As we see another fed fund’s hike of 75bps this week, we thought it would be worthwhile to simply talk about the basics of inflation. It is very easy to get caught in the storm of negative headlines. Today, let’s just get back to the basics and try to focus on factors within our control to support your goals.

What is inflation?

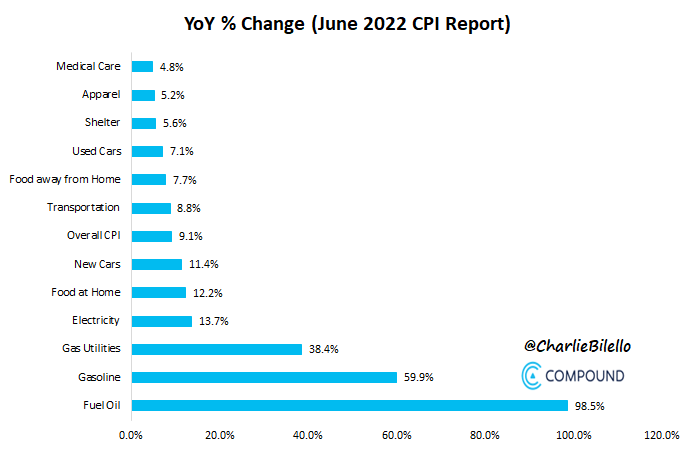

Inflation is a rise in the overall level of prices for goods and services consumed by households. The different areas of inflation are typically what matter most to you the consumer, as each family consumes and spends in different ways. As we sit today, the headline consumer price index or CPI increased 9.1% from the prior year in June of 2022. The CPI is the broad measure of goods and services related to cost of living. If you exclude food and energy, also known as core CPI, the number rose 5.9%.

Source: compoundadvisors.com as of June 2022

Source: compoundadvisors.com as of June 2022

Although 9% seems scary on paper, it is important to understand where the increase in prices is coming from as illustrated above. During a “normal” environment we all understand that price change is part of our life. As a general rule, when the economy is healthy, a moderate lower single digit inflation rate is to be expected. Don’t think of inflation in terms of higher prices for just one item or service. Inflation refers to the broad increase in prices across a full sector or industry such as energy.

Historically speaking, the inflation rate in the U.S. has averaged 3.22% per year over the past 100 years. Prices surged after World War II ended. In 1947 inflation jumped over 20%. In the 1970s, the United States experienced its longest stretch of heightened inflation because of two surges in oil prices. On the other hand, we have experienced deflation in the wake of the Great depression and the 2008-2009 financial crisis.

What causes inflation?

A supply and demand imbalance would be the most succinct way to describe the cause. To break it down in more detail, there are two main drivers of inflation:

- Demand-Pull Effect: When there is an increase in the supply of credit and money, this in turn stimulates the overall demand for goods and services. If that demand increases more than the economy’s production capacity, demand exceeds supply which leads to higher prices. In layman’s terms: a shift in demand where supply cannot catch up.

- Cost-Push Effect: This occurs when production costs increase for certain goods and the producers pass any increased costs to the consumers. So, to the contrary of demand-pull, cost-push inflation is determined by supply side factors. Causes would include rising oil prices, wages, taxes, imports, & food. In 1973 OPEC restricted production, which then caused oil prices to jump up 400%. This then caused industries who were oil dependent to see massive increases in production costs.

Why should you care?

The principal of your hard-earned money not functioning as best as it can is a tough pill to swallow. The million dollars you needed as your retirement bucket in 10 years, now needs to be 1.2million. Or your goal of buying a mountain house seems harder to achieve as home prices have moved so much higher. Well-attuned investors understand that in order to meet their goals, they must consider inflation’s impact on their plan.

As much as I want to talk about politics and what is right for the economy like Carl at the water cooler – that doesn’t matter. Inflation is systemic and completely outside of our control. The national headline numbers are not as important as what costs are changing the most in your world. Personal spending changes should be much more of your concern here.

Back to the basics

First, the cash flow in your household becomes much more important. Christine Benz of Morningstar created a simple tool to calculate your household CPI, which is certainly a good starting place. When it comes down to it, cash flow or budget planning in an inflationary environment is more important than ever. Keep a close eye on spending. Possibly the discretionary bucket of your budget is where you are seeing the biggest cost increase? How has your savings plan been impacted from the increases in costs?

