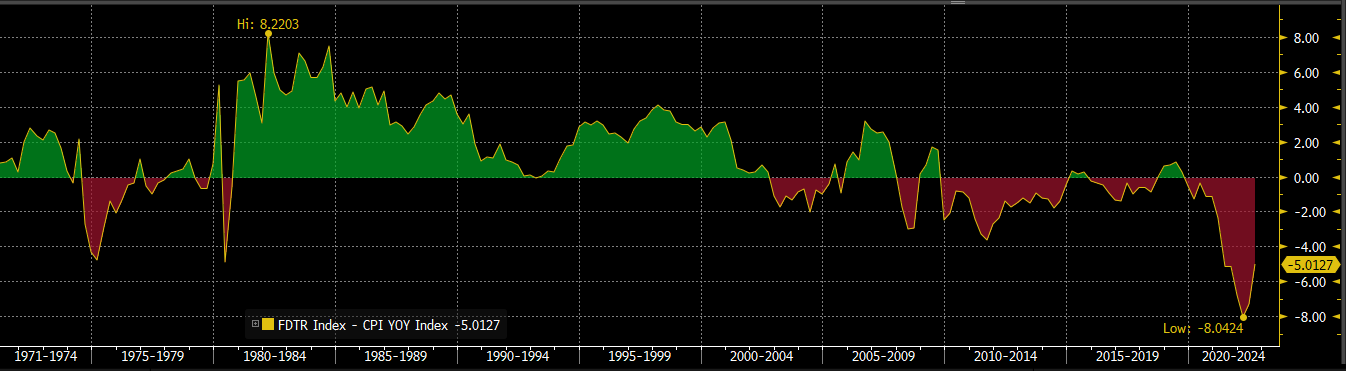

Real Rates Still Deeply Negative (Fed Funds Rates minus CPI)

Real yields are nominal yields minus inflation. Real yields have increased across the curve as the Fed has pushed their Fed Funds Rate higher, and inflation has started to peak and (hopefully) work lower. Real yields have been substantially negative the last decade, as we’ve had low interest rates and substantial central bank intervention (i.e., QE and other easy monetary policy). Real rates are key to (2) things:

- Restricting financial conditions (are real rates position or negative?!)

- Asset valuations

Simply put, negative real rates are still pushing for accommodative policy. The chart below may be stacking the deck, but real rates are still historically low and we believe are still stimulative.

Source: Bloomberg. As of 9/25/22

Source: Bloomberg. As of 9/25/22

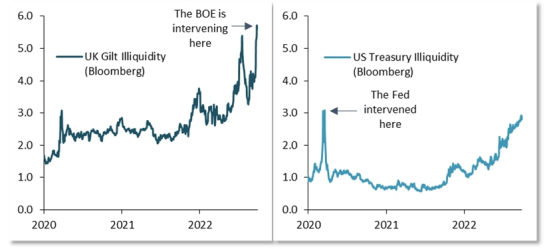

BOE Pivots

Source: PSC. As of 9/28/22

Source: PSC. As of 9/28/22

Today the Bank of England decided to intervene in the local sovereign bond market by temporarily buying up to £5 billion worth of long-dated gilts per operation “to restore orderly market conditions.” It also delayed plans to start quantitative tightening (QT) until the end of October.

The BOE’s intervention is not too surprising – disorderly gilt market action risked destabilizing financial institutions (including pension funds) and the economy, so something needed to be done. Also, the BOE is one of the few central banks with an explicit financial stability objective, and that makes its decision even more understandable.

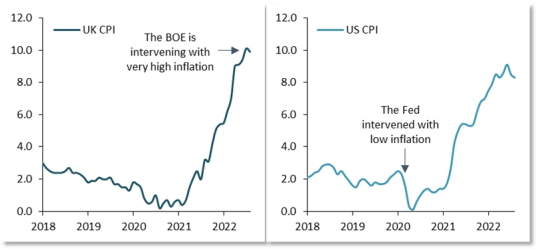

It’s also important to keep in mind that the main objectives of global central banks (including the BOE) these days is to bring inflation down, and that requires monetary tightening. The problem is that, effectively, the BOE today decided to ease policy with one hand (buying bonds) while tightening with the other (raising rates).

Obviously, this is not a sustainable situation. The question arises of whether the US will turn to a similar policy. We think the Fed would intervene if the Treasury market were to become disorderly, but as of now, it’s still functioning properly.

Source: PSC. As of 9/28/22

Source: PSC. As of 9/28/22

Looking back to the Fed’s intervention in 2020, it was at a time where inflation was low and declining rapidly (into the pandemic), and the Fed was already cutting rates; quantitative easing (QE) was a natural extension of those policies. Today, inflation is a lot higher, both in the US and the UK, and asset purchases are far from being a logical policy step.

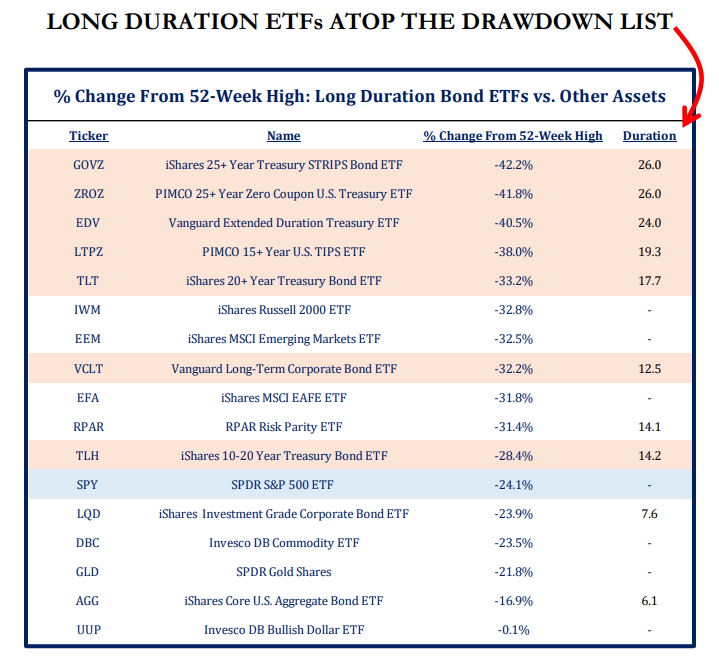

Long Duration Feels The Pain

We’ve often said the move in rates from 0% to 3% would be more painful than the move in rates from 3% to 5%. That isn’t to say there won’t be pain but mathematically, it will be less. Needless to say, long duration assets (specifically fixed income for the sake of this piece) have taken an absolute beating, YTD.

Source: Strategas. As of 9/27/22

Source: Strategas. As of 9/27/22

There has been no correlation benefit to holding bonds vs risk assets (S&P 500) and in reality, long duration bonds have performed even WORSE than their risk asset (stock) brethren.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

The 2 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 2 years.

The 10-2 Treasury Yield Spread is the difference between the 10-year treasury rate and the 2 year treasury rate. A 10-2 treasury spread that approaches 0 signifies a “flattening” yield curve. A negative 10-2 yield spread has historically been viewed as a precursor to a recessionary period.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2209-25.