The NCAA Tournament is not just an annual highlight of American sports betting—err, culture—but also a prime lesson in decision-making amidst uncertainty. And no, writing this is not just clever justification on my part to delve into bracket strategy while pretending to do my job as an investment strategist. It’s about doing what’s best for our clients by improving the expected return on their hard-earned NCAA bracket entries.

The Power of Probability

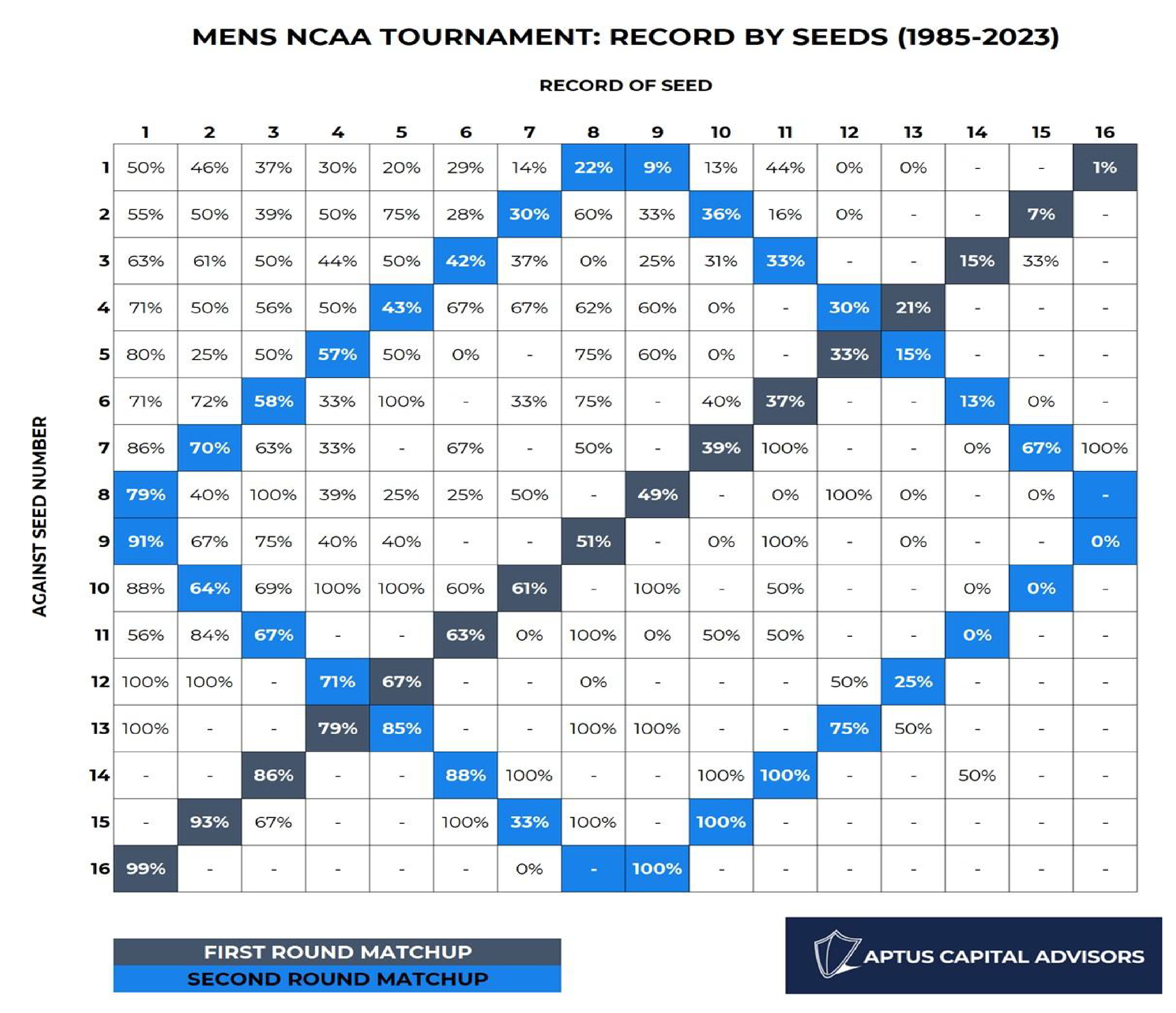

Seeding in the NCAA Tournament is the selection committee’s way of ranking teams based on in-season performance and competition. The following table summarizes NCAA tournament results from 1985 to 2023 to show each seed’s record when playing other seeds. We can see the committee has done a much better job than Sports Radio would have you believe, with top-seeded teams generally boasting much higher winning percentages, particularly in the early rounds.

Source: Aptus as of 03.18.2024

Source: Aptus as of 03.18.2024

So Just Take the Higher Seed? Absolutely Not

In the realm of NCAA brackets, the favored, higher-seeded teams—or in investment terms, the high-quality stocks (see what I did there) —often perform well. Simply choosing these favorites can place you decently in your pool and save you from embarrassment. However, unlike investing, we don’t just want to do well, we want to WIN. In this case, we need to differentiate our pick and embrace risk by making unconventional picks backed by our savvy insights.

Embracing Uncertainty

Upsets are a given in the tournament… our own JG almost willed his team to one way back when.

The same surprises hold up in investing. However, by making well-informed decisions with our handy table as a guide, rooted in historical performance, we can tilt the odds in our favor. The NCAA Tournament, with its unpredictability and excitement, serves as a metaphor for understanding risk, and probability, and improving the likelihood of achieving our desired outcome.

Bragging rights if and when Saint Mary’s takes home the title.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2403-25.