The Volatility Tax

Almost 2 years ago to the day, we published this piece: Reducing the Volatility Tax.

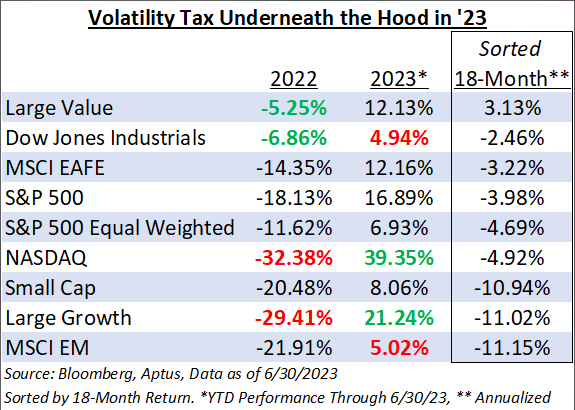

We thought revisiting this concept was timely given the last 18 months. Look at the table below and the returns of each segment of stocks during 2022, the year-to-date numbers in 2023, and the annualized returns. The last year and a half really drives home our point.

Client Outcomes

Compound returns are what determine client outcomes. Maximizing compounded returns is a singular objective that arguably encompasses all other investment objectives. It’s the one thing that all investors are trying to solve for. How can I generate sufficient compounded returns to maintain my lifestyle or better yet, improve it for those that come behind me?

Given this importance, let’s think a little harder on the table above. Keep in mind, I recognize that 18 months is not ‘long term’. But the difference between 2022 and 2023 is so stark, and a live reminder of the concept.

The Nasdaq has been the shining star of the recent past, it’s up nearly 40% year-to-date in 2023. Its annualized return over the past 18 months is still a negative -4.92%.

Compare that to the Large Value Category (as measured by the S&P 500 Value Index). It’s up only 12.13% for 2023, but its annualized compounded return over the same 18 months is a positive 3.13%.

The numbers for the Large Value Category are better because of the downside, not the upside. Sure, 12.13% is a solid 6-month return, but it’s a far cry from nearly 40%! The separation occurred because a minus 5% generates less friction towards the goal of compounding than a minus 32%. This is not a recommendation of different stock categories, it’s simply a real-world example that large losses eat Into compounding. Compounded returns are the name of the game, and the means to play the game is your capital. Protect it.

The Good News, The Basics of Time and Return

Investors seem to underestimate their time horizon and overestimate the return required to compound (grow) their wealth at a rate that sustains their current lifestyle…if not improve It. This is good news.

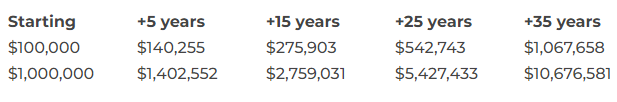

For example: the 60-year-old that wants to retire in 2 years and thinks that is her horizon. It’s not, it’s much longer. Compounding capital at 7% a year does not sound all that exciting. 7% combined with time is a compelling combination.

The table illustrates the growth of both $100k and $1mil over different time periods as it compounds at 7% with no additional savings:

We work with the lifeblood of financial services. With advisors serving families that have worked hard to accumulate assets and need those assets to work for them. Most investment objectives are based on life goals, not benchmarks.

Those objectives do not require massive rates of compounded return.

Portfolio Updates

Rather than building portfolios with the hope of negative correlation between stocks and bonds to save the day, our focus is on using volatility to create optionality. “Better in the tails” is the mantra, and using volatility as an asset class is the path of execution.

We are using strategies to position based on the windshield and not the rearview. We will continue to try and build towards more equities and less bonds, relative to more traditional approaches. We believe that allocation shift solves many problems over the long term, and is better positioned for more attractive compounded returns. We will look for ways to enhance the yield of portfolios, and protect against events that create the volatility tax that’s the focus of this note.

We’re planning for changes to allocations in the coming weeks, and will share those details soon.

As always, thank you for your trust and please don’t hesitate to reach out.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

When a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2306-8.