The Federal Reserve cut interest rates as expected by a quarter point, to a stated range of 4.0-4.25%. This marks 125 bps in reductions since initiating the cutting cycle last September, but was the first cut since December. The long pause was in response to fears of inflation stemming from the tariffs imposed earlier in the year. Governor Stephen Miran (the newest Fed member) was the only dissent, favoring cutting 50bps today.

In its statement, the Fed noted that downside risks to employment have risen. The economic assessment kicked off similarly to July’s, noting the first half economic slowdown. The Fed acknowledged slower job growth and “the unemployment rate has edged up but remains low.” Then, “Inflation has moved up, and remains somewhat elevated.”

While this sounds like a balanced assessment, the statement goes on to say, “downside risks to employment have risen.” In that light, participants appear just a little more comfortable with easing, both a little sooner and a little further than they were in June.

Labor Market Risks

During the press conference, Powell did his best to project a degree of confidence about the outlook, calling this a “risk management” move, rather than sounding the alarm on labor market weakness. There has been a notable shift from tariff-driven inflation worries to a central bank that is laser-focused on the employment side of its mandate (where “downside risks have increased”), and more worried that the economy is slowing.

Ultimately, while tariffs haven’t raised inflation as much as many expected, they are likely squeezing margins – particularly among small businesses. If profits come under too much pressure, companies might look at trimming their workforce, kicking off a reflexive process that is now at the forefront of officials’ minds.

Updated DOT Plot

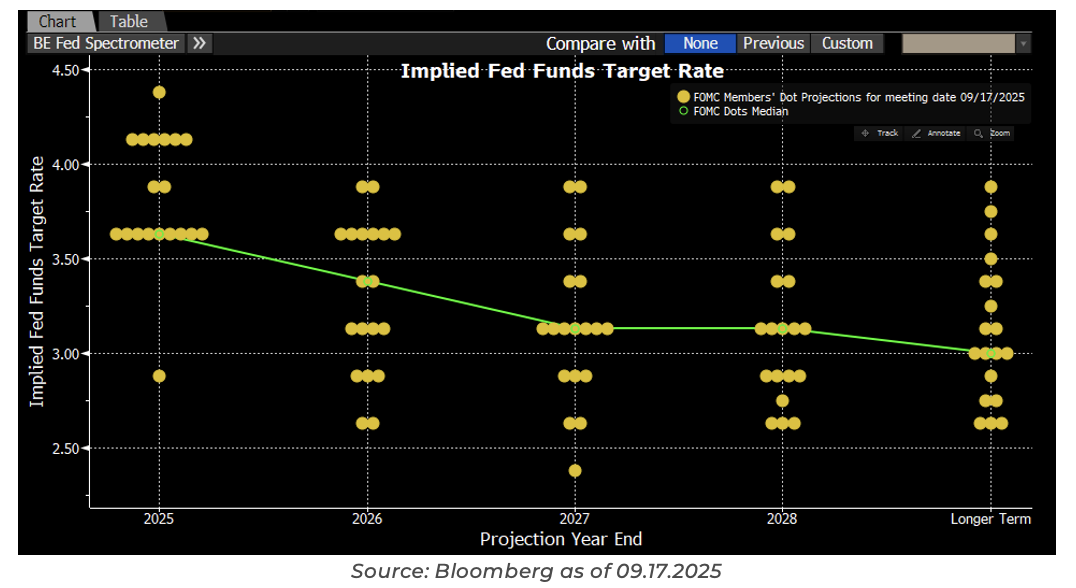

The new dot plot suggests two additional 25 bps cuts this year, which would require a cut at each of the remaining meetings (October & December). The median is 25 bps lower than in June, and the big cluster at that level suggests widespread support within the committee. The 2025 low dot, 125 bps below the current fed funds range, is undoubtedly Governor Miran’s.

The medians suggest two more cuts this year, one cut next year, and one in 2027, leaving rates 100 bps below their current level, at 3.0%-3.25% when the FOMC finishes normalizing rates. We agree that 1% above inflation (assuming it’s 2%) is probably a good target for the long-term neutral rate.

In the rest of the Fed’s new Summary of Economic Projections (SEP), the GDP forecast is a bit stronger through the forecast period, the unemployment rate little changed, and the inflation forecast unchanged this year, a little higher in 2026, and unchanged in 2027.

Inflation Thoughts

Inflation is expected to return to the Fed’s 2% target in 2028. Inflation has remained over the Fed’s 2% target for 53 months. If the projection on inflation proves correct, it will mean the Fed will have missed their target for over 80 months. We’d argue that at some point, the Fed’s commitment to the 2% inflation mandate will begin to lose credibility, as they perpetually say they will meet mandate in two years while continuing to not deliver.

Bottom Line

Recent cooling in the labor market pushed the Fed to lower interest rates for the first time since December 2024. Inflation does indeed remain elevated, but risks have shifted to the employment mandate. The bulk of the committee appears to be on/near the same page in anticipating two more rate cuts in 2025.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2509-18.