As of May 14th, 91% of the S&P 500 have reported earnings (440 companies). The first quarter of 2021 saw S&P 500 earnings at $48.21, besting Wall Street expectations by 21% – this is the biggest beat in recent memory. Not only that, but Investors have seen earnings grow +57% YoY and +23% from its Pre-COVID high in 2019. H/t egregious fiscal spending.

A common theme on the earnings calls were that earnings visibility is substantially improving, with the number of guidance instances in April hitting the highest level for April since 2015, with nearly 3x more guidance instances YoY. Moreover, we have witnessed corporate sentiment and business conditions continue to reach new record levels.

We would argue that inflation is the biggest topic this earnings season. Mentions of “inflation” have jumped nearly 800% YoY. The number of mentions has historically led CPI by a quarter with 57% correlation and points to higher inflation ahead. At a sector level, “inflation” was most prevalent in Materials, Consumers and Industrials companies.

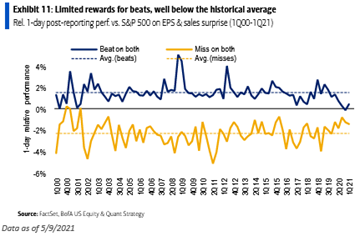

Despite the strong beats, we believe investors were largely unenthused, similar to last quarter when we saw negative alpha for beats for the first time since the Tech Bubble. So far, companies that beat on both sales & EPS have outperformed the S&P 500 by just 41bp the next day, well below the historical average of +151bp, indicating that the bar is high.

Overall, we are very happy with how our HNW holdings executed during the quarter. Keeping with the inflation theme, we believe that our compounder mentality should really bode well for companies trying to navigate the inflationary environment, as many of these companies have pricing power and inelasticity amongst the services that they provide. Thus, able to pass on a lot of the cost-push inflation to its customers.

Go here for the fully detailed reports on each stock

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The actual characteristics with respect to any particular client account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Aptus Capital Advisors, Inc. reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Forward looking statements cannot be guaranteed. This is not a recommendation to buy or sell a particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 11.2 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 4.6 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2105-9