When investors evaluate fixed income strategies, the first question is usually about yield. What’s the income? What’s the payout? That focus is understandable. Yield is easy to measure, and there’s a certain comfort in seeing income show up regularly.

But in taxable accounts, that perspective can be misleading. What ultimately matters isn’t the size of the coupon. It’s how much return you actually keep, and how much control you have over when taxes are paid.

Let’s look at three common paths in fixed income to illustrate why structure and timing make such a difference in outcomes.

Three Paths, Three Very Different Outcomes

Let’s walk through three examples to highlight how the structure of returns impacts what you actually take home.

First, municipal bonds. They offer tax-exempt income. If you earn 3.5%, you keep 3.5%. That simplicity has made them a staple for high-income investors. But the tradeoff is relatively low absolute returns, especially in today’s tight-spread environment.

Now,take traditional taxable bond funds. These might offer a 4.8% yield, but that’s before taxes. At a 33% marginal rate, that return drops to just 3.2% after tax. Worse, taxes are paid annually, which interrupts the compounding process and drags on long-term results.

Now consider a strategy that generates the same 4.8% return but defers gains for 10 years, taxing them at a 20% long-term capital gains rate. The after-tax return rises to 4.0% as each dollar compounds at 4.8% for 10 years before taxes are paid. If the gains are deferred for 20 years, the after-tax return improves to 4.2%. This ability to delay taxes and pay them at a lower rate enhances long-term compounding in a meaningful way.

What You Keep Matters More Than What You Earn

Here’s the kicker: to match the 4.0% post-tax return in the deferred example above using traditional taxable bonds, you’d need a 6% return / yield. That’s because every dollar earned is taxed annually at a higher rate, making it harder to reach the same result.

For investors who are reinvesting income rather than living off it, the structure of the return can be more important than the size of the yield.

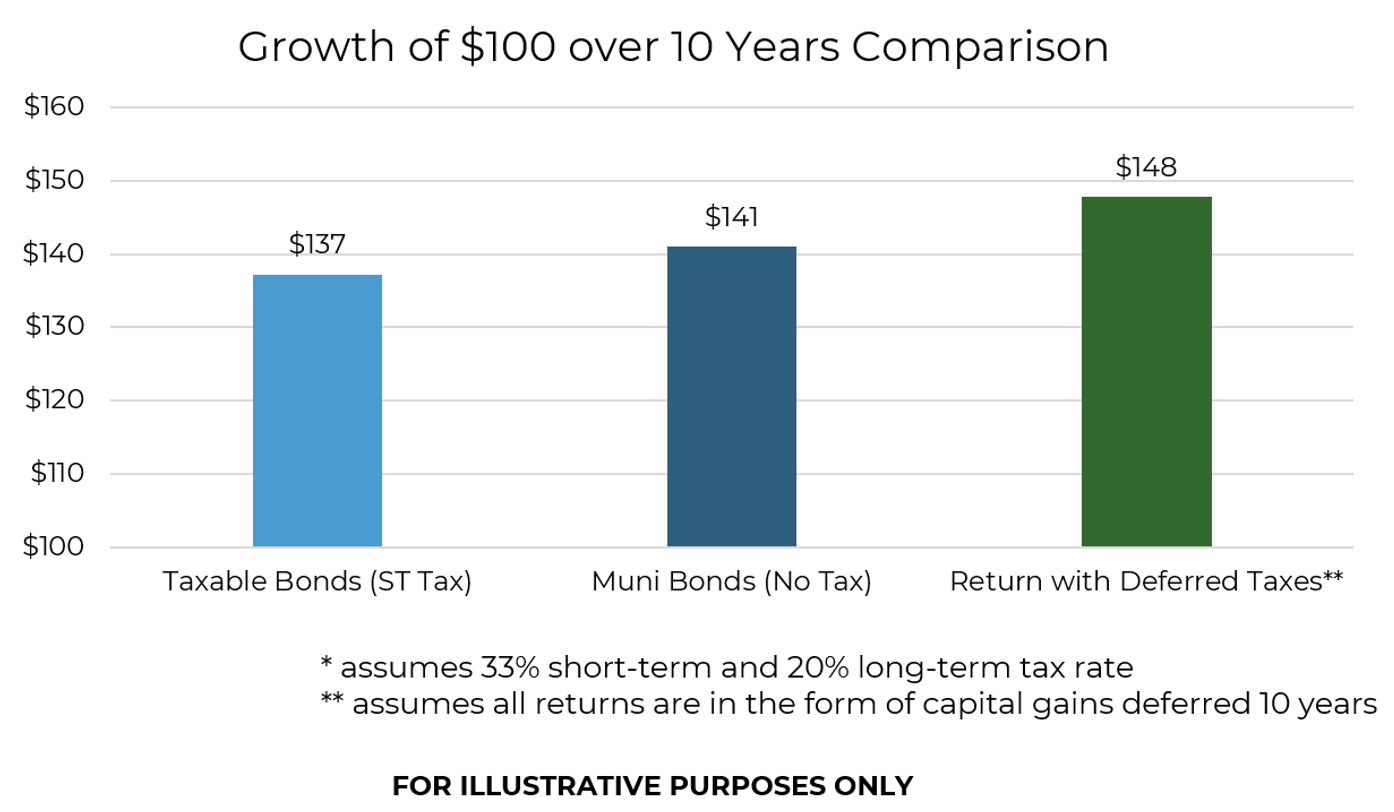

Below is a chart highlighting that an investor who receives 4.8% / year taxed at a 33% short-term rate would compound their wealth to significantly less money than an investor who receives the same 4.8% return deferred for 10 years.

And that difference grows over longer periods.

A Shift in Asset Location Strategy

An investment approach that focuses on total return while limiting taxable distributions also opens the door for better portfolio construction across taxable and tax-advantaged accounts. Today, many advisors face a tradeoff:

-

- Hold fixed income in taxable accounts and lose return to taxes, or

- Place it in IRAs and Roth accounts, sacrificing those valuable slots for investments with likely lower return potential than equities

But if a stable allocation typically used for traditional, tax-inefficient fixed income can be structured in a way that defers income payouts and taxes to improve after-tax return, it becomes more viable in taxable accounts. That frees up space in IRAs and Roths to hold higher-growth assets like equities, potentially enhancing overall wealth accumulation without increasing risk.

That’s why investors should look beyond the size of the coupon and think instead about how, and when, those returns are realized. The desire for yield often stems from the sense of certainty it provides, but many investors aren’t living off their bond income. They’re reinvesting it. And if that’s the case, capturing returns through appreciation instead of income offers a better path.

Tax Timing = Control = Opportunity

When returns come in the form of income, taxes are due whether you need the cash or not. But when returns are embedded in price appreciation, you gain control. You decide when to realize gains, whether to offset them with losses, and potentially how much tax to pay. That kind of flexibility is difficult to find in traditional fixed income strategies.

If you’re going to earn a return either way, would you rather have it taxed every year, or let it grow uninterrupted and pay tax only when it makes the most sense for you?

The Bottom Line

In today’s environment of compressed spreads and rising tax awareness, it’s not just about how much income your bond portfolio generates. It’s about how efficiently you earn your return. Deferring gains isn’t a trick. It’s a smarter way to compound wealth, reduce drag, and give investors greater control over outcomes.

Disclosures

Past performance is not indicative of future results. This material is not financial or tax advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed and all calculations may change due to changes in facts and circumstances.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2505-17.