It’s not often that earnings season takes a back seat to other global events, but that was the case in Q3 2020 as the US election, increasing COVID-19 cases, a potential vaccine, and fiscal stimulus have been sucking up all the oxygen in the room recently. But let’s talk about what happened with this noisy quarter.

Let’s dive into the following two items:

- How Were Earnings This Past Quarter?

- What Did the Market Think About These Earnings?

How Were Earnings This Past Quarter?

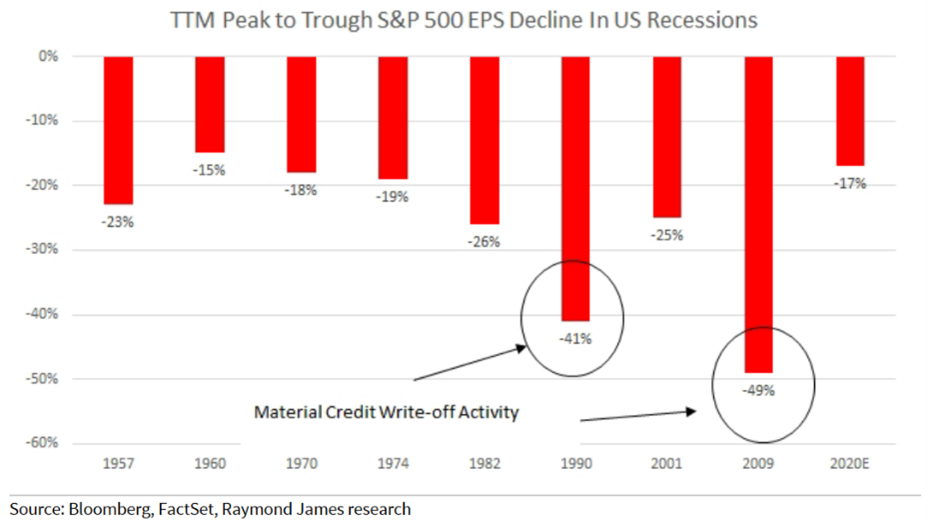

This quarter showed a continuance of a strong earnings recovery. With Q3 earnings season virtually wrapped up at this point, the consensus 2020 S&P 500 EPS is now at ~$137, up from $131 in early October, and down only 15% YoY. This peak-to-trough in annual earnings decline would make it the mildest recession from an earnings standpoint since 1960!

This has obviously been aided by unprecedented amounts of monetary/fiscal support, which we estimate has boosted EPS by ~30%. It remains uncertain how long this open water spigot will continue, but we believe the market is clearly making the bet that at least another round of fiscal support is likely, making a return to previous large cap EPS levels of $162 much more likely in 2021.

Moving down the market cap spectrum. The Russell 2000 consensus 2020 EPS has increased ~25% from $52 to $65, though still down ~50% YoY.

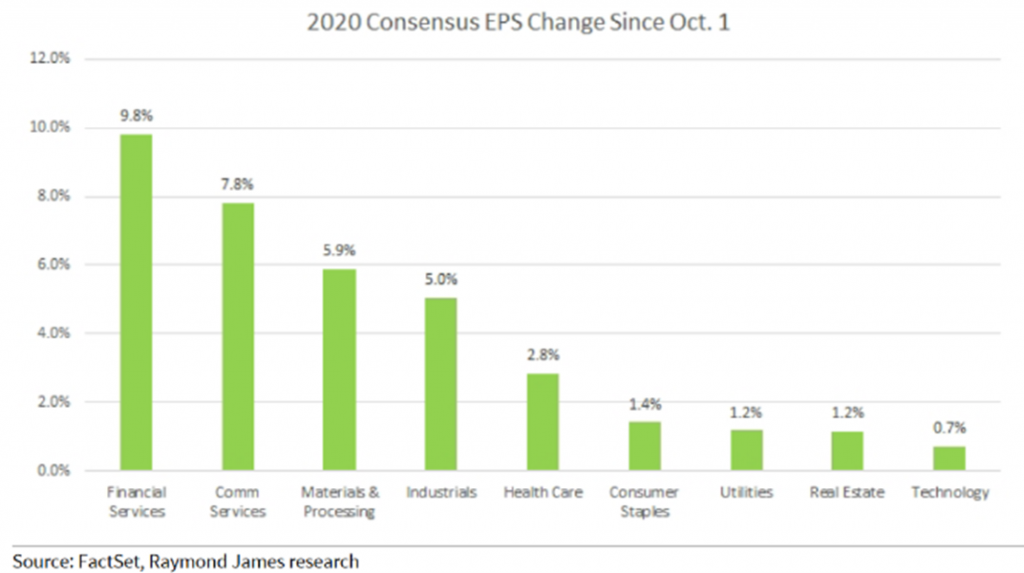

From a sector perspective, financials (mortgage, better credit trends), industrials/materials (industrial economy expanding rapidly), and communication services (ad spending recovering quicker than expected) have all seen 2020 consensus EPS expectations increase by 5-10% during Q3, but every sector has seen EPS expectations move higher since October.

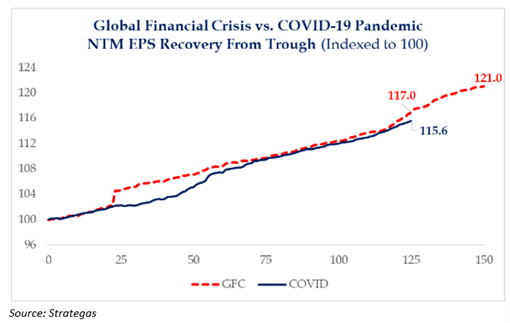

The concerning part of this information for us is that the pace of the earnings recovery has started to slow relative to the Financial Crisis – obviously not an apples-to-apples comparison, but similar given the extensive amount of fiscal and monetary support. We believe it is notable that the NTM(Next 12 Months) EPS recovery is beginning to fall behind the recovery seen during the financial crisis. While it could very well change in the next couple of weeks, more stimulus is likely necessary to keep the recovery going.

What did the market think about these earnings?

As we mentioned before, this quarter’s earnings took a back seat to a slew of events that occurred or continue to remain an overhang over the last month.

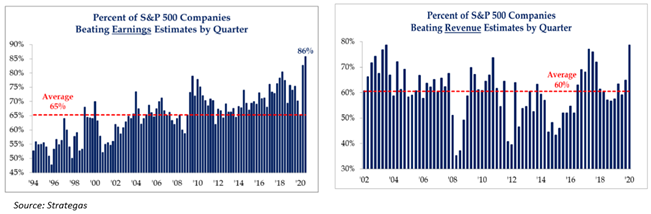

During the quarter, within large caps, 86% of companies beat analyst’s earnings expectations and 79% beat revenue estimates – both well above their historical averages over the last fifteen years. This, on initial glance looks very bullish, as companies are doing much better than anticipated. But, from our perspective the truth is that expectations were just so low as analysts did not have a clue on how to forecast this extraordinary environment.

Unfortunately for the companies that participated in this record-breaking earnings season, the market did not recognize their success – nor did it reward it. For those stocks that beat expectations on the bottom-line (earnings), only outperformed the market by 2.1% one-day after the report date, and by 2.5% over the next five days. To compare, the long-term averages stand at 3.2% and 3.6%, respectively.

Bottom-line, we are much further than we could have ever imagined we would be just seven months ago. As we’ve seen, in our opinion, earnings have been very strong, potentially signaling a “v-shaped” recovery – which is absolutely amazing, but what we think investors need to take away from the past few quarters is the resiliency of corporate America in the face of a global pandemic. Don’t bet against America.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2011-25.