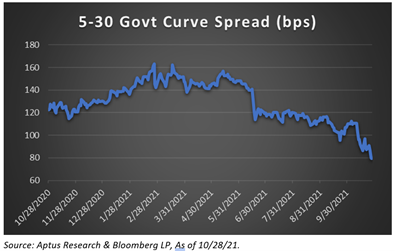

The yield curve had a massive flattening this week. The short end of curve rose sharply while the long end of the curve declined by nearly the same amount. Simply put, the short end of the curve is moving up based on the market’s expectations of an early rate hike while the long end of the curve is moving down based on a Fed policy error. The market has historically used the long end of the yield curve as a data point to measure a market expectation of how high the Fed can realistically hike rates (this is called the neutral rate). The uncertainty of who will become the next Fed chair is likely exacerbating the yield curve issues, as the market fears without a Powell led Fed, the (vocal) hawkish bunch within the FOMC, that there could be a premature rate hike, negatively impacting the economy.

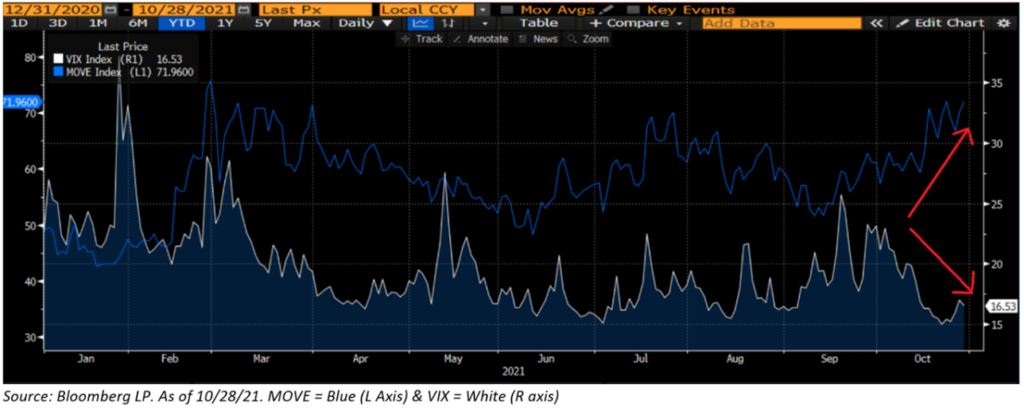

Bond Market Volatility = Typically Bad for Stocks

One thing we’ve observed time after time, it’s that the stock market does NOT like bond market volatility. The chart above shows a rather large divergence happening between the fear gauge of the bond market (MOVE INDEX in Blue) and the fear (or lack thereof) gauge of the equity market (VIX INDEX in white). Fear levels within the equity markets have been rather cavalier as the S&P 500 has melted up nearly 7% thus far in October. On the other hand, the bond market has been in a swing of uncertainty likely due to a multitude of negative headlines: potentially non-transitory inflation, uncertain future Fed Chair leadership, and a general upward pressure on interest rates, specifically the front end of the yield curve.

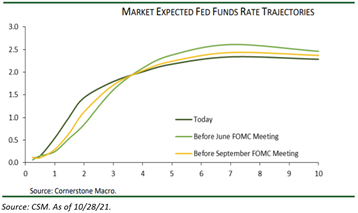

Faster Rates Hikes & a Flatter Curve?

The full ten-year trajectory that the market expects for the funds rate is plotted by the dark green line above using Fed Fund Futures. Since the hawkish June FOMC meeting and the even more hawkish September meeting, the market has started pricing in the expectations for two early rate hikes, i.e., in 2022, and consequently brought down expectations of the neutral rate, creating a flattening curve.

While we don’t view the curve flattening as indicative of a near term recession, we do believe the market is pricing in a Fed Policy error. The market has (3) questions in the face of higher for longer inflation and the future direction of policy given the uncertainty of Fed leadership.

- Will the Fed backtrack on their newly implemented flexible average inflation targeting (“FAIT”) policy?

- Will rate hikes solve inflation caused from a disastrous supply-chain problem?

- Once rate hikes are implemented, and they take their time to work through the system, will we come to find out that the rate hikes were done prematurely (a.k.a. we begin to see inflation abate with supply chain constraints and realize the hikes were counterproductive to our economy.

We believe most of these fears would subside in the event of a Powell renomination.

To Sum it All Up

We’ve gotten a slew of news from outside of the U.S. where Central Banks are cutting back on liquidity programs, think Quantitative Easing, and starting to hike interest rates – some rather aggressively. The main difference we see is in each Central Bank’s tolerance levels is for inflation (whether it’s ultimately good or not, ours tends to be higher). These global hikes likely encourage the “Hawkish” FOMC members, whom are often are the loudest, to speak out on the needs to get ahead of the inflation curve here in the states. Given their vocalism, it’s important to remember that none of the Hawks are in a leadership position.

The current Fed leadership is adamantly in the camp for both inflation being transitory and not hiking rates until the labor market recovers back closer to pre-Covid levels… we are very FAR from that. Given the fact that our freshly minted inflation targeting policy (“FAIT”) is somewhat vague, it opens the door for different interpretations regarding execution. This drives the importance of understanding the leadership within the organization and knowing it immediately.

While a new Fed chair would likely lean Dovish (Democrats tend to lean dovish), we believe they will have a more difficult time communicating and controlling some of the Hawkish members. In addition, Powell has shown the ability to work with both parties and we believe a new nomination showing political favoritism won’t be accepted by the market (relatively even spilt congress). As of now, the market appears to be pricing in a relatively high likelihood of a new Fed chair and in turn a mid ’22 rate hike.

We’ll just have to wait to see how this plays out…

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2110-17.