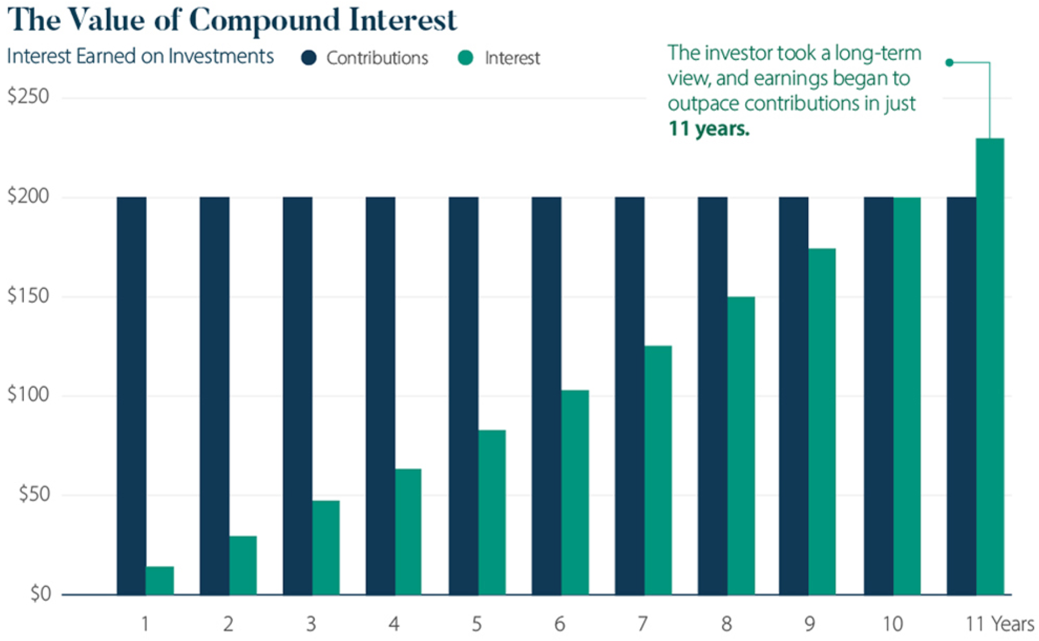

After you have confidence in your spending/savings plan, this is where investing matters. Finding opportunities for your savings to contribute to both your short-term and long-term goals. Balancing the right risk with your expected returns to allow stocks, bonds, real estate, and whatever asset that is appropriate for you to contribute to your wealth building. The same way a negative rate (inflation) can deplete your dollar, a positive rate that is compounded over time can help fight that increased cost.

Source: US News July 2018. Disclosure: Neither past actual nor hypothetical performance guarantees future results

Source: US News July 2018. Disclosure: Neither past actual nor hypothetical performance guarantees future results

Sometimes going back to the principals of what we are all trying to accomplish is well suited as we navigate the negative news and inflation talk. The above graph illustrates the result of saving $200 that is earning 7% in annual return. In year 11, you can see the interest outweighs the contribution. The beauty of compounding returns… The power of the dollar saved today, even as costs increase, can never be discounted.

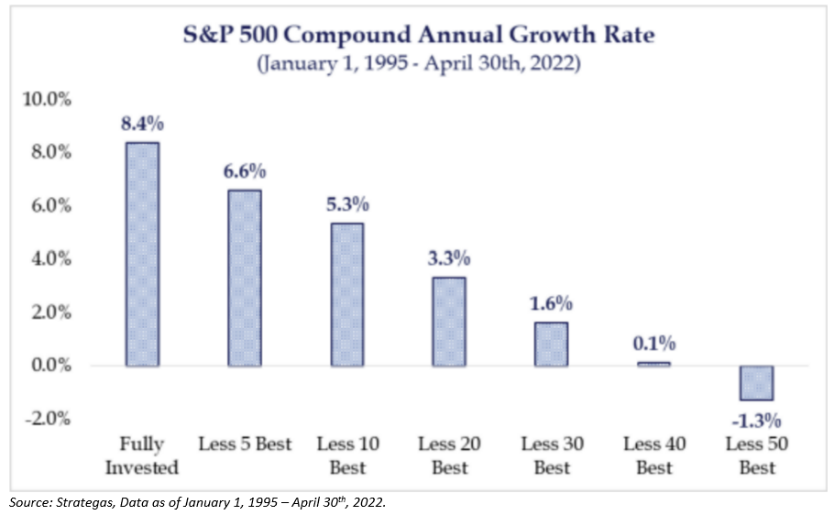

It Pays to Remain Invested

Given the macro headwinds, finding a path to positive returns in the short term this year has been almost impossible. Increases in cost of living hurt your bottom line. Your portfolio drawing down paired with that hurts even more. There is no way to sugar coat this. It is just as painful for us as financial planners as it is for you. There may be a myriad of reasons for not staying invested. We believe time in the market is much more important than timing the market. To prove this – just look at the chart below depicting returns, excluding some of the best days in the market:

It is impossible to predict market swings and the longevity of inflation. However, you can manage risk and your budget regardless of being in your accumulation years or retirement. Rely on your principals of diversifying your assets and emphasizing the importance of that extra dollar saved today. Getting back to the basics when you are facing a headwind should serve you well in today’s environment. Warren Buffet says it best, “the most important quality for an investor is temperament, not intellect.”

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The visuals shown are for illustrative purposes only and do not guarantee success or a certain level of performance.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA 2207-26.